Gold and silver prices 17 March 2017

Hello Steemians.

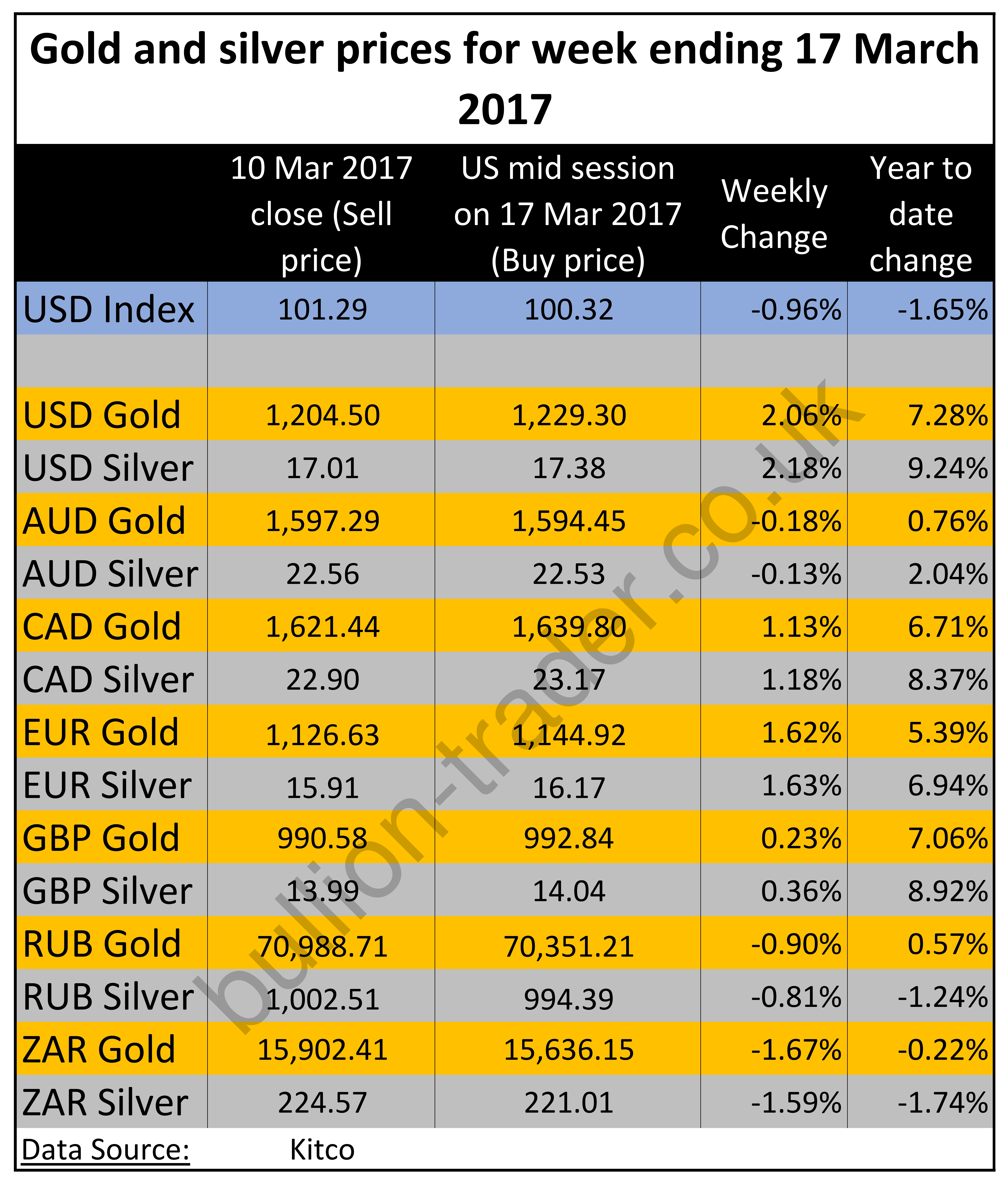

The USD index is down for the week so gold and silver prices would be up in USD terms.

Fed raises rates as anticipated.

On Wednesday 15 March 2017 the US Federal reserve raised the fed funds rate by 25 basis points, which is 0.25% in yours and my language, and indicated more rate rises were on the cards this year. The immediate effect on you and I is that our housing loan payments and possibly any other debt repayments will increase. Sadly, we suspect, the same can't be said about any interest paid to us from our savings account.

Gold and silver prices reacted favourably, with gold climbing vertically to settle above $ 1,220 for the day. Silver did the same, since gold and silver always track each other. If gold goes up, silver will go up. Likewise, if gold goes down, silver will go down.

