Cryptoeconomics: A Brief Discussion

Despite having spent many years studying economics, I've long believed that "cutting your teeth" in cryptocurrencies is in many ways superior to studying economics at all. Granted, this is partly due to the dismal state of macroeconomics and the mainstream's insistence on building their macroeconomic models on top of microeconomic assumptions. And this is precisely why diving head first into cryptocurrencies has certain advantages.

Iatrogenics and Economics

In his book Antifragile, Nassim Taleb points out that, up until the 20th century, anything that prevented you from going to a doctor improved your odds of surviving. That's because for most of its history the medical profession did more damage than good. If this is hard to believe, bear in mind that deaths due to hospital-related errors are still the 3rd leading cause of death in the United States. This isn't to say that one should see doctors or use hospitals, just that sometimes doing nothing is actually better than doing something, even when that something is seeing someone people believe to be an expert.

In the same way, trying to understand investing by listening to economists is about as good an idea as treating syphilis with mercury. Instead "just doing" is often a better approach and cryptocurrencies are an interesting opportunity for doing that with relatively low risk. What I'm certainly not saying is that people should invest their life savings into tokens in the hopes they will "moon." One of my most oft cited reasons for loving steemit is that it enabled me to invest by contributing labor--by doing things I wanted to do anyway. The fact that you can learn, grow, and gain exposure while earning tokens that you can trade for other tokens is a paradigm shift that few yet understand or appreciate. I didn't sacrifice anything, I grew as a person and a creator, and in exchange for that I received money. You can then treat those tokens as "play money" that you use to experiment, learn, develop hypotheses, test your assumptions, etc. That's going to get you much farther than even a PhD in macro.

Understanding Money

More importantly, deep diving into cryptocurrencies forces you to learn about a phenomena that is rarely even discussed in the mainstream of economics: money. Mainstream economics effectively treats banks and money as if they don't exist. They are simple intermediaries like any other. For this reason, their importance is seen as insignificant. However, more and more people, especially ordinary people with common sense not what Taleb refers to as "Intellectual-Yet-Idiots," are coming to understand the fault in this logic. Many of these people founded this movement that we are involved in. We understand the importance of money, but not just that, we understand the importance of experimenting with it. Of experimenting with token emission rates. Of experimenting with hard caps and soft caps and what I refer to as "token distribution mechanisms." If you'd like to learn more about my views on money, check out the following video:

Smart Media Tokens

This idea of experimentation is also one of the things that excites me so much about our upcoming Smart Media Tokens protocol. Many make the mistake of thinking that the idea is for everyone to launch a Smart Media Token that immediately acquires massive value. Obviously that would be amazing, and we're going to do everything we can to set up developers for success, but that's not the same standard we apply to other tokens like the US Dollar. The US economy functions despite 90% of startups failing. Token systems (or as I like to call them "productivity point systems") are not designed to ensure success for all participants--at least not good ones.

Good token systems are designed to maximize experimentation. Every potentially productive enterprise should be able to integrate the token so as to increase their odds of success. The problem with the US Dollar is not the failure rate of startups, it's the limitations it has with respect to what types of enterprises it can be integrated into. Want microtransactions? No can do. Want fee-less transfers? No can do. Want to connect money to actions (like upvotes) no can do.

This also highlights what many people within our industry get wrong. If your goal is to replace the dollar, I think you're kind of missing the point. What's so revolutionary about what we're doing isn't that we're making a "better dollar" it's that we're monetizing entirely new things. We're creating money that can do things the dollar never could. We are not competing against the dollar inside the old economy, we are developing entirely new economies, monetizing value that had previously been ignored because the dollar was useless in that respect. This is why Smart Media Tokens are so potentially revolutionary: because they will give anyone the ability to launch their own hyper-efficient money, customize the most critical properties, and monetize entirely new behaviors and actions. Some efforts will fail, but the information we gain from those failures--in addition to the successes--will be priceless. And all of this is powered by the Steem blockchain.

