Metavault.Trade - A new type of Decentralized Exchange, designed to provide a wide variety of trading features

Introduction.

Cryptocurrencies and their innovations have been amazing since they were introduced. One of the things that cryptocurrencies are known for is that their transactions are highly secure, verified, and all records are maintained or protected by a cryptographic, decentralized system. This makes it difficult or impossible for cryptocurrencies to double-spend or be counterfeited.

Cryptocurrencies provide investors with an easy, innovative and profitable way to invest and make money online. Also, it is important to note that digital currencies (cryptocurrencies) such as bitcoin provide the world with a trusted gateway to unrestricted private wealth. not confiscated.

To make crypto mainstream, a platform like Metavault.Trade platform is needed where crypto enthusiasts (users, traders and investors) can easily see. review. Their overview of trading signals as well as crypto news updates not only help them make the right decisions, it also puts an end to the pressure to maintain multiple accounts across multiple platforms.

What is Metavault.Trade?

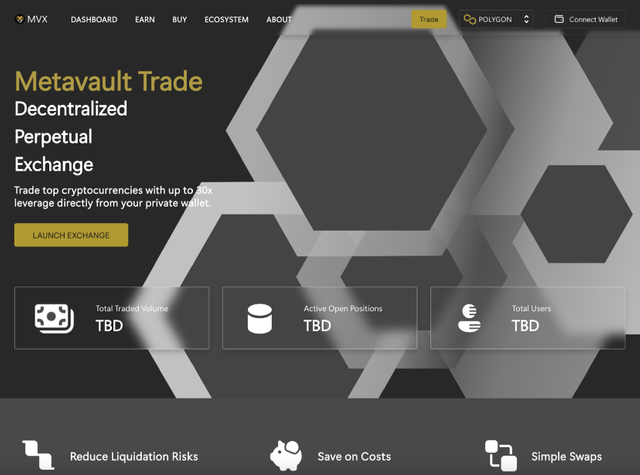

Metavault.Trade is an exchange platform that provides decentralized crypto exchange services designed with various crypto features. Metavault.Trade provides spot & perpetual exchange services that allow users to trade with up to 30x leverage and directly from their personal wallet.

Metavault.Trade is an innovative decentralized exchange platform as it provides spot & perpetual exchange services where users can trade safely and easily without going through an account, but simply by connecting their wallet and they will be able to trade. So it is a decentralized crypto exchange platform with leverage and convenience for users.

Metavault.Trade is a DEX for swap and perpetual trading with up to 30x on Polygon.

In essence, Metavault.Trade is a decentralized and perpetual exchange that trades top cryptocurrencies with up to 30x leverage right from your personal wallet.

At Metavault.Trade, trading is supported by a multi-asset pool which is in turn backed by liquidity providers. Liquidity providers receive rewards from swap fees, market building, rebalancing, and perpetual trading. 100% of platform revenue is distributed to stakeholders.

#Dex #metavault #mvx #defi #polygon #trade #ido #sale

Traders can use it in two ways:

- Spot trading, with swaps and limit orders.

- Perpetual futures trading with up to 30x leverage on short and long positions.

Metavault.Trade aims to become the go-to solution for traders who want to stay in control of their funds at all times without sharing their personal data. Its innovative design gives it many advantages over other existing DEXes:

- Very low transaction fees.

- No price impact, even for large order sizes.

- Protection against liquidation events: the sudden changes in price that can often occur in one exchange (“scam wicks”) are smoothed out by the pricing mechanism design.

- All-in-one platform: spot and leverage trading.

#Dex #metavault #mvx #defi #polygon #trade #ido #sale

Metavault Exchange Features

Low Fees — Very low transaction fees.

No price influence, even for large order sizes.

Simple Swap — Open positions via a simple swap interface. Easily swap from any supported asset to your preferred position.

Reduced Liquidation Risk — Protection against liquidation events: sudden price changes that often occur in a single exchange (“scam wicks”) are smoothed out by the design of the price mechanism.

Complete platform: spot trading and leverage.

Multi-asset pools — The key innovation at the heart of Metavault.Trade is multi-asset pools. This feature allows the platform to share liquidity across all the assets it supports.

It is the act of buying/selling assets on a Centralized Exchange (CEX) such as Binance, KuCoin or Coinbase. These platforms have pros and cons: they can offer low transaction fees and allow a lot of flexibility through APIs and bots. But they also require a different level of KYC to use — which is a good thing in principle, until they are hacked and your personal data is available for use by every bad actor imaginable — and sometimes they freeze your assets for reasons only known to them. . . Worst case scenario they get hacked and you lose everything you have on their platform. “ Not your keys, not your crypto! “As the saying goes.

Decentralized Applications (dApps) solve some of these problems by transferring trades to blockchains such as Ethereum and offering decentralized trading solutions. Uniswap is probably the most famous Decentralized Exchange (DEX). No KYC required, and you can use it from anywhere in the world. But fees on Ethereum can be 10 to 100 times higher than they would be charged for similar trades on CEX, especially for those with smaller position sizes. High decentralization price! Metavault.Trade is a new generation DEX that delivers a lot of innovation and very low costs.

