January, the month of the big pullbacks. A look at previous years. What to expect?

So we are here again. Who could imagine we where going to have a correction now? :)

I thought we were going to have a pull back 1,5 weeks ago, and was starting to wonder if it was ever going to come. But it did, as it usually does.

So, what's new? Well, some news has come, but nothing really now as I can see. South Korea and China governments acting nervous as usual I would say (with good reason as well :). But they should calm down, this is just the labor pains, and the birth is inevitable.

Lets look at the previous years. How did we do? It seems January is the real problem here. The month of the major pull backs. We are actually doing pretty good so far if you compare with previous years.

Here they are:

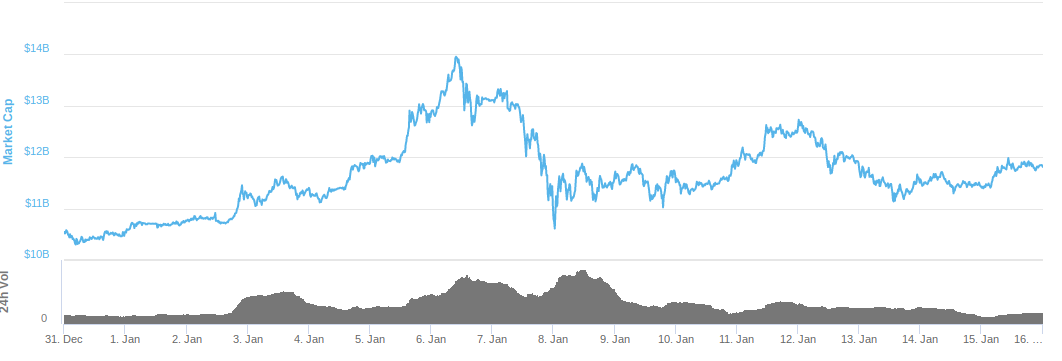

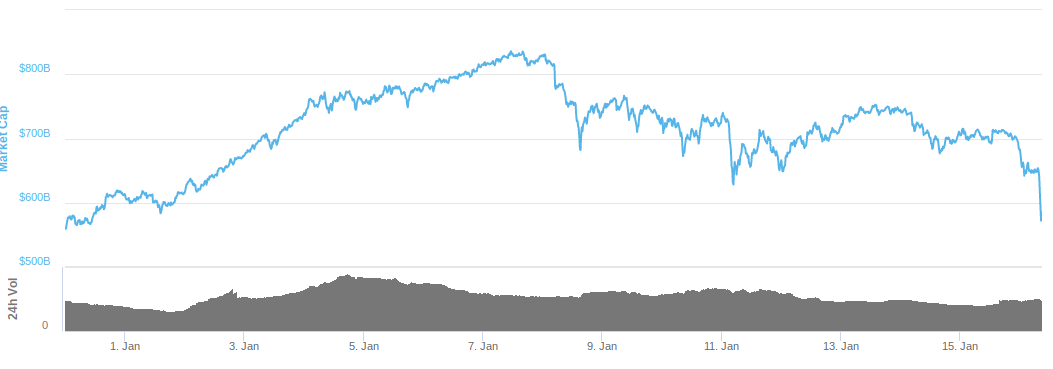

January 2014

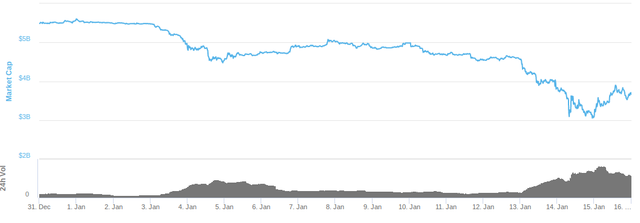

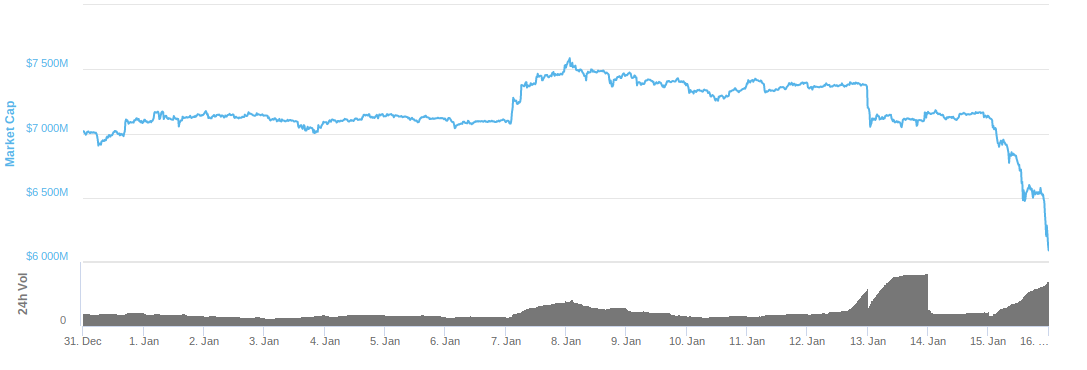

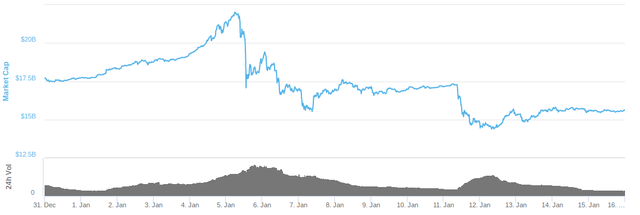

January 2015

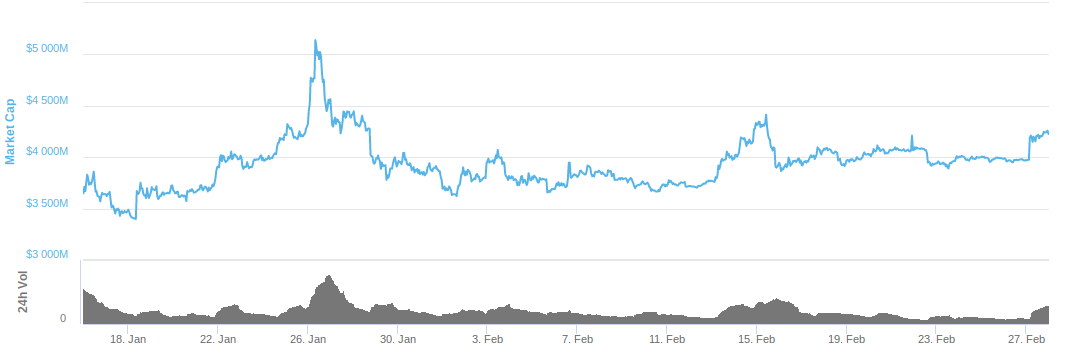

January 2016

January 2017

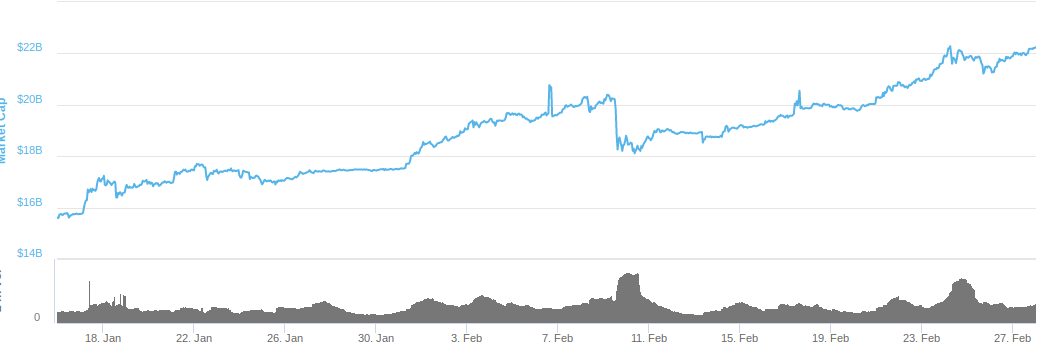

January 2018 (present moment)

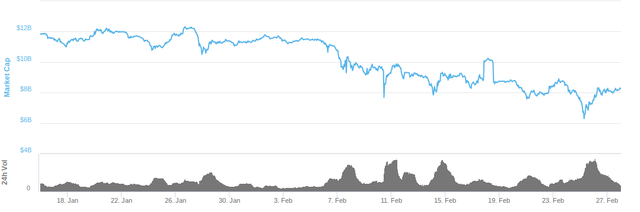

