Warren Buffett's rating agency ready to downgrade the U.S. permanently if government shutdown emerges

The United States financial system may be taking another hit soon if Congress fails to come up with a legitimate bill to raise the debt ceiling by the end of September.

According to Moody's ratings agency on Sept. 6, the Warren Buffett owned determiner of credit worthiness is prepared to downgrade the United States permanently should a government shutdown take place due to its inability to pay or rollover debt obligations.

A Republican-led House of Representatives, Senate and White House may witness the permanent downgrade of the US federal government’s credit rating by one of the three largest ratings services.

If the US government fails to raise the “debt ceiling,” which limits how much the government is able to borrow, and subsequently misses a debt payment, its outstanding rating would not only be lowered by Moody’s Investor Service, it might stay downgraded for good, CNBC reports.

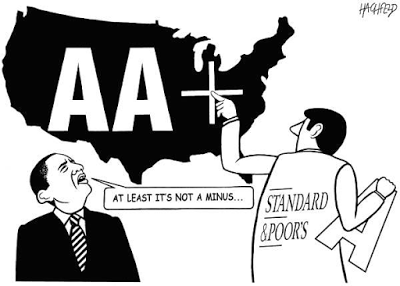

"An upgrade back to AAA," the gold standard in credit ratings, "would be unlikely while the institution of the debt ceiling, and the political environment that gave rise to the missed payment, remained in place," Moody’s team of analysts concluded in report published Tuesday. – Sputnik News

Back in 2011, the U.S.'s AAA+ rating was downgraded by S&P when Congress failed to raise the debt ceiling limit and the Federal government went into a modified shutdown for a few weeks. And ironically the Obama Administration then sicced Attorney General Eric Holder on Standard and Poores over activities done during the Financial Crisis, leading them to quickly revoking the downgrade.