Top best loan apps in Kenya

It has not been easy to qualify for a loan in Kenya most especially from banks. Considering the ever-rising rate of unemployment in the country, many people have opted for soft loans from Mobile loan apps. These apps have gained popularity due to their low-interest rates when compared to shylocks and banks. There are several loans apps in Kenya but am going to show you the ones that request for no registration fee to qualify for a non-collateral loan.

If you are in hard financial times, I hope the list below is going to be of much assistance.!

1. TIMIZA

Timiza is a digital banking platform launched by Barclays Bank of Kenya. The platform offers services such as loans, insurance, can hailing, bills payment and can also serve as a bank account.

To get a loan from Timiza, you need to do the following:

• Register for the service

You can register on the Timiza platform by dialing via dialing *848# on your Safaricom line or downloading the app from the Google Play Store.

• Creating an account

To create an account you need a Safaricom number that is M-Pesa registered. You will be sent a PIN to activate the service and later a recreate key to access your account.

Once you have successfully created an account, you can be able to apply for a loan.

Timiza offers loans of upto Ksh. 150,000 and the loan amount that you get depends on your M-pesa transaction history. The loan amount will be charged an interest of 6.17% (i.e. 5% processing fee and 1.17% interest). The loan is payable in 30 days.

2. UBAPESA

UbaPesa is another Kenya’s peer to peer loan app! Loan is approved with a matter of seconds and disbursed to your M-Pesa telephone number.

UbaPesa is the one stop app that brings together lenders and borrowers in one app. In the Money Market page you will find Borrowers on the left hand side and Lenders on the right hand side. Lenders are those out to make a profit on their money and Borrowers are those seeking to get a loan.

Getting Started

#1. Download https://play.google.com/store/apps/details?id=com.ubapesa.app

##2. Register using your Mpesa Number.

###3. Get approved and receive loan.

####4. Upload money to your wallet and start lending.

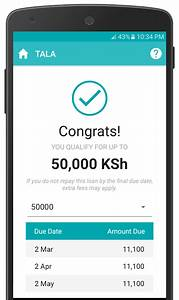

3. TALA

Formerly known as Mkopo Rahisi, Tala has managed to establish itself as one of the most trusted loan mobile apps in Kenya. They pride themselves on providing loans in the shortest time possible; 5 minutes. They provide loans up to Ksh 50,000. It’s the second most download Loan app on Google play.

Getting Started

#1. Download http://inv.re/78svp you can use my referral code 2BZ2QF.

##2. Register using your Mpesa Number.

###3. Get approved and receive loan.

####4. Upload money to your wallet and start lending.

4. BRANCH

This app was founded back in 2015 and it is currently the most downloaded loan mobile app in Kenya. They offer loans up to Ksh 50,000.

Getting Started

#1. Install app https://branch.co/download/2wyt5h

##2. Register using your Mpesa Number.

###3. Get approved and receive loan.

####4. Upload money to your wallet and start lending.

5. USAWA

Usawa gives you access to fast & convenient loans to your M-Pesa. Use our loans to grow your business, pay your bills or deal with emergencies.

Install Usawa loan app http://play.google.com/store/apps/details?id=ke.co.usawa.Usawa and create account and begin applying

Usawa will check how you have been using your phone to make calls, sms, data and how you use mobile money services such as M-Pesa. Usawa will notify you of the amount of money you can apply for and explain the repayment terms.

Have you looked at Uwezo Kash and Zidisha. They are awesome

Zidisha will give a loan yes but after registering, has a registration fee of kes 1000. On the other hand Uwezo kash their phone verification has issues.

I had an instant request from Zidisha approved

This does not mean that they will not check anything, but they may run a so-called soft credit check, which will not affect your credit score. UnitedFinances so I need money right now? If you take an installment loan, you can agree for automatic payments, which means that they will be taken from your account on a monthly or biweekly basis, depending on your cash advance agreement’s conditions.

Creation of a Lending App The expense of creating a mobile application for a financial financing company. It all depends on how extensive the project is, how complicated the features are, and how quickly you need them completed. The price of loan lending app development usually incorporates the price of staffing a development team, creating the software, testing it, releasing it, and maintaining it.

The blog post https://attractgroup.com/blog/establishing-a-devops-culture-key-principles-for-building-a-successful-devops-model/ on Attract Group offers insightful strategies for cultivating a DevOps culture within organizations. It emphasizes the importance of collaboration, continuous improvement, and transparency as foundational principles. By fostering strong communication between development and operations teams, companies can enhance productivity and streamline processes. The real-world examples and actionable tips presented make it a valuable resource for anyone looking to implement a successful DevOps model. A must-read for tech leaders!

The blog posts https://premiercomfortac.com/blog/ on Premier Comfort AC’s website offers useful advice for homeowners looking to enhance their HVAC system’s performance, but if you're looking to finance your HVAC upgrade, the top best loan apps can make the process easier. Many loan apps today provide fast, flexible, and accessible financing options for home improvement projects, including HVAC systems. These apps emphasize low-interest rates, user-friendly interfaces, and quick approval times, helping you secure the funds you need without hassle.