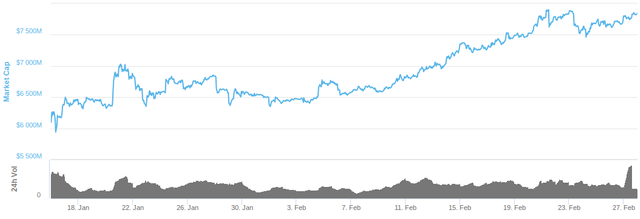

With the exception of January 2014 it has all been pull backs. Now these above are all the first half of January until the 16th, today's date. So, what's more interesting, how did it turn out post January 16th? Did it all crack down just to pick up in June. Well, 2014 was an exception as we seen above, but 2015, 2016 and 2017 draws pretty much the same image for us. As I've been rambling before, we are in for a ride. Take a look at this. These are January 16th to end of February.

2014 (seems the pull back came a little later that year)

2015

2016

2017

One can acctually see that the bulls has become stronger for each year.... :)

So instead of focusing on updating blockfolio every 2 minutes, one is probably better off by going chopping some wood and hodling!

Note to self: Prepare a decent amount of fiat money before January 2019.

Agreed, I just think that the amounts of fiat I will be able to put into crypto will look like farts in a storm compared to the total portfolio in Jan 2019 :)

Well said

Rice. Agree! People selling now must be semi-retarded or just out of their minds.

I think both apply to most people in certain fields :)

Thank you for this informative post, @deismac