Learn With Steem; Learn How to Calculate the Conventional Cashflow Techniques - PBP (2nd Edition) #burnsteem25

Introduction

.jpeg)

Link

In my previous post here, I spoke about ARR- Accounting Rate of Return as a conventional cash flow technique.

There are other techniques that I would be explaining with workable examples for a better understanding of them.

The other methods are:

- Payback Period (PBP)

Payback Period (PBP)

.jpeg)

Link

PBP is the total duration it takes an investment to recover through various cash inflows the initial cash inflow that was invested in the project.

It's the total period taken by an investment involved or project to make enough profit that will cover the money that was initially invested at the start.

Periods under this investment umbrella represent number of years and the returns only measure liquidity rather than profitability.

The payback period is referred to as the first screening process a project undergoes during evaluation and can be calculated in two different ways based on its screening criteria.

The techniques used in calculating the payback period of viable projects are;

- Regular Nature of Returns

- Irregular Nature of Returns

Regular Nature of Returns

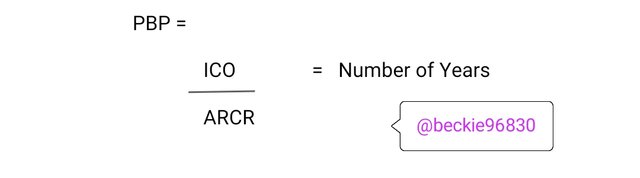

When a project has a series of regular cash inflows over a given period, the payback period is automatically calculated as:

Where:

- PBP = Payback Period

- ICO = Initial Cash Outlay

- ARCR = Annual Regular Cash Returns

Illustration 1:

Becky PLC intends on investing her funds into a project which requires an initial cash outlay of #3,000,000 and expects to have an annual regular cash returns of #600,000 for 7 years.

Required: Calculate the Payback Period of the investment to determine how long it will take to recoup the initial investment and start making a profit.

Solution

Using the formula above:

PBP = #3,000,000 ÷ #600,000 = 5 years

So after five years of recovering the initial cash invested, the other two years generate a profit of #1,200,000 from the investment.

The profit is gotten from multiplying the remaining number of years by the cash returns.

Profit = 2 years × #600,000 = #1,200,000.

Irregular Nature of Returns

This occurs when the cash inflows over a given period or number of years are irregular that is the amount recouped differs in each year.

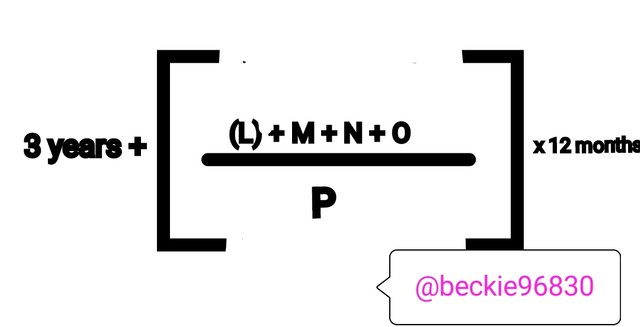

The technique used to calculate this irregular nature of returns to get the actual payback period is shown below:

| Year | CR | Cum CR |

|---|---|---|

| 0 | (L) | (L) |

| 1 | M | (L) + M |

| 2 | N | (L) + M + N |

| 3 | O | (L) + M + N + O |

| 4 | P | - |

| 5 | Q | - |

| 6 | R | - |

The PBP is calculated as thus:

PBP =

Where;

- CR = Cash Returns

- Cum CR = Cumulative Cash Returns

- 1-4 = Years of Cash Returns

- M-P = Amount of Cash Returns

Illustration 2:

Commissioner PLC is considering investing in a viable project that has an initial capital of #5,500,000. The project is estimated to be yielding the following returns;

| Year | Cash Returns(#) | Cum Cash Returns (#) |

|---|---|---|

| 0 | (5,500,000) | (5,500,000) |

| 1 | 250,000 | - |

| 2 | 2,000,000 | - |

| 3 | 800,000 | - |

| 4 | 2,350,000 | - |

| 5 | 1,250,000 | - |

| 6 | 1,000,000 | - |

Solution:

