BLOCKCHAIN, BITCOIN, & CRYPTO

This article is long overdue as Bitcoin (BTC) has been on the top of every investor’s mind since they had a huge run in 2017. Bitcoin started at $1,002 in 2017 and reached an all-time high of $19,184 in late 2017 – a gain of %1800+.

Bitcoin recently had a huge correction dropping %63.4 down to a low of about $7,000 in early 2018. