Litecoin Price Nearly Doubles In Just 24 Hours

While Bitcoin and Ethereum appear stuck in sideways limbo action after last week’s “crash” from which they both rebounded promptly, other altcoins are gaining a lot of interest, mostly from Asian buyers in desperate need of a new bubble to chase higher.

And Litecoin (which was recently added to Coinbase) is the cryptocurrency which has fallen squarely in their sights, having soared nearly 50% in the past 24 hours to over $48, before settling in around the $45 level.

With the sudden surge, Litecoin is now approaching its all time highs.

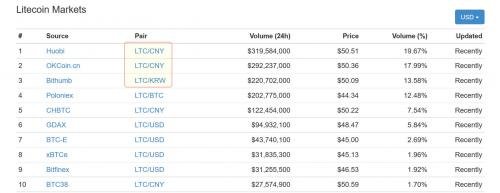

Having missed out on much of the surge in Bitcoin and Ethereum in recent weeks, Litecoin is, if only for the time being, the primary focus of crypto traders. With over $1 billion trading volume in 24-hours, Litecoin has become the latest darling of Chinese and Korean momentum chasers. A quick look at the source of activity reveals that over 50% of the volume is out of China and Korea.

However, as the Merkel points out, the bigger question is why this price increase is happening right now. One possible explanation points to concerns about the upcoming hurdle event for Bitcoin, where a looming chain split on August 1st has some people concerned. It is possible a chain split could hurt Bitcoin’s market position and another cryptocurrency may overtake it, especially with the market share of Ethereum soaring and poised to overtake Bitcoin (at the current pace of growth) in months.

It could also merely be another false breakout: there have been several LTC price rises over the past few months which never lasted long, even as BTC and ETH continued to soar. That said, the Litecoin community is delighted by today’s price increase. Things have been looking better for Litecoin, ever since it enabled Segregated Witness and Charlie Lee left Coinbase to focus on the digital silver. To be sure, with a market cap of “only” $2.5 billion (4th behind BTC, ETH and Ripple), the altcoin has a long way to go before catching up with Bitcoin at just under $44 billion.

A quick primer on Litcoin: launched in 2011, Litecoin was one of the first altcoins to gain significant traction. As opposed to some newer altcoins like Ethereum, Ripple and Monero, Litecoin is a straight fork of Bitcoin’s codebase but with a different mining algorithm and some changed parameters, such as faster confirmation times. This similarity to Bitcoin does mean that Litecoin suffers from similar weaknesses as Bitcoin, like transaction malleability.

Ultimately, allegations that the move is merely another bubble forming (it is, but so is virtually every other asset class) or that LTC, like BTC and ETH, is merely rising due a result of the latest and greatest ponzi scheme will emerge. They may be right, but now that Asian buyers – whose remarkable resilience is well known to both Beijing and the PBOC – are involved, it is impossible to predict just how high this particular “bubble” will grow before bursting.

Source: http://www.zerohedge.com/news/2017-06-17/litecoin-explodes-higher-after-flood-chinese-korean-buying?page=2

Not indicating that the content you copy/paste is not your original work could be seen as plagiarism.

Some tips to share content and add value:

Repeated plagiarized posts are considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

Creative Commons: If you are posting content under a Creative Commons license, please attribute and link according to the specific license. If you are posting content under CC0 or Public Domain please consider noting that at the end of your post.

If you are actually the original author, please do reply to let us know!

Thank You!