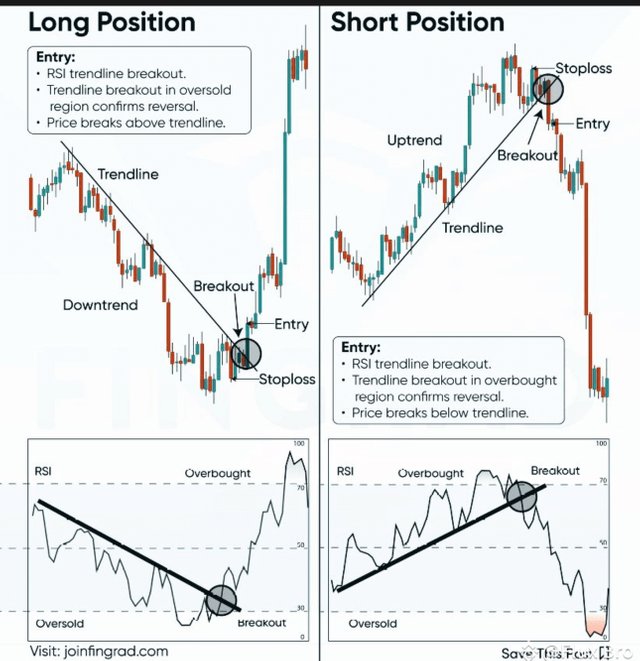

🔥 " Long vs. Short: Master the Art of Entries with This Game-Changing RSI Strategy! 🚀📉

Whether you're aiming to catch a bullish trend or ride the bearish wave, these practical RSI-based techniques will give you an edge. Let’s break down exactly how to trade long and short positions like a pro:

Long Position: Ride the Bull Market 🚀

Steps to Enter a Long Position:

📈

RSI Trendline Breakout: Watch for a breakout from a downward trendline on the RSI.

📊 Oversold Region: Ensure RSI is in the oversold zone (<30) before the breakout—this confirms a potential reversal.

🔄 Price Breaks Above Trendline: Enter the trade when price action breaks a major downward trendline.

Stop-Loss Placement:

Set your stop-loss just below the recent swing low to limit losses.

Adjust based on volatility—tighter for scalping, looser for swing trading.

Pro Tip:

Combine this with volume spikes to confirm the move. Higher volume = stronger breakout!

Use moving averages (e.g., 20 EMA) for dynamic support after entry.

Short Position: Dominate the Bear Market 📉

Steps to Enter a Short Position:

📉 RSI Trendline Breakout: Look for RSI to break a trendline in the overbought zone (>70).

🔥 Overbought Region: Overbought RSI signals exhaustion of the uptrend.

🔻 Price Breaks Below Trendline: Enter when price action confirms by breaking below the upward trendline.

Stop-Loss Placement:

Place your stop-loss above the recent swing high for protection.

Monitor closely to tighten as price moves in your favor.

Pro Tip:

Watch for divergence between RSI and price—if RSI starts falling while price rises, it’s a strong signal for reversal.

Add Bollinger Bands to spot price hitting upper bands in overbought zones.

How to Maximize Both Setups 🔍

Volume Confirmation: Increased volume during breakout confirms the strength of the move.

Risk Management: Stick to 2% risk per trade—always plan your exit before entering.

Multi-Timeframe Analysis: Confirm signals on a higher timeframe (e.g., 4H) for stronger trades.

Patience Wins: Only act on confirmed setups; avoid FOMO.

🔥 "Simple strategies like this can transform your trading! Which setup do you prefer—long or short? Drop your thoughts below! 💬👇"