Gold and silver is the only money not controlled by any one government. They are also outside the banking system so when there is a financial crisis, gold and silver stand separated and do what they do best – protect wealth.

The Federal Reserves' justification is carefully crafted so not really worth paying much attention to. Safe to say they will never reveal the real reason for their actions and anyone that put some thought into the current economic climate will realise that all central banks have their backs against a wall.

In 2008 the central banks all started reducing their interest rates in conjunction with various QE (money printing in everyday language) programmes to stave off a meltdown of the global financial system, caused by the banks that were effectively bailed out by the reduced interest rates and QE money.

With their interest rates now close to zero, should a financial crisis arise – which seems very likely, they cannot reduce these interest rates further to kick start an economy or help the banks out again. Essentially they are out of bullets.

The likelihood of interest rates returning to previous levels of between 4% – 6% is very slim. If they raised them by 0.25% four times in 2017, they would only manage to raise them by 2% this year. That could potentially be destructive in itself for the following reason.

Since global debt (government, corporate and personal) has increased exponentially a 2% interest rate rise in one year would cause so many defaults that banks wouldn’t survive. It would be 2008 all over again, except a lot worse, since there is now much more debt than in 2008.

What happens in the global financial system in future is anyone’s guess, but a few things are certain.

- Inflation will rear it’s ugly head, since this is the only way, apart from an outright default, that all governments can pay off todays' debts in the future. This future could be 50 years or more so it’s a long time-frame. During that time, inflation will ravage the money in your pockets and bank accounts so that in 50 years time, todays' money will be worth almost nothing.

- Government spending very seldom decreases and since governments only get their revenue from taxes, taxes will be increasing to pay for the increasing spending.

Protect yourself and your families wealth, no matter how small, by investing in physical gold and silver.

Getting started with investing in physical gold and silver is much easier than many think. Visit the bullion-trader education centre to see how easy it is and where to get started.

Access our educational videos where we also cover many other aspects of gold and silver investing.

Take control of your future. It’s never too late to start and you’ll never regret it.

Have a good weekend.

Hey @bulliontraderuk, i'm interested to help protect my Family Wealth.

A 21 Year old Student looking out for his single mother and younger brother, i don't have a big budget but i'm willing to invest some of my hard earned money just to feel some sort of security for the next following years. Would you recommend to get Silver & Gold Coins, trade the price on the Forex Market or Invest in Company Stocks? Would appreciate your feedback

Hi @steemitguide.

I'm not allowed to give financial advice but I can tell you what we do and why, being firm believers in putting our money where our mouths are.

When making your decisions bare the following in mind. All markets are rigged and manipulated including the gold and silver market and there is no reason to believe it will stop anytime soon. With the advent of hft (high frequency trading) over the last decade or so, trading on any market becomes very risky since you have computers making automated decisions which can affect prices wildly.

Physical silver and gold coins are ideal for small budgets (which let's face it, applies to most working people - ourselves included). They are also one of the few "assets" that you don't need a loan to pay for and they are highly unlikely to go to zero in value (which they have never done in the past 5,000 years).

How about using silver as a regular savings account? If you have $20.00 a month to save, buy a 1 oz pure silver coin, instead of putting it in a bank account. Since all currencies are affected by inflation and consequently devalue over time, after one year you will have 12 oz of pure silver which can appreciate in value vs $ 240.00 in currency which will only depreciate as time goes by.

Physical gold and silver can also be very easily moved across borders. If your family decides to move countries you can take your metals with you and they can be exchanged for any local currency, giving you a very liquid asset. The same doesn't apply to Forex Market contracts or Company stocks.

If you wanted to trade the gold and silver price an ETF might be your best solution. ETF's give exposure to the underlying metal price but not access to the the physical metal. That basically means you will not be able to exchange your shares for the physical metal.

If your risk tolerance is high and you think you can make money trading prices on the Forex Market your budget constraints will reduce any meaningful gains due to any dealing costs you will likely incur.

We have also explored the option of investing in mining stocks, which are the most volatile and risky stocks on the planet, but they do have good leverage against the underlying gold and silver prices. For this you would need to pay for a subscription to a well known and respected newsletter, that has people analysing and doing the due diligence on these stocks, since about 60% of all mining stocks are just names of companies which will not make any money. Again risk is ever present.

Personally we wouldn't risk safeguarding our parents wealth at all, since you never know when they might need to draw on that in the coming years. Look to the long term, there are no quick bucks to be made. Accumulate as much physical gold and silver as possible although many can only afford silver. It has exceptional purchasing power protection over that long term.

Thanks for the Advise! Will consider this and do my own research

Upvoted for life! Appreciate you taking your time to write all of this. This makes Steemit Great for Discussion