Investment Language 101 Series: TERM OF THE DAY: -- What Is: ' Price-Earnings Ratio - P/E Ratio ' | E.87 | Trading Candle Cheat Sheet Incl. Each Episode.

A series designed to help all the new people flooding into & entering Crypto/Investments daily who get thrown into the rabbit hole so to speak and everything is new to them.

Bitshares 101 Focus/Resources Section for New Crypto Folks now included near the end of each post - starting just prior to Christmas 2017. BTS is a Decentralized Exchange and much more. Very undervalued!

It is a TLDR / Short Form Series, covering ONLY one thing each episode in blue collar, easy to understand language to give a SHORT OVERVIEW of the term or lesson of the day.

It is specifically designed this way to keep it short and simple.

People can then search out extra info if they wish.

I've never seen a regular series or resource running on Steemit to continually address this basic need so I decided to do it.

TERM OF THE DAY:

What is....

' Price-Earnings Ratio - P/E Ratio ' ?

--

The price-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings. The price-earnings ratio is also sometimes known as the price multiple or the earnings multiple.

The P/E ratio can be calculated as:

Market Value per Share / Earnings per Share

--

Breaking Down...

' Price-Earnings Ratio - P/E Ratio' :

--

In essence, the price-earnings ratio indicates the dollar amount an investor can expect to invest in a company in order to receive one dollar of that company’s earnings. This is why the P/E is sometimes referred to as the price multiple because it shows how much investors are willing to pay per dollar of earnings. If a company were currently trading at a multiple (P/E) of 20, the interpretation is that an investor is willing to pay $20 for $1 of current earnings.

To calculate the P/E ratio, the earnings per share (EPS) must be known. EPS is most often derived from the last four quarters. This form of the price-earnings ratio is called trailing P/E, which may be calculated by subtracting a company’s share value at the beginning of the 12-month period from its value at the period’s end, adjusting for stock splits if there have been any. Sometimes, price-earnings can also be taken from analysts’ estimates of earnings expected during the next four quarters. This form of price-earnings is called a projected or forward P/E. A third, less common variation uses the sum of the last two actual quarters and the estimates of the next two quarters.

Let's calculate the P/E ratio for Wal-Mart Stores Inc. (NYSE:WMT), as of November 14, 2017 when the company's stock price closed at $91.09. The company's profit for the fiscal year ended January 31, 2017 was $13.64 billion and its number of shares outstanding is 3.1 billion. Its EPS can be calculated as $13.64 billion / 3.1 billion = $4.40. Wal-Mart's P/E ratio is, therefore, $91.09/$4.40 = 20.70.

You can track the P/E ratios for the stocks in your portfolio or individual stocks by adding them to your own 'Watchlist'. Here we list the top and bottom three companies in the S&P 500 by P/E ratio. This list updates daily based upon movements in the stock prices, so adding stocks you are interested in to your Watchlist is the best way to keep an eye on them.

-- Investor Expectations:

In general, a high P/E suggests that investors are expecting higher earnings growth in the future compared to companies with a lower P/E. A low P/E can indicate either that a company may currently be undervalued or that the company is doing exceptionally well relative to its past trends. When a company has no earnings or is posting losses, in both cases P/E will be expressed as “N/A.” Though it is possible to calculate a negative P/E, this is not the common convention.

The price-earnings ratio can also be seen as a means of standardizing the value of one dollar of earnings throughout the stock market. In theory, by taking the median of P/E ratios over a period of several years, one could formulate something of a standardized P/E ratio, which could then be seen as a benchmark and used to indicate whether or not a stock is worth buying.

-- Limitations of 'Price-Earnings Ratio - P/E Ratio':

Like any other fundamental designed to inform investors as to whether or not a stock is worth buying, the price-earnings ratio comes with a few important limitations that are important to take into account, as investors may often be led to believe that there is one single metric that will provide complete insight into an investment decision, which is virtually never the case.

