The Writing is on the Wall. The Canary is Dead. What are We to Do?

(image source evilenglish.net)

The Situation

The canary has been showing signs of sickness. The Fed has to decide whether to raise rates in a few weeks or not. Raising rates in a meaningful way will wreck the country due to the debt load and economic conditions. Not raising rates is a de-facto admission the economy is in dire straits and attempts to correct course have failed. If they raise rates in any meaningful way, and possibly in an insignificant way such as a .25 rate hike, it may just start the beginning of the end as the bubbles begin to pop.

Weaker countries that don't have the luxury of cranking up the money printers when it suits them have already begun to partially/totally collapse or default (Greece, Venezuela, Ukraine, etc). Most of these developing countries still possess the means and mindsets to survive the challenges. Long standing developed nations... not so much.

The number of alarms and warnings going off increases every day no matter where you look. We are essentially at record highs for the DJIA, SP500, and NASDAQ as companies report customer order collapse, announce layoffs, scale down or close facilities, and fail to meet earning expectations. Various bubbles appear to be formed and prime to pop at this point. Car loan bubble, another mortgage bubble, higher education loans, etc. For example:

Update Last week one of the world's biggest shipping lines, Hanjin Shipping, declared bankrupcy stranding $14 BILLION in cargo at sea. A major canary for the state of the global economy.

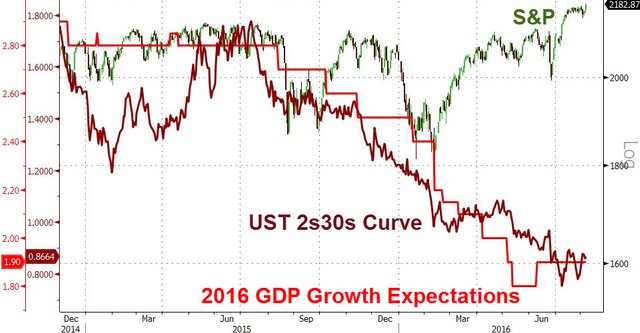

- Markets seem completely detached from reality

(sourced from zerohedge.com) - Take ratio of total market cap of top 5000 publicly traded companies divided by gross national product. $21.4T / $18.4T = 1.2. The ratio has only been this high in 1929, 1937, 1966, 2000, and now. Current P/E ratios are equally unsettling. (credit Marco Santarelli)

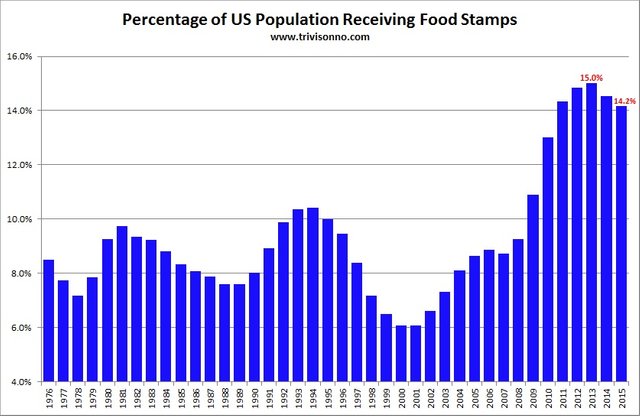

- Percentage of population receiving welfare is at record highs.

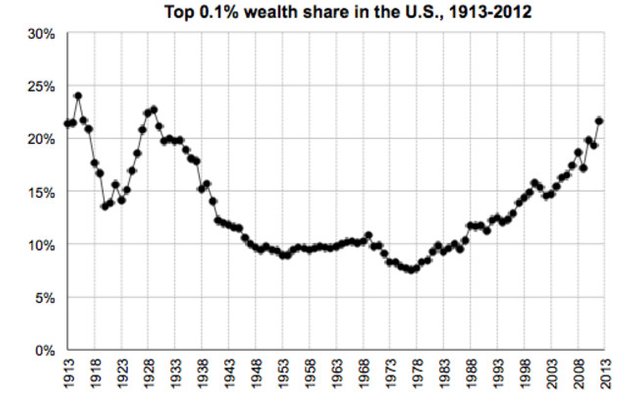

(sourced from zerohedge.com) - Wealth distribution is nearing all-time highs last seen preceding the Great Depression