To learn more about Smart Media Tokens, check out the following video:

As always @andrarchy, really enjoyed your post. Likewise, Taleb is one of my favorite authors; I was lucky enough to get introduced to him and his ideas before I even started my career in finance. as a very junior analyst at a hedge fund, i was tasked to read the black swan and fooled by randomness. never was short vol in any of my portfolio. it has been costly as of the last few years. i don't mind it.

as the concept of antifragility gets more widely known, here is a short video (from jimmy song) of it applied to Bitcoin that I think is quite well done. Was during a conference in LA in Oct 2017. that day, BTC crossed $7,000 and everyone was like celebrating. And now where are we at??

next up on the reading pile is "skin in the game". Will be released on February 27, 2018. cannot wait!

Additional point.

The barbell strategy is a method that attempts to secure the best of both worlds. It’s possible, the thinking goes, to garner substantial payouts without taking on undue risk. The strategy’s prime directive is interesting in that it’s not only counterintuitive to a populace weaned on the benefits of tempering risk and reward, it’s unambiguous: Stay as far from the middle as possible.

Nassim Nicholas Taleb [...] phrases the barbell strategy’s underlying principle as follows:

"If you know that you are vulnerable to prediction errors, and […] accept that most “risk measures” are flawed, then your strategy is to be as hyperconservative and hyperaggressive as you can be instead of being mildly aggressive or conservative."

Source:

https://www.investopedia.com/articles/investing/013114/barbell-investment-strategy.asp#ixzz53AmkiceV

When taking into account potential returns in BTC and crypto in general, one would conclude that the exposure is "hyperaggressive". As a result, it has a place in a portfolio constructed according to the barbell methodology.

Thanks for posting this video! Jimmy Song usually is an insightful guy to hear from.

Wow this is a brilliant post. One of the best I have ever read on the matter. You make this very complex and difficult topic so obvious and simple. I think along these lines, but don't think I could have explained it this well.

So glad I got to meet you and that your a part of the Steemit Team!

Full Steem Ahead!

Thanks so much! I really appreciate that

Your very intelligent, articulate and good on camera also.

Thanks homey! That means a lot coming from you! Hope all is well at the Garden of Eden

Life is really awesome here man. Just keeps getting better. I have been thinking a lot about starting a show A Live Truth Production of life in the GOE. May make a post about it sometime in the new year.

I am sure all your projects like @hardfork-series and Steemit it self haha are going well, but wish you and your team the best!

You should defiantly keep making more videos you have a really good skill for it.

SteemOn!

Do it! Thanks!

I can second that. I've read most of Taleb's books and while a lot of it is overwhelming and difficult to summarise in a single blog post, @andrarchy did a great job here.

@andrarchy, your postulation and ananlytical presentation on the subject matter you are discussing here is quite apt. Your knowledge of micro and macroeconomics is in no doubt.

Fiat money system was designed with the propensity to overly enrich only the elites at the huge expense of the larger population (the poor masses).

It's indeed unfortunate.

But, thanks to the arrival of crypto money system, where its functionality is based on tokens.

Tokens are really, really potentially revolutionary, given that they have the capacity and capability to give everyone the ability to launch their hyper-efficient money, control and be the bank to themselves. Fiat money jinx is broken by crypto tokens.

Here we are in the Steemit community where life is becoming more meaningful each passing day.

Bravo.

Thanks so much for the very thoughtful comment and kind words. I’m honored

Beautifully stated. So much so that I’ve become interested in your actual works and have begun following you.

The thing that appeals to me about the steem blockchain and steemit in particular is exactly what you mentioned above: trading labor for stake.

There is so much talk lately about guaranteed minimum incomes due to a chronic shortage of jobs. And much has been said about the cultural value of performing work to provide our subsistence. Right here is our answer. The longer I am here the clearer I see that this is a model for the future of economic activity, period.