One primary limitation of using P/E ratios emerges when comparing P/E ratios of different companies. Valuations and growth rates of companies may often vary wildly between sectors due both to the differing ways companies earn money and to the differing timelines during which companies earn that money. As such, one should only use P/E as a comparative tool when considering companies within the same sector, as this kind of comparison is the only kind that will yield productive insight. Comparing the P/E ratios of a telecommunications company and an energy company, for example, may lead one to believe that one is clearly the superior investment, but this is not a reliable assumption.

An individual company’s P/E ratio is much more meaningful when taken alongside P/E ratios of other companies within the same sector. For example, an energy company may have a high P/E ratio, but this may reflect a trend within the sector rather than one merely within the individual company. An individual company’s high P/E ratio, for example, would be less cause for concern when the entire sector has high P/E ratios.

Moreover, because a company’s debt can affect both the prices of shares and the company’s earnings, leverage can skew P/E ratios as well. For example, suppose there are two similar companies that differ primarily in the amount of debt they take on. The one with more debt will likely have a lower P/E value than the one with less debt. However, if business is good, the one with more debt stands to see higher earnings because of the risks it has taken.

Another important limitation of price-earnings ratios is one that lies within the formula for calculating P/E itself. Accurate and unbiased presentations of P/E ratios rely on accurate inputs of the market value of shares and of accurate earnings per share estimates. While the market determines the value of shares and, as such, that information is available from a wide variety of reliable sources, this is less so for earnings, which are often reported by companies themselves and thus are more easily manipulated. Since earnings are an important input in calculating P/E, adjusting them can affect P/E as well.

-- Things to Remember:

-- Generally a high P/E ratio means that investors are anticipating higher growth in the future.

-- The average market P/E ratio is 20-25 times earnings.

-- The P/E ratio can use estimated earnings to get the forward looking P/E ratio.

-- Companies that are losing money do not have a P/E ratio.

Resharing this one..... This is a KEY everyday thing to understand in the crypto space / privacy /markets. So many new people coming daily and posts often also miss people in other timezones..... 2 things I try and remember, to help people and be aware of, thanks.

Your Friend in Liberty, Barry.

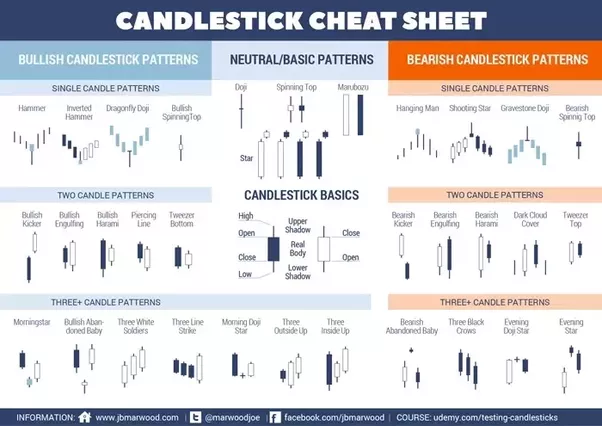

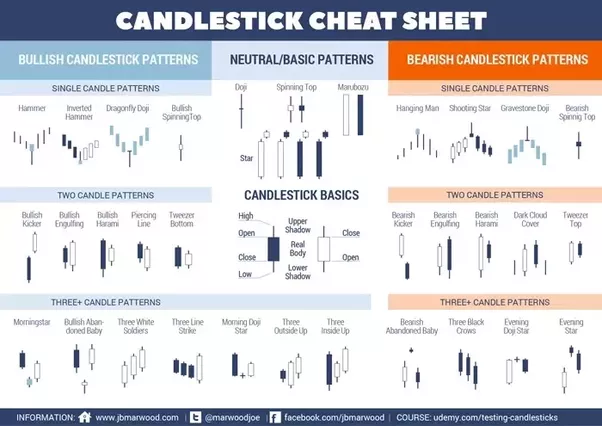

Trading Candle Cheat Sheet:

--

Further Reading/Source/Resources

Friend of the People -- Enemy of the State.

--

Bitshares 101 Focus/Resources Section:

for New Crypto Folks.

https://bitshares.org/

--

-- Bitshares is a Trading platform, and a LOT more.... designed by blockchain wizard here Dan Larimer - @dan / @dantheman.

I've blogged on him, and BTS many many times.