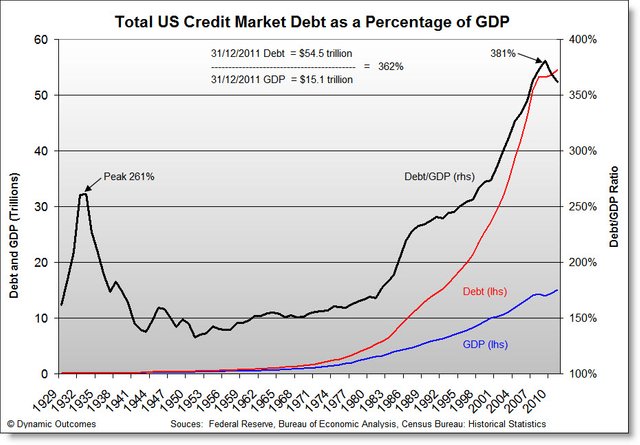

(sourced from zerohedge.com) - US Credit Market Debt is insane and unsustainable

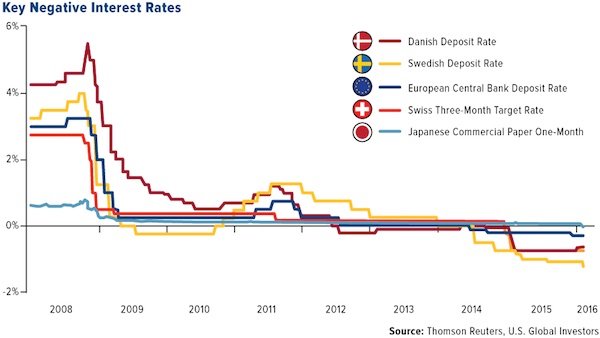

(sourced from zerohedge.com) - Negative interest rates... Zero rates for almost a decade didn't help and central banks are now sailing into the great unknown in a sign of outright desperation to address the mess they made themselves.

(sourced from zerohedge.com) - Some of the bubbles are beginning to pop such as the utter crash of the Vancouver housing market.

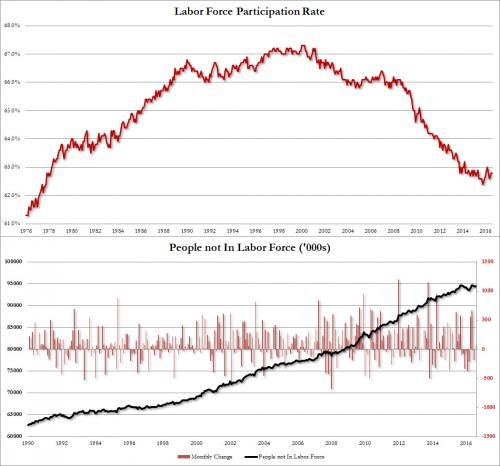

- Many economists have pointed out unemployment rates are much higher than the "official" 4.7% when accounting for those groups excluded from the official metric... more around 9.6% (credit zerohedge.com)

(sourced from zerohedge.com) - Labor participation rates are at never before seen lows

