Investment Language 101 Series: TERM OF THE DAY: -- 'Trailing Stop' | E.15 | Trading Candle Cheat Sheet Incl. Each Episode.

A series designed to help all the new people flooding into & entering Crypto/Investments daily who get thrown into the rabbit hole so to speak and everything is new to them.

It is a TLDR / Short Form Series, covering ONLY one thing each episode in blue collar, easy to understand language to give a SHORT OVERVIEW of the term or lesson of the day.

It is specifically designed this way to keep it short and simple.

People can then search out extra info if they wish.

I've never seen a regular series or resource running on Steemit to continually address this basic need so I decided to do it.

TERM OF THE DAY:

What is....

Trailing Stop?

--

A stop order that can be set at a defined percentage away from a security's current market price.

A trailing stop for a long position would be set below the security’s current market price; for a short position, it would be set above the current price.

It is designed to protect gains by enabling a trade to remain open and continue to profit as long as the price is moving in the right direction, but closing the trade if the price changes direction by a specified percentage.

-- A trailing stop can also specify a dollar amount instead of a percentage, and is also known as a “chandelier stop.”

--

Breaking Down...

'Trailing Stop' :

--

The trailing stop is more flexible than a fixed stop loss, since it automatically tracks the stock’s price direction and does not have to be manually reset like the fixed stop loss.

Like all stop orders, the trailing stop enforces trading discipline by taking the emotion out of the “sell” decision, thus enabling traders and investors to protect profits and investment capital.

The following example illustrates how a trailing stop works.

Assume you purchased a stock at $10. You could place a 15% trailing stop order (good 'til canceled or GTC) on it right away to protect your principal. This means that if the stock declines by 15% or more, the trailing stop will be triggered, thereby capping your loss.

Suppose the stock moves up to $14 over the next few months, and while you have enjoyed its appreciation, you are a little concerned that it could retrace its gains. Recall that your GTC trailing stop is still in place, so if the stock plunges 15% or more tomorrow, it would be triggered. You decide to tighten the trailing stop to 10% to protect as much profit as you can, while still giving the trading position room to run.

Let’s assume the stock moves up further to $15, and subsequently declines 10% to $13.50. The 10% price drop would trigger your trailing stop, and assuming you were “filled” at $13.50, the gain on your long position would be 35% (i.e. the difference between $10 and $13.50).

Note that if the stock drifts down in up-and-down fashion, with single-digit declines every other day, the trailing stop would not be triggered since you have set it at 10%. The key is to set the trailing stop percentage at a level that is neither too tight (to prevent the trade being stopped before it has a chance to work) nor too wide (which if triggered, may result in leaving too much money on the table).

Trailing stops can also be used for other asset classes such as currencies. Like other stop orders, trailing stops can be set as limit orders or market orders. But unlike conventional stop orders that are held on the market book at the exchange, trailing stop orders are stored in the brokerage’s computerized system.

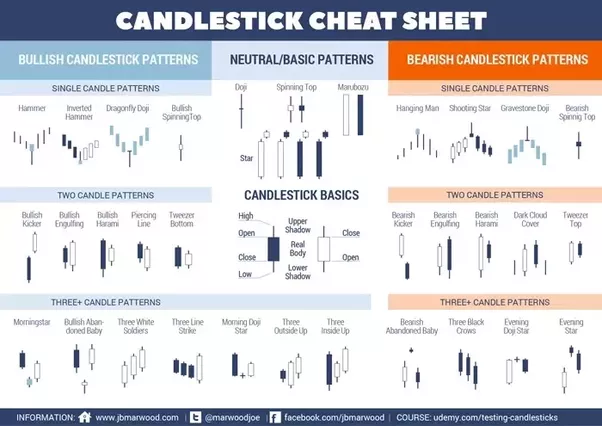

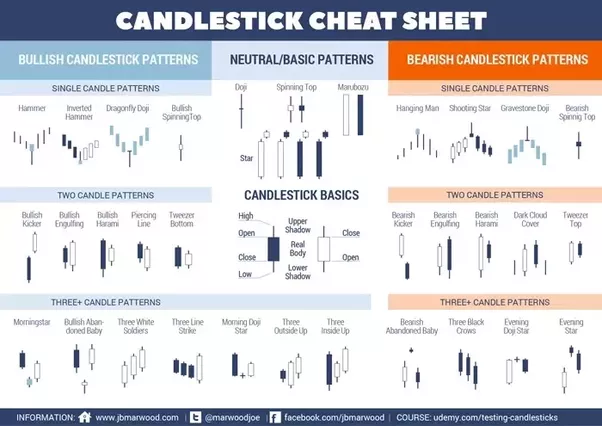

Trading Candle Cheat Sheet:

--

Further Reading/Source/Resources

Friend of the People -- Enemy of the State.

--

I am leaving these images I made here until I figure out one that fits properly and looks right for the first/main image for the post/series.

--

Since Steemit dev's changed the size of the picture frame that shows, it has honestly been a real problem getting images to match the screen, it was perfectly fine months ago before they messed around with it.

SMH.

Thanks for reading, have a nice day.

PixaBay has tons of free pictures for us all to use!!!

Super Easy/Fast Picture Edits / Resizing at: http://www.picresize.com/ and also https://www298.lunapic.com/editor/

If you liked this blog post - please Resteem it and share good content with others!

--

Some of my recent blogs:

--

Most Images: Gif's - via Giphy.com , Funny or Die.com / Pixabay. Today:

If you feel my posts are undervalued or you want to donate to tip me - I would appreciate it very much.

--

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

Monero (XMR) - d8ecb02c09f70ec10504b59b96bc1f488af28b05933893dfd1f55b113e23fbff

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

A series designed to help all the new people flooding into & entering Crypto/Investments daily who get thrown into the rabbit hole so to speak and everything is new to them.

It is a TLDR / Short Form Series, covering ONLY one thing each episode in blue collar, easy to understand language to give a SHORT OVERVIEW of the term or lesson of the day.

It is specifically designed this way to keep it short and simple.

People can then search out extra info if they wish.

I've never seen a regular series or resource running on Steemit to continually address this basic need so I decided to do it.

TERM OF THE DAY:

What is....

Trailing Stop?

--

A stop order that can be set at a defined percentage away from a security's current market price.

A trailing stop for a long position would be set below the security’s current market price; for a short position, it would be set above the current price.

It is designed to protect gains by enabling a trade to remain open and continue to profit as long as the price is moving in the right direction, but closing the trade if the price changes direction by a specified percentage.

-- A trailing stop can also specify a dollar amount instead of a percentage, and is also known as a “chandelier stop.”

--

Breaking Down...

'Trailing Stop' :

--

The trailing stop is more flexible than a fixed stop loss, since it automatically tracks the stock’s price direction and does not have to be manually reset like the fixed stop loss.

Like all stop orders, the trailing stop enforces trading discipline by taking the emotion out of the “sell” decision, thus enabling traders and investors to protect profits and investment capital.

The following example illustrates how a trailing stop works.

Assume you purchased a stock at $10. You could place a 15% trailing stop order (good 'til canceled or GTC) on it right away to protect your principal. This means that if the stock declines by 15% or more, the trailing stop will be triggered, thereby capping your loss.

Suppose the stock moves up to $14 over the next few months, and while you have enjoyed its appreciation, you are a little concerned that it could retrace its gains. Recall that your GTC trailing stop is still in place, so if the stock plunges 15% or more tomorrow, it would be triggered. You decide to tighten the trailing stop to 10% to protect as much profit as you can, while still giving the trading position room to run.

Let’s assume the stock moves up further to $15, and subsequently declines 10% to $13.50. The 10% price drop would trigger your trailing stop, and assuming you were “filled” at $13.50, the gain on your long position would be 35% (i.e. the difference between $10 and $13.50).

Note that if the stock drifts down in up-and-down fashion, with single-digit declines every other day, the trailing stop would not be triggered since you have set it at 10%. The key is to set the trailing stop percentage at a level that is neither too tight (to prevent the trade being stopped before it has a chance to work) nor too wide (which if triggered, may result in leaving too much money on the table).

Trailing stops can also be used for other asset classes such as currencies. Like other stop orders, trailing stops can be set as limit orders or market orders. But unlike conventional stop orders that are held on the market book at the exchange, trailing stop orders are stored in the brokerage’s computerized system.

Trading Candle Cheat Sheet:

--

Further Reading/Source/Resources

Friend of the People -- Enemy of the State.

--

I am leaving these images I made here until I figure out one that fits properly and looks right for the first/main image for the post/series.

--

Since Steemit dev's changed the size of the picture frame that shows, it has honestly been a real problem getting images to match the screen, it was perfectly fine months ago before they messed around with it.

SMH.

Thanks for reading, have a nice day.

PixaBay has tons of free pictures for us all to use!!!

Super Easy/Fast Picture Edits / Resizing at: http://www.picresize.com/ and also https://www298.lunapic.com/editor/

If you liked this blog post - please Resteem it and share good content with others!

--

Some of my recent blogs:

--

Most Images: Gif's - via Giphy.com , Funny or Die.com / Pixabay. Today:

If you feel my posts are undervalued or you want to donate to tip me - I would appreciate it very much.

--

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

Monero (XMR) - d8ecb02c09f70ec10504b59b96bc1f488af28b05933893dfd1f55b113e23fbff

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

--

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

Monero (XMR) - d8ecb02c09f70ec10504b59b96bc1f488af28b05933893dfd1f55b113e23fbff

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

nice info about TLDR for newbie. It is beneficial & worth to read your article keep sharing info @barrydutton your post deserve to be upvoted & Resteemed. so Upvoted& Resteemed from my side.

Many many Thanks for sharing important information@barrydutton