It's a place you can use that is decentralized, with an active community, to use trading lessons like this, that we are learning together.

Just a few of my past $BTS blogs....

to help you apply lessons today!

--

Thanks for reading, have a nice day.

PixaBay has tons of free pictures for us all to use!!!

Super Easy/Fast Picture Edits / Resizing at: http://www.picresize.com/ and also https://www298.lunapic.com/editor/

If you liked this blog post - please Resteem it and share good content with others!

--

Some of my recent blogs:

--

Most Images: Gif's - via Giphy.com , Funny or Die.com / Pixabay. Today:

If you feel my posts are undervalued or you want to donate to tip me - I would appreciate it very much.

--

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

A series designed to help all the new people flooding into & entering Crypto/Investments daily who get thrown into the rabbit hole so to speak and everything is new to them.

Bitshares 101 Focus/Resources Section for New Crypto Folks now included near the end of each post - starting just prior to Christmas 2017. BTS is a Decentralized Exchange and much more. Very undervalued!

It is a TLDR / Short Form Series, covering ONLY one thing each episode in blue collar, easy to understand language to give a SHORT OVERVIEW of the term or lesson of the day.

It is specifically designed this way to keep it short and simple.

People can then search out extra info if they wish.

I've never seen a regular series or resource running on Steemit to continually address this basic need so I decided to do it.

TERM OF THE DAY:

What is....

' Price-Earnings Ratio - P/E Ratio ' ?

--

The price-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings. The price-earnings ratio is also sometimes known as the price multiple or the earnings multiple.

The P/E ratio can be calculated as:

Market Value per Share / Earnings per Share

--

Breaking Down...

' Price-Earnings Ratio - P/E Ratio' :

--

In essence, the price-earnings ratio indicates the dollar amount an investor can expect to invest in a company in order to receive one dollar of that company’s earnings. This is why the P/E is sometimes referred to as the price multiple because it shows how much investors are willing to pay per dollar of earnings. If a company were currently trading at a multiple (P/E) of 20, the interpretation is that an investor is willing to pay $20 for $1 of current earnings.

To calculate the P/E ratio, the earnings per share (EPS) must be known. EPS is most often derived from the last four quarters. This form of the price-earnings ratio is called trailing P/E, which may be calculated by subtracting a company’s share value at the beginning of the 12-month period from its value at the period’s end, adjusting for stock splits if there have been any. Sometimes, price-earnings can also be taken from analysts’ estimates of earnings expected during the next four quarters. This form of price-earnings is called a projected or forward P/E. A third, less common variation uses the sum of the last two actual quarters and the estimates of the next two quarters.

Let's calculate the P/E ratio for Wal-Mart Stores Inc. (NYSE:WMT), as of November 14, 2017 when the company's stock price closed at $91.09. The company's profit for the fiscal year ended January 31, 2017 was $13.64 billion and its number of shares outstanding is 3.1 billion. Its EPS can be calculated as $13.64 billion / 3.1 billion = $4.40. Wal-Mart's P/E ratio is, therefore, $91.09/$4.40 = 20.70.

You can track the P/E ratios for the stocks in your portfolio or individual stocks by adding them to your own 'Watchlist'. Here we list the top and bottom three companies in the S&P 500 by P/E ratio. This list updates daily based upon movements in the stock prices, so adding stocks you are interested in to your Watchlist is the best way to keep an eye on them.

-- Investor Expectations:

In general, a high P/E suggests that investors are expecting higher earnings growth in the future compared to companies with a lower P/E. A low P/E can indicate either that a company may currently be undervalued or that the company is doing exceptionally well relative to its past trends. When a company has no earnings or is posting losses, in both cases P/E will be expressed as “N/A.” Though it is possible to calculate a negative P/E, this is not the common convention.

The price-earnings ratio can also be seen as a means of standardizing the value of one dollar of earnings throughout the stock market. In theory, by taking the median of P/E ratios over a period of several years, one could formulate something of a standardized P/E ratio, which could then be seen as a benchmark and used to indicate whether or not a stock is worth buying.

