Investing Basics: P/E Ratios

What Are P/E Ratios?:

P/E Ratios, or Price to Earnings Ratios, represent the price of the stock of a company in comparison to the earnings that they bring in. For example, if you have a P/E ratio of 10, you are paying 10 dollars for every dollar that the company brings in on a quarterly basis.

Calculating P/E Ratios:

P/E Ratios can be calculated by dividing market price per share by earnings per share.

For example:

100 / $4 = 20

This means that investors are paying $20 for every $1 that company brings in.

Finding Undervalued Stocks With P/E Ratios:

Here are the average P/E ratios for different market Indexes:

- S&P 500: 25.5

- Russell 2000: 147

- Dow Jones Industrial Average: 22.28

- Nasdaq 100: 27.93

- GDX: 36.51

It's easy to say that paying 20xs a company's earnings for a share of their company is a bit ridiculous. Having a high P/E ratio can either signal the expectations of the market for companies to have higher earnings in the coming years, or it can signal overvalued assets.

With commodity-related stocks, such as gold mining stocks, it's hard to say that a P/E ratio of 36 is overvalued. Here's why:

Precious metals have been on a decline for the past 50 years or so. Mining companies are struggling to make a living and have earnings as low as a few pennies per share. Those are some low margins. As gold and silver price manipulation and suppression wear off and their prices rise, these mining companies will be more profitable. That's why I consider stocks in this sector undervalued.

With companies from sectors like the Russell 2000, one could make the argument that these companies are overvalued because the US GDP is only increasing by about 2.5% per year, which is quite weak. For these stocks to reach a more reasonable P/E ratio such as 20, it would take 8 years for their earnings to catch up. Things are out of wack in the small cap sector.

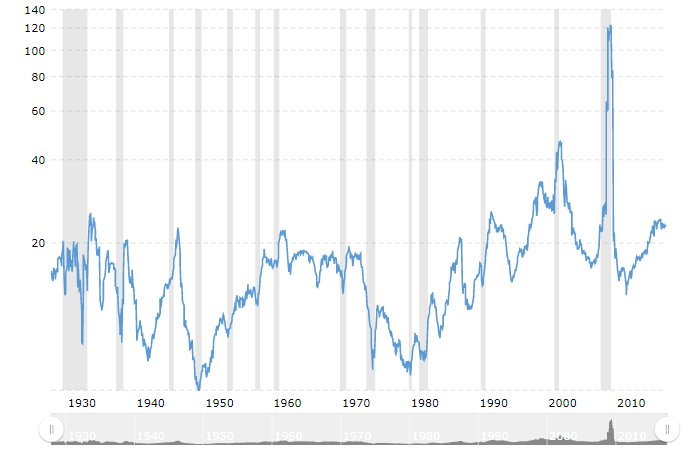

Historical P/E Ratios During Market Crashes:

Here's a look into the S&P 500's past P/E ratios. Within the gray bars is where market crashes occured. Note that P/E ratios were as high as 122 during the 2008 housing bubble. The P/E ratios of today are not that high, but that's not to say that they aren't high at all. In my opinion, stocks in general are becoming overvalued.

As you can see, P/E ratios aren't the end all be all solutions to determining a good buy, but they are a good start to help you understand the true value the stock of a company holds.

Thanks For Reading!

Well written and great post for beginning investors. P/E ratio is the first thing I look for before buying. Companies like Amazon and Tesla don't care though, lol.

Yes, it's a different story when it comes to tech companies. Nasdaq average is coming up on 30!