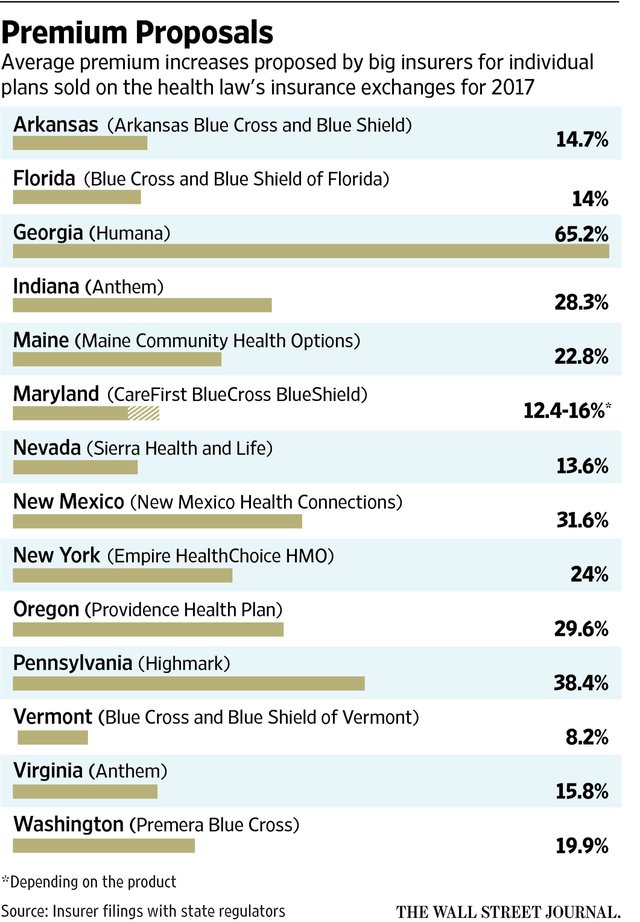

(sourced from zerohedge.com) - I've personally watched health insurance rates (which I pay in full for all my employees) rise 9%-10% year over year for at least the past 4-5 years. It is approaching the point where I may not be able to pay for my employees' insurance in the future

(sourced from zerohedge.com) - US government and services jobs continue to expand while US manufacturing jobs continue to collapse. We would no longer possess the ability to make what we need. One of the primary reasons we protect (must protect) countries like S. Korea, Japan, and Taiwan is we require their technology exports to run the military machine as well as our digital lives.

(sourced from zerohedge.com) - Global trade continues to collapse... shipping is

(sourced from zerohedge.com) - Even what we do "well", producing our own food, is unsustainable as the land is depleted, the soil dead, and things only grow when they are genetically modified and the land sprayed with petroleum derived fertilizers.

- Speaking of petroleum, though the price has collapsed and that is crushing economies in and of itself, its getting so hard to find that we are using drilling rigs offshore in waters as deep as 10,000 feet to drill a further 10,000 feet into the earth.

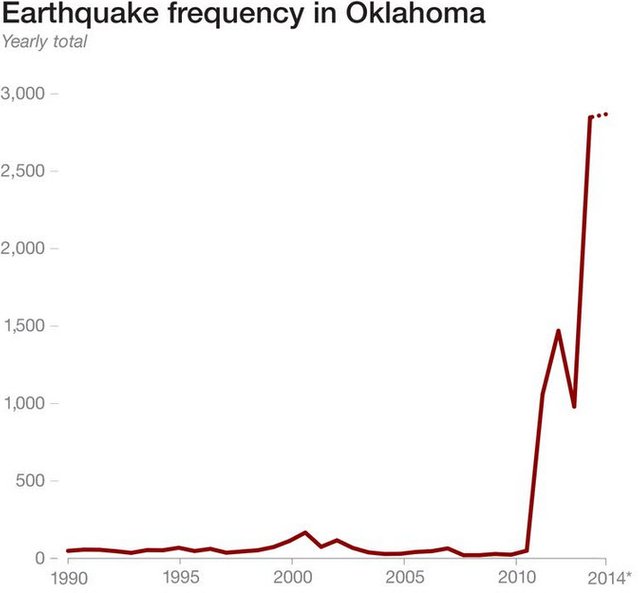

- Fracking... pumping carcinogens into the earth to fracture it and suck out the last bits of oil like a straw in an empty McDonalds super sized drink, has now been confirmed by the USGS to be the cause of the startling rise in earthquakes in areas like Oklahoma normally associated with a lack of earthquakes.

