You are viewing a single comment's thread from:

RE: Cryptocurrency, permanent negative interest rates and cashless society.

Super video - thanks. I'm learning...and slowly the fog is clearing :) Although maybe it's not your area of interest, but how do you see the Euro(zone) turning out? I've been screaming for years that it's doomed. Maybe it's just one small piece of the global jigsaw.

You are touching a huge issue, - the issue of political sovereignty of Germany and probably the most closely guarded public misconception of the present day. To properly address your question I'd need lots and lots more space and time than just a short post. What I'll do instead is to present you with a synopsis of my future article that one day I'll have the time and inclination to write and let you connect the dots for yourself.

1). Go back to 1945 Occupation zones of Germany https://en.wikipedia.org/wiki/Allied-occupied_Germany

2). Try to understand the real agenda behind the Morgenthau Plan https://en.wikipedia.org/wiki/Morgenthau_Plan

3). Who and for what purpose created European Coal and Steel Community? Is this the Morgenthau Plan in action? https://en.wikipedia.org/wiki/European_Coal_and_Steel_Community

4). USA default on its Bretton-Woods obligations in 1971 and almost back-to-back introduction of The European Unit of Account (EUA)https://en.wikipedia.org/wiki/European_Unit_of_Account

5). European Exchange Rate Mechanism (EERM) and the introduction of The European Currency Unit (ECU) as a replacement of the EUA https://en.wikipedia.org/wiki/European_Exchange_Rate_Mechanism

6). EUR as a basket of currencies (index) derived from ECU. https://en.wikipedia.org/wiki/Euro

7). Unification of Germany and the only one condition to allow it by the Anglosphere after Moscow abandoned its occupation zone, which was delivered to then Chancellor of West Germany Mr. Helmut Kohl by the British-USA Frech puppet François Mitterrand, - i.e. a clear and unconditional commitment to abandon Deutsche Mark (= to abandon financial sovereignty) and to join the EUR from its inception.

8.) Is it by accident that EUR has a Central Bank but does not have a Central Treasury? Therefore, is it by accident the EMU Members have one currency unit but vastly different real interest rates?

9). Dollar Index (DX) as a basket of currencies https://en.wikipedia.org/wiki/U.S._Dollar_Index

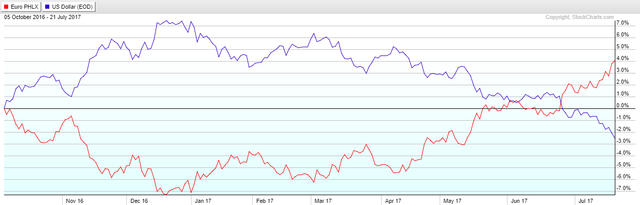

10). The perfect negative correlation of two traded indices - DX vs. EUR

http://stockcharts.com/freecharts/perf.php?$XEU,$USD&n=200&O=011000

11). Conclusion.

EUR - is a Mechanism to neutralize German political and economic Sovereignty by financial means in replacement of the direct British, American and French occupation zones.

EUR as a mirror reflection of the weighted US Dollar together with the Dollar itself makes up a gigantic unified trans-Atlantic monetary pendulum which involves all the world's money into its swaying thereby providing Anglosphere with the global economic dominance tool box.

UK has always been and still is a Trojan horse in the EU. Together with maitaining EUR intact BREXIT - is a mechanism of creating and delivering political uncertainty and eventually political chaos into the main land Europe (read: Germany) to help dragging it down together with depreciating into oblivion the mighty King Dollar before the Global Financial System has been reset.

Your reply plus the video are a one two punch of analysis.

I have no idea what your background is, but if you come from traditional finance I commend you for not drinking the kool aid or at least figuring out the game. Personally, I was trained as an accountant and still work in the profession albeit independently now. My clarity on these issues came during my post graduate business and accounting education. Once you understand how economic policy is used, you cannot miss the implications unless you willingly blind yourself.

I've been watching this situation with growing interest since the early 2000s and have been wondering how in the hell the bankers would unwind the mess they created. It took me a while to realize that unwinding was never the intent, but that only became clear to me after the last meltdown.

Due to my background I tend to be extremely conservative from a financial standpoint and have been skeptical of trading as I found many applications to be manipulative at best. Although I'm late to the game, I've come to have a strong appreciation for blockchain technology and it's possible applications. I'm in the process of learning, but it's clear to me that if we continue to live in a world dominated by digital technology that blockchain will be the foundation for the next phase of economic development. Doing my best to catch up on my understanding of both blockchain and trading.

Thanks again for being a resource.

Oh my - thank you for such a detailed reply. I'm out and on my mobile this evening and I need to give your reply some worthy attention on a bigger bit of real estate! I wish you well on Steemit - I think you could fly here.