Why I Am Not a Fan of Financial Advisors and Believe in Learning Finance Yourself

I have stated multiple times before in articles that I am not the biggest fan of financial advisors, not because I believe they are inherently bad people, but because I know they have to make a living, often at your expense. In order to survive as a financial advisor you often have to pitch investments that might not be in the client’s best interest but will make you commission. This is why there is such a fast turn over in their industry and why certain people cant do it for long periods of time. If you don’t want to get taken advantage of, the key is to learn something yourself.

Financial advisors basically work by getting as much people going to them as possible and making a tiny portion of their portfolio something undesirable like annuities. However because the financial advisor is making them money in the long run, they end up loving them and building a relationship. However, 99% of the time, if you had just taken your money and put it in an index fund you would have more money in the long run. I have done this test with many of my friends and their parents who rave about “their financial guy”.

In addition many big time financial advisers who are making money hand over fist and charge large hourly rates to meet with them, will position themselves as pillars of the community. They will go to a church, town meeting, ect and get clients as much as possible. It’s not a total scam, but like I said before, you would end up doing much better if you had just dealt with your money yourself. Advisors do have a use case when it comes to help organizing certain account and tax purposes, but I wouldn’t let them invest your money in most of the cases.

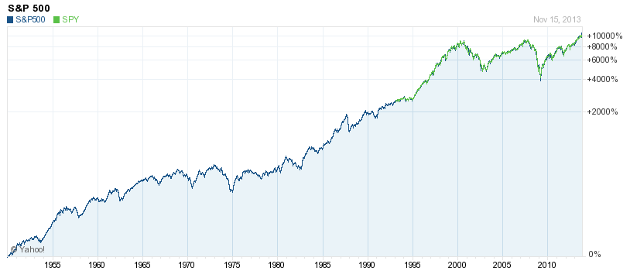

The real lesson here is that with money, you cant afford to not learn about finance yourself, or else you will get taken advantage of. People are out there to take every little penny they can at your expense. Most people never realize it is happening either, but in the long run they might be costing you thousands of dollars. Learn about index funds, how stock market ETFs work, just personal finance in general and you will be glad you did. If you are younger, it is imperative that you learn at a younger age. The faster you start investing, the more you will have for your retirement. It is never too early to start, especially when the stock market has doubled money on average every 7-8 years over a 60 year period.

If you are looking to start learning about personal finance and have no idea where to start, there are many people who I do believe are very good. Suze Orman and Dave Ramsey, I believe might be a good start for a complete novice. They don’t really take any risks with any of the money, but they do teach you a good basis. If you are looking for other research, there is a fantastic subreddit r/personalfinance, which has a ton of material and people that are willing to help you out. You can ask them specific questions as well and they will respond. This is your money that we are talking about, money you work hard for every day, don’t let a parasite skim some of it from you.

Thanks to @Elyaque for the badges

100% agree. In the US, the average Financial Advisorr job is really a sales job. Their goal is to push their companies products (mutual funds, other funds).

There are also some legit portfolio managers out there that help with all aspects of wealth management (tax, investments, etc). But these guys/gals are hard to find and evaluate.

Cryptopay - ORDER BITCOIN DEBIT CARD and Wallet with advantages 😃 NFC 2.5 $ iphone https://steemit.com/card/@happycoin/cryptopay-order-bitcoin-debit-card-and-wallet-with-advantages 😎

True Flip {ICO} - Already running a transparent blockchain lottery! Bomb! Bonus 20%! Hurry! :)

The platform is already working and making a profit :)

https://steemit.com/ico/@happycoin/true-flip-ico-already-running-a-transparent-blockchain-lottery-bomb-bonus-20-hurry

meep

Meep!

meep

I have to say that I don't 100% agree with your assessment of financial advisors. I consider myself somewhat versed in investing and have the time to do my own research, as it seems that you do too. However, a "good" financial advisor's job would be to tell me the things I don't already know, as well as some things to watch out for. I acknowledge that I don't know everything when it comes to finance, and an advisor can help me with that for a flat upfront fee. Even if he never manages my assets.

I was right with you until you said Suze Orman... The starting book I like to recommend is "the Richest Man in Babylon" by George S Clason. It is such an easy read, and makes you think if they could do that then, then i can do that! Also I think that it shows a better model for financial advisors. That said, good financial advisors help people maintain discipline if they dont have it and can help when people are scared by volatility, but I doubt the crypto community is bothered much by volatility.

So I don't recommend everything she says, but I think the underlying message she brings which is live below your means and the hardest part of investing is just putting the money into the market, is good for most people. Also I think there are good financial advisers, but there is such an incentive to be a bad one that most people choose that option. So realistically if you wanted to invest into a fund with a high cost versus just an S&P500 etf with near 0 costs, you are trading a bit of return in the long run, but usually getting less volatility. So if you are older it is a better bet.

people should not buy common stocks, only the A shares. The common shares are only give aways to the insiders, who then sell to the public. They are not used to raise new capital for growing the business. In fact, corporate debt is at an all time high, and PEs are too. This does not bode well for anyone's stock holding, and they should get out now, before the crash picks up steam. no pun intended. ;)

And then came the Cryptos, where men and women of all ages, educate themselves as there are no advisors.

It is too new, too dynamic to sit and listen, you act and learn by those actions.

Here's to the next school of hard knocks!

I was thinking about it from a different angle... that you REALLY can't trust the advisors in crypto. When every guru is heavily invested in several cryptocurrency projects, whose advice can be "non-partisan"?

and I am waiting the outcome of the plan to pass laws against or controlling crypto, in the name of controlling money laundering, which the big banks do every day

Very much on the same page as you. I can't stand how I was treated with FA when I was younger and didn't fully understand the Financial Space.

All that I know I have learned on my own or found resources that I could connect with to better understand.

Much like the Cryptos, I am still learning this space and find a lot of info and guidance right here on Steam.

Agree that having a "finance guy" is a poor setup. After all, who better than yourself to have the motivation to grow your own capital?

It just takes a considerable amount of reading/research, discipline, and patience. No silver bullet or magic formula.

try reading "Dialectical economics" by lyndon larouche

Holy crap i cant agree more! Most FA give you the most generic advice for top dollar too!

When i learned about the stock market and managing my own finances, i felt like i was hosed by FA/FP's

I agree, financial advisors are a waste of money, you handle your money because its yours, you are your best financial advisor!

I agree 100%. I always tell people this.