How To Read A Newspaper - Part 1

Most economists and journalists who write about the economy haven't actually realised what I'm about to say, but knowing this may actually make a profound difference to how you view the World and front page newspaper stories.

You may imagine bonds to be pieces of paper with fancy writing and a bunch of numbers on them. A bit like toffee-nosed IOU's. They're nothing like that.

- They're just numbers in savings accounts

- The accounts are held on a computer

- The computer belongs to the government sector

In the US, the accounts are on a computer which is held at the Fed. In Australia, the accounts are registry entries on a system called Austraclear which is managed by the Australian Office of Financial Management (AOFM).

Congratulations!

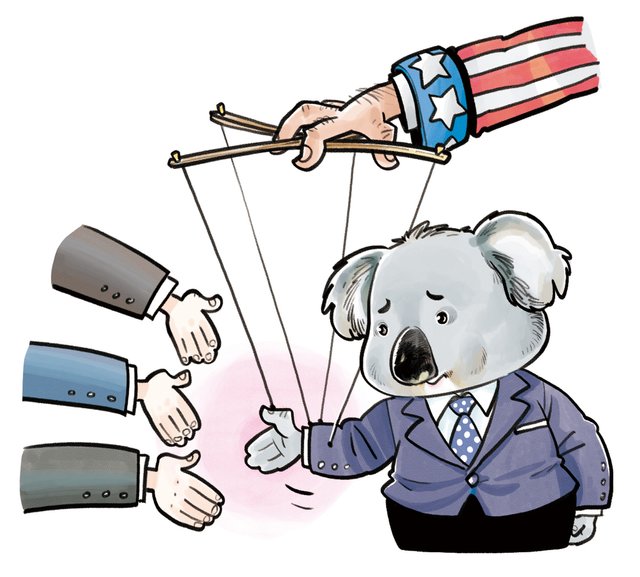

So, the next time you read a newspaper article that's been written by someone who's getting their knickers in a twist about how much your country owes to China, you now know that they're telling the World that they're terrified about the fact that the Chinese have savings.

One you understand what the National Debt actually is, you'll be infuriated by the ignorance of journalists, economists and politicians every time you read a newspaper.

We deserve better!

My country also has huge debt sometimes I wonder how will the government able to pay and monitor it. Well, in my opinion also, what you read in newspaper is not all that is going through. There are so much facts not included in newspaper and it is not meant for citizens to know. All the best to all the countries in debt.

If the debt is in your own countries currency, then there's nothing to worry about - your government cannot fail to pay it. If it's in another countries currency, then that's a problem. I don't know what the balance is in Malaysia.

there are lots of things people don't know unless you're in the related industry and has insight. No gov wants to admit that they owe money to another nation or they have to sign agreement under political constraints

I hope you got your living arrangements sorted our for a while, because I would miss your blog if it disappeared. Your writing isn't the most scholarly style, and maybe that's a good thing, but you do know what you're talking about. (Which is scary in its own way.)

Anyhow ... I'm here today to let you know your post How Queen Cersei Can Solve Her Money Problems was included in my new curation project The Inbox Runneth Over.

You can find your featured post this link. Stop by when you have a minute and see what else I found along the trail. Your companions here are all interesting in their own way.

I know I'm late notifying you of all this, although I do note the people I include in Inbox in our Discord group for The STEEM Engine when I announce a new issue. Look for future acknowledgements to appear with you tagged in the publication announcement in the railway post office channel. (Running behind in getting comments written on actual blogs is pretty much standard for me, it seems. There are just not enough hours in the day.)

You'll see a vote for about $.75 done by valikos in your voters list here on this post. That's from me -- for the post mentioned above. That is well above what I could give you in a simple upvote myself ... and I want inclusion in Inbox to be known as a "rewarding experience." Also, I figure better you should have the $$$ than some spammer. There is also a small upvote from me that when combined with the rewards for your participation in The STEEM Engine bring you to about what inclusion in that group post would total. Sometimes it's even a few pennies more.

I know it's odd to get a vote on a post that should have gone on another post, but blame that on Steemit's 7-day payout policy. Also, there is an individual in Steemit who has made my ability to do this work and reward it this way much more difficult lately, but we work with what we have. (But he's part of the reason for this strange arrangement.) Keep putting out quality posts, and I'll keep finding creative ways to encourage it. As I tell my husband when he yells at our pets, "It helps if you're smarter than the cat."

LOL, I know the tension between Australia and China alright. especially this

Australian newspapers don't talk much about to whom the national debt is owed. However, when it comes to real estate price bubbles, they're aware of the Chinese influence which has propped up the market. I feel sorry for anyone who's going to lose a significant amount of wealth when the market crashes and prices drop by around 70% (according to Steve Keen).

From what I am aware of the wealthy Chinese usually buy properties outside China because its so expensive in Mainland and it is not freehold. and they treat it as investment to live outside China since "the grass is always greener on the other side". Perhaps what Australia gov can do is setting a limit on the market, or else the Chinese will definitely take advantage of the market since money is not an issue for them, only the rich will consider investing abroad