How to up the balance of the FX to understand the public psychology and prospect theory

Is it true that has lost 90 percent of people in the FX?

If the person of the FX trader, I think that there is a thing that once was heard. "90% of the people who are doing the FX is being defeated," Do not you have seen in the article of the net?

Since this is not a number that took the actual FX company statistics, I do not know the real winning percentage. But it does not change that are suffering that many people keep winning, I think the words that came out from there.

A person with an idea to win at FX is about 10%

Today, for the advantage of the fact the word this "FX is losing 90 percent of the people", let's analyze the thinking and action for the win!

Well those of FX beginners, align the mouth "FX is be easy because only one down or go up?" Says the. Without taking into account such as spread (commission), is 50 percent winning percentage if you just shed or fall or rise from entry after one minute. Yet why wins 10%: lose 90% and Will big difference comes out?

If on the basis of the above-mentioned 10% of the people, win = correct way of thinking is a person with a. Have a FX that reverse to 90% thinking of most people, lose = wrong idea it says.

Exchange rate is determined value by the human emotion

Here it is where difficult of FX. Exchange rate will move the value by human emotion.

For example, consider the dollar yen! From the uncertainty of as the current world economy, seeking risk-averse yen appreciation of the yen against the dollar if the buy will be. Once it becomes the new president to reverse going to be better the American economy! Including hope and dollar depreciation park if buy the dollar it will be.

Effects of emotion in the individual units give in exchange is insignificant, but it may move a large exchange if the collective psychology, mass psychology.

Everyone thought, "I want to win" to FX trade

I Even thought "wins want! Want to make money!" Has been trade. Anyone not limited to FX, you do not have anybody that is the investment going to the loss.

However, as noted in the above that the values in the mass psychology, mass psychology moves would make you went to those who lose the 90 percent when I was the same idea as people.

So, do you believe what 10% of the people who are winning. Than is trade in a different place than the consciousness that I'm a "I want to win"?

And I was also suffering at the time that is crowded is defeated. "I was supposed to have Once ... plus stretched all of the transaction to reverse this month ..." Why do not you ever think so?

Am going or lose in the FX tried to trade

If you would lose with a strong awareness that "I want to win", or better yet "trade am going or lose," What will happen I do?

100,000 yen or lose it and the trader psychology of time

For example, we set a goal of this month of losing amounts to 50,000 yen. (Assuming a trade in the dollar yen)

Employment statistics is strong → "because the dollar bought likely imprisonment in selling to reverse"

And the dollar bought as expected to $ park depreciation → "I did it! 20,000 yen confirm the loss because it is negative!"

"Because should I Makere 30,000 yen somewhere of this month, also try to entry When you get a chance."

Willing to unrealized losses of 20,000 yen if it is true, it can not be cut loss. Remains of slurping and salted state waiting for a rebound, is likely to continue to increase in unrealized losses scene.

But when you trade am going or lose early Togi確 (stop-loss) is possible. But I think that people do not have to trade thinking of course or lose ( '× ω × `)

Why did the reverse of the idea? And say because the "pitfalls of FX" is involved in a very called prospect theory is.

People who stop loss is late trying to understand the prospect theory

The basic person with an FX is "Earnings do not want even to confirm forever-loss want to confirm soon" there is a tendency to believe that.

Always for profit amounted winning percentage is higher win steadily smaller, it would lose big to not be forever cut losses to be the unrealized losses. Those of typical diligently wham also I think that this trend can be said.

"Prospect theory" of Daniel Kahneman

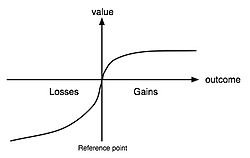

And take a look at the figure above. He was awarded the Nobel Prize in Economics in behavioral economics in 1979 figure of Daniel Kahneman has preached "Prospect Theory" is.

In terms of FX vertical line is the emotion and horizontal line represents the profit (loss). If the profit and loss of the same distance and the same amount from zero to the left and right in the middle comes out, people will feel larger in the loss.

For Prospect theory, we explain in this article ↓

Profit-taking commentary about the feature-loss avoidance of people stop loss is slow too early in the FX

If you do not know this Prospect theory, as nearly Prospect theory "to confirm early profit, Sonsetsu is forever not even" will be the act of. The fact that I will become a person who is losing 90 percent.

The remaining 1% of the people to understand the prospect theory, people who are trying to Aragao so that it does not apply to the theory is. Or thorough-loss rules, is the person if you deviate significantly from their speculation, which is away from the watch-rate objectively market.