Market Turmoil? The Ups and Downs, Supply Shock, and COVID-19

Red one day, green the next, is this just trying to soften the blow?

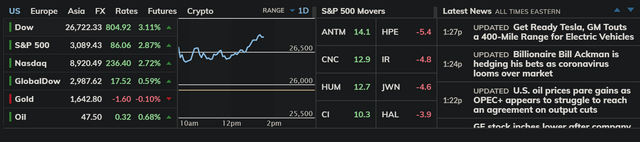

Last week we reported on the market chaos that sent many markets deep into the red. The Dow alone lost nearly 3,000 points! This week though, it seems people are unsure of what to do with it. Monday started off well, recovering about 2,000 points worth in the Dow and several other markets that, at least on Market Watch were severely in the red with plummeting graphs. Tuesday saw some reds again losing at least another 1,000 after the Feds announced they were trimming the federal funds rate by 0.50 percent to a range of 1-1.25 percent. The Fed is trying to stay ahead of disruptions and economic slowdown caused by the rapidly spreading coronavirus. Today, although still early, it looks like people are regaining their faith in the markets.

What people don't realise is, that if the coronavirus known as COVID-19 continues to spread and cause panic, supply shock could hit the markets very hard. A supply shock is an event that suddenly increases or decreases the supply of a commodity or service, or of commodities and services in general. This sudden change affects the equilibrium price of the good or service or the economy's general price level. An article out of Market Watch states:

It is too soon to predict the long-run arc of the coronavirus outbreak. But it is not too soon to recognize that the next global recession could be around the corner — and that it may look a lot different from those that began in 2001 and 2008.

For starters, the next recession is likely to emanate from China, and indeed may already be underway. China is a highly leveraged economy, it cannot afford a sustained pause today anymore than fast-growing 1980s Japan could. People, businesses, and municipalities need funds to pay back their out-size debts.

Also to quote my previous article on this matter:

If we are approaching economic collapse there are several things that people need to consider; food storage, their means of trade (gold, crypto, etc...) and safety. While shortages are bound to occur as multiple countries begin to stop shipments due to fear of COVID-19, it is a good time to stock up on canned goods that will last you several months. How will you trade? The most important means will be that of gold, and crypto. One such cryptocurrency will incorporate both a gold backing and digital; GODcoin!

Could this all go away? It's possible, but how long until it completely collapses? Take into consideration that Peter Schiff, the man who predicted the 2008 collapse, believes we're on the cusp of a much worse collapse. He revealed to Market Watch:

“We are going to have a collapse of the bond market and the financial crisis that’s coming will be much worse than the one we had in 2008,” he said. The bond market wasn’t quite collapsing on Tuesday but the 10-year Treasury note did establish a fresh historic low yield beneath 1%, while the U.S. dollar, as measured by the ICE U.S. Dollar Index, has fallen 1% this week and gold GCJ20, -0.10%, Schiff’s favorite asset, has gained 4.4% over the same period.

Are you willing to bet your future on this chaotic market, or would you prefer to bet on something more sustainable? The choice is yours. Please leave your thoughts below. Have a nice day!

Checkout GODcoin! The Currency of the New Kingdom!

https://godcoin.gold

lordrayel.org

https://armageddonbroadcastnetwork.tv/

https://sanctuaryinterfaith.org

https://www.youtube.com/c/Armageddonbroadcastnetwork

https://www.facebook.com/groups/ICoLR/

https://vk.com/congregation_of_lord_rayel

https://lordrayel.org/donations/