Personal Finance: The 7 Day Rule

The seven-day rule is so simple, yet it's one of the most efficient principles that will work every time.

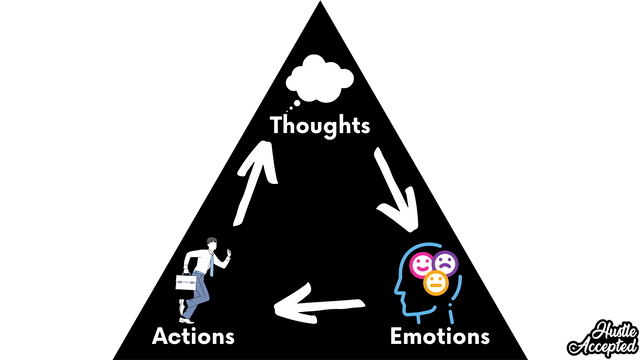

Have you ever heard about the cognitive triangle?

The cognitive triangle has three main components: Thoughts, emotions, and actions.

Everything starts with an idea, then this idea gives you some emotions, which drive you into taking action.

The purchasing process has the same cycle, and it gets more clear with an example:

You saw an advertisement for your favorite car with its newest model, you thought of how great it looks and how amazing the features it has, so you felt a strong urge to buy it. Therefore you took a car loan and ruined your financial position.

To be able to cut this cycle, you have to start with its root, the thought!

You shall have more authority over your thoughts, like being able to say this car is excellent, but I don't have a real need to buy it currently.

It's not worth ruining my financial position to get it; plus, my car works fine, and it gets me wherever I want to go.

The seven-day rule saves you from having a thought, then emotions, then taking an impulsive and dumb financial decision.

It states that whenever you feel the need to buy something, wait seven days before you do so; if you still have the same need, go ahead and buy it.

The surprising part is that you'll either forget about it or discover that it was just hype and that you don't have a real need to buy it.

Most of our purchases occurred because we thought it was a good idea to buy this product or service, but you can figure out that it was the exact opposite after a while.

Remember the seven-day rule; wait seven days before making any purchase, and only buy if you have the same need with the same intensity.

Brought to you with love by Hustle Accepted