(sourced from zerohedge.com) - All around the world US influence and power is waning as our traditional adversaries began testing the waters with incidents of provocation on the rise worldwide.

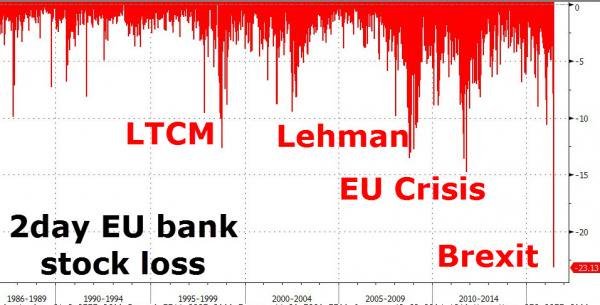

- Our traditional allies are collapsing under the increasing pressure of hostile migrants, crushing debt loads, collapsing trade, and weakening/fracturing strategic/economic alliances.

(sourced from zerohedge.com) - And the alarms go on and on and on and on...

The end game appears to be approaching. I don't think we are able to kick the can further down the road. It may be finally time

What the Hell Do We Do?

(sourced from airliners.net)

Keeping your wealth under the mattress is dangerous and difficult to use in a digital world. Keep it in an account and FDIC/NCUSIF insures the cash (up to $250k per person or business entity) in our banks and credit unions, respectively, but where would that money come from in an anything-larger-than-trivial banking sector collapse?

Keeping your wealth in real property insures you'll get property tax which is another way of big brother saying "on a long enough timeline, all your wealth is mine". Even if property tax is a necessary evil, governments are known to take what they want when they wish and there is no means to stop them from doing so as a community much less a common man. Underlying causes and contexts aside, the last time seven US states declared they'd had enough and would take no more it resulted in the bloodiest conflict in US history.

Keeping your wealth in cryptocurrency is obviously an option, however it is volatile and dependent on a functioning infrastructure. Governments all already trying to crack down and control crypto currencies. If things went really south bitcoin wouldn't do me much good to buy some tomatoes from my neighbor.

What I've Done

Here is a brief summary of what I've done to prepare for economic strife or other difficulties.

Wealth Preservation

(sourced from nsbank.com)

Preserving wealth is critical. But how? Every method of doing so has it's own pro's and con's.

Cash on Hand

For me this subject must be broken into two parts: personal and business. My personal cash holdings I keep quite low. Enough cash to function without income for 3-6 months. Nothing more. I don't even bother with a savings account as whats the point when the interest rate of return is so pitifully low?

With my business I'm in a pinch. My business requires a great deal of working capital to function as we have large swings in the course of business. I could leverage debt (line of credit, loan, etc) instead of actual capital to shift the risk and protect that capital in the event of a bail-in, banking collapse, or outright seizure. Morally/Ethically I wish not to do this as I am a big believer in capitalism... my primary business has never borrowed a cent or had a loan.

401(k) & Financial Markets.

I have moved my 401(k) balances into money market for the time being. Its mathematically demonstrable that in the long term it is more important to preserve 10% you'd have lost rather than make 10% playing more risk. Because of my personal situation (own the company) I do max out my 401(k) only because of the tax implications.

Debt

Every personal loan I have has been refinanced to the lowest rate possible. 2.4% on student loans. 2.7% on mortgage. 1.9% on vehicle, etc. Why not pay them off? In the event of a serious economic collapse I'd rather default on everything and preserve my capital than pay it all off when the loans are near free thanks to zero interest rate policy (ZIRP).

Precious Metals

I've been accumulating physical metal for many years. Probably don't need to explain why to this crowd.

Real Estate

I've purchased high value land and continue to look for more opportunities to store wealth in real estate when it makes sense, where value is available, and if I have the capital on hand to pull it off.

Stock Market

I totally exited the markets for the time being. Its been proven time and again how quickly fortunes are made and lost here. It isn't a method of preserving wealth anyway.

