The Dollar Reserve Status is Deteriorating Right Under Everyone's Eyes...

I know what most of you are thinking, the dollar isn't crashing and this is just a pullback.

Let's look at the charts below and I will tell you why and a little backstory. At DXY 103 when "King Dollar" was all that was talked about I said this was the top and we were headed to the 80's. Flash forward a little bit and in the upper 80's it was the most short the dollar HAS EVER BEEN. Queue the bounce. Now that the bounce is over and the long are back we can roll over once more.

Look at the MASSIVE resistance that is over 2 years worth of consolidation from 2015-2017. This cannot go unnoticed here and I believe the Dollar is beginning a secular downtrend.

This is very important and the reason it is is because If I am right about the dollar, then I will be right about Metals, EEM, Rates, Inflation, etc. and EEM is where my fund are allocated too.

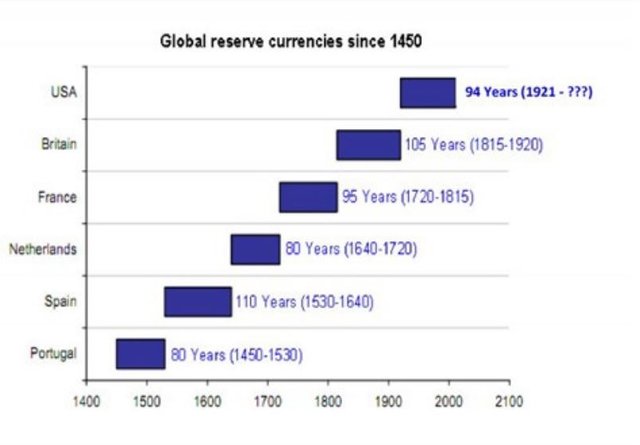

Let me leave you with this graph, it is inevitable that the dollar WILL NOT BE THE RESERVE currency sometime over the next decade. It is just math and numbers and cycles. Nothing can really stop it and I am not 100% sure what takes it's place.

My guess is Crypto or China, but that is just a guess right now

I don’t think China there Economy is in shambles. They are just like U.S.S.R was in the 80’s and it will collapse. I think China in 2 -5 years will open the curtain and we will see how bad it is.

Now for the USD watch the money supply. Since the ‘16 Election the Fed has increased the money supply by 1 Trillion Dollars. There are Trillions more coming on the market. This will make each individual dollar weak but with a strong economy people worldwide will still run to us.

As far as crypto I am a huge believer but being used as a currency is really far out. 1st it will take over legal markets for contract execution. As that happens it will slowly spread as a currency (at least that will be the USA adoption cycle)

The money supply has been dcreasing steadily since march of 2017 when the federal reserve decided to trim the balance sheet and they have drastically trimme dit back to March of 2014 levels. This is what caused the emerging markets to get destroyed thi year and for other global economies to falter as well.

This was a mistake by the FED and wikll be costly. It is one thing to be raising rates which was fine it is another thing to be trimming the balance sheet as fast as they have been. The dollar as the global reserve as we know it is changing right now. The dollar is entering a secular bear and emerging markets and other economies are about to explode, one example is the Euro to 1.30+

I think you are reading a ton of FUD them shrinking the balance sheet doesn’t decrease the money supply. It puts the money they already printed into circulation.

They say they are shrinking the money supply but they are just pushing it out into the economy off their books.

They have done this before.

Euro 1.30 is nothing. EU is collapsing.

I agree their will be inflation due to more dollars entering the market but no one can challenge us as a reserve currency.

These are long multiple decade trends and this is a pattern we have seen before a ton of FUD around reserve currencies so big money can continue to control things.

I love your posts but on this I think your drinking the GOV / Wall Street / Fed Kool-aid

So, out of curiosity, are you saying this time it is different considering the past 5 global reserve currency powers?

Yes. We will stay the reserve currency until it doesn’t matter anymore.

I actually see a near future of the collapse of nation states and back to city-states or Corp-states.

Large population and food supply trends are very disturbing. But as long as the USA is the farm to the world we will be the reserve currency.

can we keep this discussion going please guys ? I am enjoying both of your perspectives on the situation.

Sure.

My main point was yes the fed has reduced their balance sheet but the money supply increased as a result of it.

I guess snuffles had nothing else to add.

I am always up for a monetary discussion.

Good talk tho.

I’m still here, i was curating for a while lol, you probably know more from the economics side than I do so I’ll admit that here. But we can agree that interest rates are rising and this would be “theoretically” due to a decrease in the money supply.

How are they hiding this increase in the M while Rates are rising and then what happens?

Posted using Partiko iOS

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by heyimsnuffles from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

This post has received a 3.13 % upvote from @drotto thanks to: @sbi-booster.

There's a reason why China and Russia are buying huge amounts of gold and dumping US debt!

HUGE Amounts

Very convincing argument for the dollar drop.