Using the formula stated above we have;

| Year | Cash Returns(#) | Cum Cash Returns (#) |

|---|---|---|

| 0 | (5,500,000) | (5,500,000) |

| 1 | 250,000 | (5,500,000) + 250,000 = (5,250,000) |

| 2 | 2,000,000 | (5,250,000) + 2,000,000 = (3,250,000) |

| 3 | 800,000 | (3,250,000) + 800,000 = (2,450,000) |

| 4 | 2,350,000 | (2,450,000) + 2,350,000 = (100,000) |

| 5 | 1,250,000 | (100,000) + 1,250,000 = 1,150,000 |

| 6 | 1,000,000 | 1,150,000 + 1,000,000 = 2,150,000 |

Note: In mathematics, any monetary figure inside the bracket indicates a deduction. Meaning (#500) is -#500. Currencies don't have a negative value so it's best represented in the bracket.

PBP =

4 + [100,000 ÷ 1,250,000] × 12 months.

Using the rule of BODMAS, we have:

4 + [0.08 × 12] =

4 + [0.96] = 4.96 years.

Which can be better understood as:

- 4 years, 9 months 6 weeks or

- 4 years, 10 months, 2 weeks or

- 5 years.

Merits and Demerits of Payback Period

.jpeg) Link

LinkMerits

- This formula is by far one of the easiest methods to know and calculate in terms of conventional cash flow techniques.

- This formula can be used to evaluate a project quickly.

- The risk of losing part or all of your funds is noticed using this method.

Demerits

- Payback Period is more of a technique than it is a formula for calculating.

- This formula does not recognize the other cash returns accrued in the coming years.

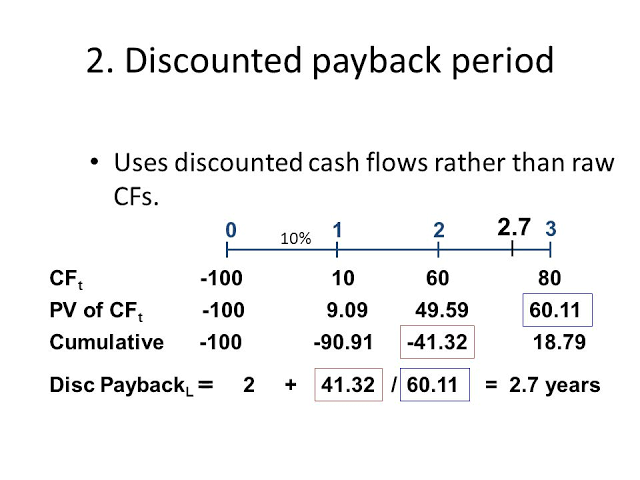

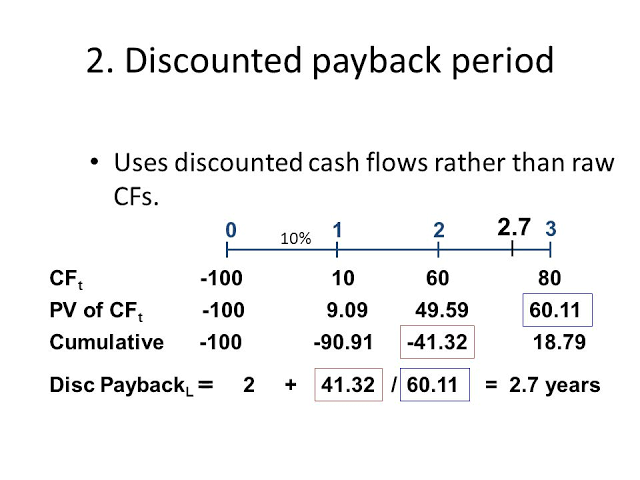

Discounted PBP

.png) Link

Link

.png) Link

LinkIt's an enhanced PBP that accounts for the time value of money through the discount factors of the cash inflows of an investment project. Here, we calculate the present value of the cash inflows.

In this method, there must exist a discount rate that will be used to compute the present value of the investment.

Decision Rule: Accept the project if Discounted Payback Period is ≤ Company's acceptable target period.

Also, Reject the project if Discounted Payback Period is > the maximum acceptable target period of the entire project.

Please, prefer images without copyright for your publications.

Thank you for contributing to #LearnWithSteem theme. This post has been upvoted by @maazmoid123 using @steemcurator09 account. We encourage you to keep publishing quality and original content in the Steemit ecosystem to earn support for your content.

Regards,

Team #Sevengers