Other Preparations

In case it gets really, really bad. Maybe the wealth is gone. Maybe the wealth just doesn't matter at that point.

Hard Assets & Goods

I've steadily accumulated anything I can think of that I might need should the economy tank and goods we must import become unavailable. Food, equipment, tools, medical supplies, clothing, shelter, seeds, etc. At this point I have what I would need to truly go off-grid indefinitely, albeit with a drop in lifestyle and standard of living. Most importantly, I can make my own potable water, make or gather my own food, make my own electricity, etc.

Intangible Preparations

I've worked to educate myself... on money, gardening, health, first aid, mechanical skills such as engine repair, trade skills as plumbing/electrical/construction/etc, refresh and expand my skills on self defense . I've worked to keep my body and mind strong and prepared for what may come. I've worked to help others prepare themselves in all the above ways as the success of the network of community members, friends & family is a safety net, mutual benefit, and threat reduction to me.

Please Use The Comment Section To Share Your Thoughts

What am I doing right & wrong?

- Am I wrong on any assessment of the state of things? Did I miss anything major?

- Do you disagree with any of my preparations?

- Am I falling short or omitting entirely anything in any of my preparations?

Tell me what you've done, are doing, or are going to do.

- What are you waiting for? The fasten seat belts sign is lit!

- Not feeling the need to do anything? Why?

That's a perfect example of this country fulfilling the first plank of the communist manifesto:

If you don't have the allodial title to your land -- you don't own shit. If you don't have the MSO (Manufacturer's Statement of Origin) of your newly purchashed vehicle -- you don't own shit. I can go on ...

Lastly, if you have your bitcoin private key -- you own it all baby! God bless the nerds.

I agree with you an all points for the most part. Property tax I find truly offensive due to the fact that eventually, they take it all... this after I paid income tax on the money earned, paid sales tax on the money spent, and paid invisible tax through purposeful inflation...

Only a state can have allodial title at this stage of the world until commercial space flight and colonization of other worlds becomes possible. All I can do is acquire it by their rules, stay off their radar and keep my wheel well greased, and make the offensive seizure of it not work the cost.

If you live in a world where there is someone more powerful than yourself (gov't, mafia, etc) then it is simply not possible to guarantee absolute ownership of anything physical. Even with something intangible/non-physical such as a bitcoin private key is vulnerable because I am physical and vulnerable to a "rubber hose" attack.

Please elaborate about the MSO? This differs from a standard title in what way?

MSO is the Manufacture's Statement of Origin and it is the equivalent of an allodial title. Every automobile that comes off the assembly line has a piece of paper associated with it like a birth certificate. That is the MSO.

Whenever you buy a car the MSO is transferred to the State where they microfiche it and then put it through the shredder. After your car is all paid off you receive the certificate of title -- not the MSO. The State is now co-owner of your car hence why you always need to pay registration to drive it. Source of my info is from Michael Badnarik's video below. Topic starts at 38min and 23 secs in:

Interesting. I actually had the MSO or equivalent for my boat (it was a test boat by Cummins from the hull manufacturer. I had to then go get the initial title as it hadn't been titled when I purchased it)

I've made a conscious effort to not ratchet up my expectations and lifestyle over the decades. Even without a market collapse, within a lifetime other more personal issues come up -- illness in the family, job losses, or even opportunities that require setting aside other plans. So, personal resiliency is one thing I would add to your interesting list.

Yes I agree that in general and Americans specifically tend to live by the seat of their pants and from check to check compared to 100 years ago even if they bring in $250k a year. The belief there is always a safety net seems to pervasive.

And as families are smaller and spread out over long distances, it's hard for them to be the safety net they once were. So building up our own social networks, local and distant, are important, too.

