Budgeting myself into the life I deserve.

I wanted to share with all of you why I am a huge supporter of personal finance and budgeting. It is such an important aspect of life these days. But many, many people just "wing it" and that is very detrimental to long-term savings.

In my own personal life I have had money struggles and made some pretty major money mistakes. My parents were not about budgets and they were very bad with money, unfortunately I did not learn anything positive about personal finance from them.

(Credit: SacramentoBankruptcyoffice.com)

So at the young age of 22 I was over 10k in debt and about to be a mom so I filed bankruptcy. I was able to be in this much debt because some credit card company thought it was a good idea to offer an 18 year old a 7k card…..and I was dumb enough to accept it.

Why I did not use it to book a tour of Italy or for some other amazing adventure still bugs me. Instead I used it for a bunch of silly junk I could not even name today. But I sure used it!

(Credit: Huffingtonpost.com)

After the bankruptcy I made the added mistake of ignoring my credit for years and did nothing to fix it; That is until I found myself divorced, broke, homeless, with an 8-year-old son and with horrible credit.

If there was ever a sink or swim moment, this was it for me.

I have always loved numbers so I started doing research and reading up on advice from the likes of Suze Orman and Dave Ramsey. I took what I learned from them and I tweaked it to fit what would work for me. In the 10 years since I was at the lowest low of my life I was able to:

· Raise my credit score to 800.

· Pay off all my credit card debt.

· Pay off student loans I had been carrying for more than ten years in deferment (collecting interest).

· Buy and pay off my dream car (Mustang baby).

· Buy and pay off a second car (both were a few years used because I will not buy a new car ever again).

· Purchase a home on my own (this was particularly sweet because it was my family home, the one I had to run back to just a few short years before, when I was newly divorced and broke).

· Purchase a 2nd home on my own (sold the first home, first).

· Build a 6-month savings reserve.

· Take a cruise every year (a big deal to me because I love to travel).

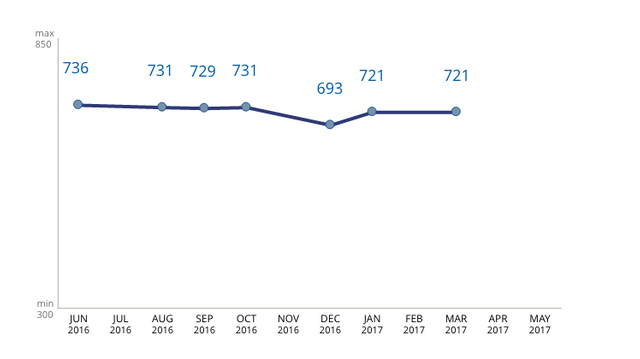

My current credit score ( its gone down due to my increased debt)

I really loved that car!!

I think it is important to mention that I accomplished ALL of that on a yearly income that never exceeded 35k.

So for about 10 years I lived debt free, which translated to worry free.

Unfortunately life happens, as it tends to do and after loosing my job and dealing with some very persistent medical issues, I have gotten back into double digit debt again. I don’t even have the guts to say how much exactly it is out loud, so hope you will forgive me for that.

I considered bankruptcy again (for like 5 minutes) but I really did not want to mess up my credit like that again. And lets face it I DID spend the money so it just did not seem right.

What I did instead was trust in myself to do what I know I can do and HAVE done before. So I created a payoff budget and schedule. Once I put it all on paper I felt really good. And it did not look impossible; in fact it looked very doable….even on my currently still limited income.

What I created for myself looks like something very similar to the debt snowball Dave Ramsey is always talking about. Along with taking advantage of some 0% interest balance transfer offers on my current credit cards.

I started with balances on 4 cards and I have already brought it down to 3 cards, due to the balance transfers. Then I calculated how much of my emergency fund I Really needed to hold on too and I put everything else on the card I plan to pay off first.

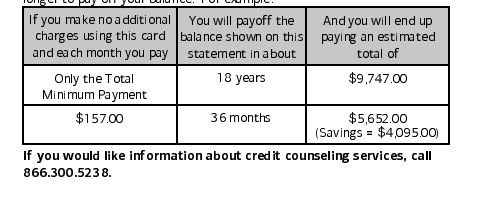

As it stands right now I will have all my debt paid off by December 2018. I think that is great considering my middle credit card (the one that does not have the highest or lowest balance) says it could take between 36 months and 18 YEARS to pay it off.

I am not giving up, I know it can be done and I am excited to prove to myself that the first time was not a fluke.

I hope that my story has given you hope and that if nothing else you can tell yourself “It is possible, and I CAN budget myself into the life I deserve.”

Xoxox

Josie

Great post! Good on you for working through a plan. You'll be out of debt before you know it. We are using a budget now too which is the first time we've ever done so. We are now a single income family so sticking to a budget is a necessity. It's new to both of us, but working well so far.

Good luck with your plan. I'm sure you'll do well.

Thank you and thanks for the support. Glad to hear you are giving budgeting a try. I think once you get used to it you will love the power it gives you over your finances. I am rooting for you!

I spent more than a decade "winging" my finances, until it started to drive me crazy that I had no idea where my money was going! Now i set a monthly budget and diligently track my spending, and I feel much less stress about money.

I followed you and I'm really looking forward to reading about your journey to zero debt. Good luck! You've got this! 😀

I am glad to hear that you decided to take control of you money. As you already are experiencing it really makes life a bit easier. And we can use all the help we can get in the department. Thank you for your faith in me, I will for sure be posting updates along the way. And best of luck to you too!

Increase your income and decrease your expenses. this simple method is what i have used to get ahead in my finance life.

Upvoted and resteemed! Great article!

Thanks for the support!!

May I ask if you are Financially free? Do you have your own business?

I think there are many ways to approach money. Debt isnt always bad if its for business?

Have you read Rich Dad poor dad?