I couldn’t agree more. Extremely well said

"If your goal is to replace the dollar, I think you're kind of missing the point. What's so revolutionary about what we're doing isn't that we're making a "better dollar" it's that we're monetizing entirely new things."

Wow. In three lines you changed my view on cryptocurrencies. Amazing statement.

I know your a fan of thinking from first principles, just wanted to say you do it really well.

There needs to be a definition on that "entirely new things" or it can mean anything. Vote manipulation for example monetizes a cheap way to make money and makes actual good content an afterthought.

Yeah but that is a bit of a strawman, especially if it makes you believe that is the actual goal of competing cryptocurrencies. I mean there are probably some people that say this, but a lot of the cryptocurrencies I've been into, they want to replace the whole system, not just the dollar, but banks, financial institutions, law institutions (with smart contracts), corporations/organizations (with DAOs), exchanges (with DEXs), they want to bring a solid money to the unbanked, and bring it to IoT devices, they even want to change the internet itself! And Steem is included in those.

So both options are available and thus everyone is right

"If your goal is to replace the dollar, I think you're kind of missing the point" I have to disagree with this point. There is potential for cryptocurrencies to replace the dollar AND to create entirely new economic systems, we just don't know yet which happens first (or if it actually happens).

I'm starting to learn a lot of these lessons for myself, firsthand. Thanks for being so pragmatic, transparent, and educational about this stuff!

My pleasure! Thanks for reading!

You had me with “not doing anything is often better than going to the doctor”....there is a balance in that, stay aware and know thyself. Working on Steemit I have grown and learned so much about myself and the new world we are creating. Ti can’t wait for smt, I truly cannot imagine what will happen, I’m going to dive in and find out! Thank you @andrachy🌀

My pleasure! Thank you!

Great stuff, Andrew. I've learned a ton just experimenting and playing around. When I started asking my "financial advisor" some of the questions I had, it quickly became clear he didn't really know what he (or I) was talking about.

I have Taleb's book as the next on my list in Audible. Already downloaded. I really enjoyed The Black Swan.

Haha I can only imagine how that conversation went!

Maybe when you’re done reading we’ll have a chat about it!

Yeah, that would be fun!

Up-voted, re-steemed, and followed. I really enjoyed this post. Below is a link to a column I wrote about the ideas of subjective value and the way money emerges out of our cooperative human instincts. The idea is to help SF writers think more clearly about economics, because they are essentially doing virtual experiments which could be really valuable if they understood more about what they were doing.

http://www.intergalacticmedicineshow.com/cgi-bin/mag.cgi?do=columns&vol=randall_hayes&article=002

For instance, Corey Doctorow addressed the "productivity points" arguments in Walkaway.

https://steemit.com/scifi/@plotbot2015/post-scarcity-punk-review-of-walkaway-by-cory-doctorow

Nice post. Anitfragile is the best books I have written bar none. You can implement lots of wisdom from the book into your life. I even wrote a post of Bitcoin being Antifragile:https://steemit.com/bitcoin/@janusface/bitcoin-is-antifragile-it-gains-from-disorder. Thanks for your good work at Steem/ Steemit btw:)

Sounds interesting! I’ve often thought about writing just such an article. I’ll have to check it out!

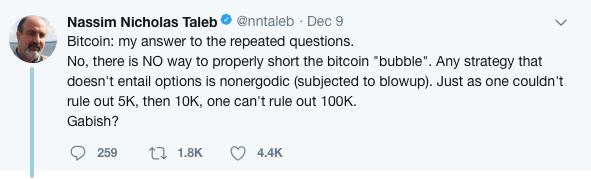

Thanks! It is very simplicitly written, because until recently very few people where aware of Taleb's works and the concept of Antifragility. I have a feeling that the man himself has starting to look at BTC as an Antifragile entity. Thus, he advices against shorting it.

It will be very interesting how BTC will interact with the future/ derivate markets going forward. Perhaps BTC will be eating Wall Street for lunch:)?