That is a great analysis on what is going on and to me it looks like you are doing many good things. It is so hard to tell how this is all going to go down. Another option for gold that I found because of Peter Schiff selling his business to them is getting a Goldmoney account and have some gold in different locations around the world. I even transferred some Steem Dollars to Bitcoin then to a vault in Dubai just to see if I could and it worked. Really cool. Now that is my referral link they give us and if people use that then they get 10% bonus gold with their deposit up to a gram free. I think that Singapore is a good vault location. What do you think of this?

I don't know where you physically are, but I do agree with distribution of wealth... meaning qualitatively and quantitatively distributed... physical locale and political locale... even distributed so that it is by design out of your reach should a "persuasive" individual "request" you provide access to it.

If I had physical gold in Singapore I personally could not easily gain access to it. Nor could I protect it, particularly when countries have begun legally requiring disclosure of offshore wealth. It is a solution with its own flaws that can be one tool in a toolbox of complimentary solutions.

Yes I agree that we need many tools in our toolbox. I've been also diversifying my sources of income not just asset protection. I know that some people have a hard time with network marketing but if you have the right company and product you can earn income from all around the world with really no risk. Even though steemit isn't networking it still income coming in from around the world. Only thing is if I don't personally write an article then the income stops. But what is nice with one company I work with now is that they take bitcoin as payment so I can use the money I make here to pay for my product.

I'm working aggressively to diversify my income and reduce my expenses myself. The best source of income is that which requires nothing from you to produce. So along those lines...

Running a company requires great effort. Putting others in charge and incentivizing them (profit-sharing, equity stake, etc) requires little effort and becomes passive income albeit reduced... but now I'm free to rinse and repeat.

Flipping real estate takes effort. Renting real estate takes little (assuming you have a third party handle the management)

Actively trading in markets requires effort. Passive income on capital deposits (used to) require no effort.

Because of fiscal policy even precious metals are effectively passive income producing from the perspective of a fiat currency world, though thats not strictly true.

I apply this principle universally...

Growing corn for food requires great effort. Planting sweet potatoes requires virtually none.

Eating the weeds and other wild plants takes even less effort! : )

@haphazard yeah but that ain't as easy at is seems. If deer aren't touching it it's probably not viable for humans either. There's a reason they raid gardens

Damn, GREAT article. You've nailed it here, and you paint a stark picture. You've just inspired me to go to the gym and get fit...gonna need that endurance when shit hits the fan, if I can't just be a lazy tard on my couch. Cheers, brother.

Thanks!

So long as you're faster than the slowest member in your party you're good lol

Cheers!

Well... light a joint and relax :)

The world doesn't stop moving if our "system" fails.

Well of course the world won't just stop... but its very likely there can be mass unemployment, and disruption of welfare, logistical supply chains, food availability, etc...

“There are only nine meals between mankind and anarchy.” - Alfred Henry Lewis

Whether the world is moving or not, if the system fails social unrest follows and that can be extremely damaging or even lethal to me or my loved ones... ask Baltimore, Ferguson, LA, etc.

Well, yeah, but it can also be the beginning of something a lot better. Our shops were empty here in the Baltics during 88~91. The Soviet Union collapsed and with that there was mass unemployment. We survived. We got our independence back with 0 shots fired.

Might be good, might be bad, wait and see. The one thing I know: I won't panic.

Unfortunately here in the US very little can be accomplished without a few shots fired. Often shots are fired without anything being or even trying to be accomplished at all!

Love it, great post hunter! It all goes downhill slowly until it goes fast.

Additionally most folks are either unaware or only concerned with the issues that personally and directly impact them or their agenda the most, all the while unable to see the forest for the trees

Thank you so much for sharing all this information in one easy to read article. I think your diversification is extremely sound and I'm striving for the same type of asset division.

I am new to investing so I have a bit of a dumb question. How exactly are you buying precious metals? I want to hold physical gold/silver, so is the best way to just buy coins? What kind of coins? From which trustworthy companies? Or is there another tangible way to get gold and silver? Should I also get appraisals on my jewelry just in case?

Thank you in advance!