Physical vs. digital cash

Cash has several advantages over payment cards and bank transfers, but physical cash also has a number of serious drawbacks. What we need is a form of digital cash (a “reliable e-cash”, as Milton Friedman called it in 1999) that preserves all of the advantages of physical cash, but suffers from none of the disadvantages.

One chief advantage of cash is its anonymity. A physical coin or bank note does not carry a record of who has held it before, or of the transactions in which it has been used in the past. This makes financial surveillance difficult, safeguarding privacy. Cash also makes it harder for governments to extract taxes on transactions. This feature must be preserved by a viable digital form of cash.

Drawbacks of physical cash

Cash cannot be used for online payments. You can of course send bank notes by post, but it takes a lot of time, and involves risk of loss. The same is true of alternative currencies that take a physical form, such as gold or silver. Digital cash promises instant and secure transactions, both online and offline at points of sale.

Cash is not easily transportable in larger quantities. It takes up space and is heavy, and makes you exposed to potential loss. Again, the same is true of gold and silver coins. Digital cash weighs nothing, and can be safely carried at all times.

Cash can easily be stolen, if you are robbed or burgled. Digital cash in the form of crypto currency can be stolen too, of course, but not as easily as it requires extra steps to force you to give up your password or recovery phrase (and you can have a “fake” wallet with small amounts to protect your real funds against such attacks). Here there might actually be an advantage of payment cards, as they can be remotely cancelled, and fraudulent transactions can be reversed.

Cash can be confiscated by the police (a version of the above), though not as easily as the funds in your bank account can be frozen or confiscated. Here, the advantage is clearly with crypto currency. Crypto can confiscated too, but only if it is known that you have it.

Cash can be destroyed in a fire or flood. Or, less dramatically, it gets worn down and dirty. Digital cash cannot be destroyed, and does not get worn down or dirty. However, if you have your recovery phrase written down on paper, that paper can be destroyed in a flood or fire, so it is smart to store that information in multiple locations (preferably password protected and offline, for example on encrypted usb-sticks).

Cash as we know it is national and tied to a specific territory, so it is less useful when you cross borders. Exchanging one national currency for another is possible, but requires an institution willing to do so for you for a price, and in larger quantities might make you look suspicious. Besides, taking cash with you when crossing borders is sometimes illegal, and there is a risk that it can be confiscated by border control. Digital cash is global, and the same digital currency can be used wherever you are in the world.

Cash as we know it is fiat currency and is controlled by a financial institution, most often governments or central banks that control the supply. As such, it is subject to the monetary policies of the country and most often inflation. In this respect, there is no difference between cash and the ones and zeros on your traditional bank account. But crypto currency is fundamentally different. It is not issued by or controlled by any financial institution that can manipulate the supply, it is not subject to monetary policies or inflation (though the price in relational to fiat currencies have been volatile to date).

The future is digital

Digital cash (in the form of crypto currency) is now a reality, but mass adoption is not yet here. Rushing into a cashless society, and relying more and more on existing digital payment options provided by banks and centralized financial institutions, is reckless and dangerous. A premature move to a cashless society would undermine the financial freedom that cash makes possible, and keeping physical cash is therefore important. For now.

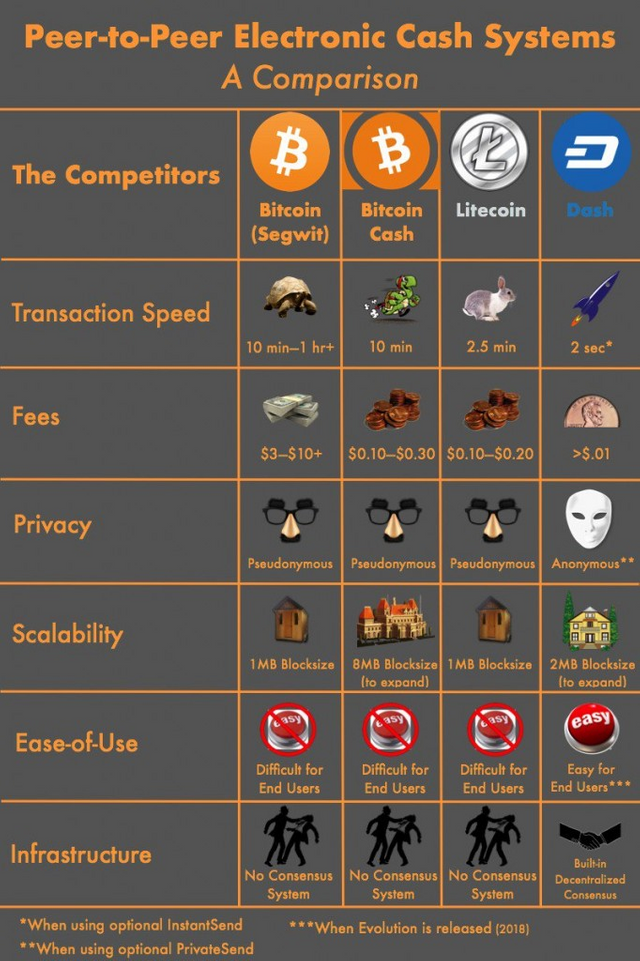

However, in the longer run, when adequate alternatives have become widespread, a cashless society should be embraced, and no longer feared. The best project in the space right now, in my personal opinion, delivering a truly digital form of cash is Dash (a portmanteau of "digital" and "cash"). Dash provides instant, private, and secure transactions for very low fees. They also have viable solutions for scaling the network.

Wish You Success

@destinyworld