#Dex #metavault #mvx #defi #polygon #trade #ido #sale

Futures contract

When people start trading, they usually start with “spot trading”, which consists of buying and selling assets directly on the market. But there are also more sophisticated instruments called futures contracts, or “futures” for short:

A futures contract is an agreement to buy or sell a commodity, currency, or other instrument at a predetermined price at a specified time in the future.

Unlike the traditional spot market, in the futures market, trades are not ‘completed’ instantly. Instead, the two counterparties will trade a contract, which dictates a future settlement. In addition, futures markets do not allow users to buy or sell commodities or digital assets directly. Instead, they are trading representations of contracts from them, and trading assets (or cash) that will actually occur in the future — when the contract is executed [Ref].

These contracts were created so that one could hedge against market variations, but futures trading also offers more possibilities than spot trading:

Traders can “sell”: they can bet against an asset without even owning it.

Traders can use leverage: they can enter positions for multiples of their balance. But in doing so, they run the risk of losing their entire balance when the market goes in the wrong direction, even if only slightly. Using high leverage (10x, 20x… 100x!) with large positions is very dangerous and should be avoided if you are not an expert trader!

Tokenomics and community

Metavault.Trade is built by the team behind Metavault DAO which fuels a whole ecosystem of blockchain and technology projects.

The code is a friendly fork of GMX, which has already been audited by ABDK Consulting [Find the audit here under the name “Gambit”, the original name of the GMX project].

As security is of utmost importance, an independent audit is about to be finalized.

After carefully considering GMX’s tokenomics, the Metavault DAO team chose to redesign them completely for Metavault.Trade. As a result, a larger proportion of the tokens have been allocated to those who invest in the platform (e.g. staking) than with GMX. The token also launched in a fair way, with no private or seed rounds.

Metavault DAO intends to be a liquidity provider in Metavault.Trade, which will make it robust and independent.

#Dex #metavault #mvx #defi #polygon #trade #ido #sale

Staking

Staked MVX Generates Three Reward Types:

(Native Token Like MATIC/CRO)

EsMVX

Multiplier Points

30% Of Swap And Leverage Trading Fees Are Converted To (Native Token Like FTM/MATIC) And Distributed To The Accounts Staking MVX.

Treasury Assets

The MVX-USDC LP-Pair Gets Provided By And Owned By The Protocol. 100% Of The Fees From This Pair Are Converted To MVX And Deposited Into The MVX Treasury.

Supply

The Maximum Supply Of MVX Is 10,000,000. Minting Beyond This Maximum Supply Is Controlled By A 28 Day Timelock, An Eventuality That Will Only Be Considered If The Demands Of The Protocol Necesitate An Increase In Liquidity.The Rate At Which The Circulating Supply Changes Will Be Dictated By The Number Of Tokens That Are Distributed Through Other DEXs, Vested, Burnt And Spent On Marketing:

- 1.2 Million For Marketing, Partnerships And Community Development

- 2 Million For The Metavault DAO Treasury (Staked+Locked)

4 Million Reserved For Rewards (EsMVX Reserve For Multichain Expansion)

1 Million Paired With USDC For Liquidity On Uniswap

- 300,000 For MetavaultDAO Team (Linearly Vested Over Two Years With A Three-Month Cliff)

Presale

MVX token price at launch: 1 USDC

GMX community sale = 200,000 MVX at 20% discount (0.8 USDC/MVX), 200 slots

Whitelisted public presale = 1,000,000 MVX at 10% discount (0.9 USDC/MVX), 500 slots

Metavault DAO community sale = 300,000 MVX at 20% discount (0.8 DAI/MVX), 300 slots

Total $ to be raised in presale: 1,060,000 USDC + Metavault DAO Treasury allocation from MVD -> MVX sale

->500,000 USDC paired with 500,000 MVX initial liquidity V3 Pool

-> 60,000 USDC as marketing budget

-> 500,000 USDC as initial MVLP liquidity (owned by the MVX Treasury)

1.5 Million Allocated To Presale

Token Information

MVX token address: https://polygonscan.com/address/0x2760e46d9bb43dafcbecaad1f64b93207f9f0ed7

After staking MVX, you will receive staked MVX:

MVX staked token address: https://polygonscan.com/token/0xacec858f6397dd227dd4ed5be91a5bb180b8c430

#Dex #metavault #mvx #defi #polygon #trade #ido #sale

Reference Official Information

You can find a lot of information about the Metavault.Trade project here:

Website: https://metavault.trade/

Telegram: https://t.me/MetavaultTrade

Github: https://github.com/metavaultorg

Discord: https://discord.gg/metavault

Twitter: https://twitter.com/MetavaultTRADE

Author:

Username : siska55

Telegram username: @siska555

Bitcointalk profile Link: https://bitcointalk.org/index.php?action=profile;u=1662258

Polygon Wallet Address : 0x77297ff822f498Fe57698EaB1c1edE3dE21e154f

Proof Of Authentication: https://bitcointalk.org/index.php?topic=5414372.msg61018094#msg61018094