-- Limitations of 'Price-Earnings Ratio - P/E Ratio':

Like any other fundamental designed to inform investors as to whether or not a stock is worth buying, the price-earnings ratio comes with a few important limitations that are important to take into account, as investors may often be led to believe that there is one single metric that will provide complete insight into an investment decision, which is virtually never the case.

One primary limitation of using P/E ratios emerges when comparing P/E ratios of different companies. Valuations and growth rates of companies may often vary wildly between sectors due both to the differing ways companies earn money and to the differing timelines during which companies earn that money. As such, one should only use P/E as a comparative tool when considering companies within the same sector, as this kind of comparison is the only kind that will yield productive insight. Comparing the P/E ratios of a telecommunications company and an energy company, for example, may lead one to believe that one is clearly the superior investment, but this is not a reliable assumption.

An individual company’s P/E ratio is much more meaningful when taken alongside P/E ratios of other companies within the same sector. For example, an energy company may have a high P/E ratio, but this may reflect a trend within the sector rather than one merely within the individual company. An individual company’s high P/E ratio, for example, would be less cause for concern when the entire sector has high P/E ratios.

Moreover, because a company’s debt can affect both the prices of shares and the company’s earnings, leverage can skew P/E ratios as well. For example, suppose there are two similar companies that differ primarily in the amount of debt they take on. The one with more debt will likely have a lower P/E value than the one with less debt. However, if business is good, the one with more debt stands to see higher earnings because of the risks it has taken.

Another important limitation of price-earnings ratios is one that lies within the formula for calculating P/E itself. Accurate and unbiased presentations of P/E ratios rely on accurate inputs of the market value of shares and of accurate earnings per share estimates. While the market determines the value of shares and, as such, that information is available from a wide variety of reliable sources, this is less so for earnings, which are often reported by companies themselves and thus are more easily manipulated. Since earnings are an important input in calculating P/E, adjusting them can affect P/E as well.

-- Things to Remember:

-- Generally a high P/E ratio means that investors are anticipating higher growth in the future.

-- The average market P/E ratio is 20-25 times earnings.

-- The P/E ratio can use estimated earnings to get the forward looking P/E ratio.

-- Companies that are losing money do not have a P/E ratio.

Resharing this one..... This is a KEY everyday thing to understand in the crypto space / privacy /markets. So many new people coming daily and posts often also miss people in other timezones..... 2 things I try and remember, to help people and be aware of, thanks.

Your Friend in Liberty, Barry.

Trading Candle Cheat Sheet:

--

Further Reading/Source/Resources

Friend of the People -- Enemy of the State.

--

Bitshares 101 Focus/Resources Section:

for New Crypto Folks.

https://bitshares.org/

--

-- Bitshares is a Trading platform, and a LOT more.... designed by blockchain wizard here Dan Larimer - @dan / @dantheman.

I've blogged on him, and BTS many many times.

It's a place you can use that is decentralized, with an active community, to use trading lessons like this, that we are learning together.

Just a few of my past $BTS blogs....

to help you apply lessons today!

--

Thanks for reading, have a nice day.

PixaBay has tons of free pictures for us all to use!!!

Super Easy/Fast Picture Edits / Resizing at: http://www.picresize.com/ and also https://www298.lunapic.com/editor/

If you liked this blog post - please Resteem it and share good content with others!

--

Some of my recent blogs:

--

Most Images: Gif's - via Giphy.com , Funny or Die.com / Pixabay. Today:

If you feel my posts are undervalued or you want to donate to tip me - I would appreciate it very much.

--

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

--

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

Well articulated, I respect you bro!

good post frineds amazing

Thanks for informative post

if i invest in share market then i will consult with you

Nice post beautiful presented and explained. detail oriented with nice information. thank you for sharing @barrydutton

educative post with sponsored

Nice post thanks for sharing @ barrydutton

I was looking for a good cheat sheet thanks.

-- glad to help, I know it is a valuable little tool, new people seeing blogs every day can use it.

Thanks for this, I never really understood or paid attention to this metric. You've explained the ratio beautifully.

Thanks for stopping in again man.

The really common stuff that is important, I share again here and there, knowing the new people coming daily.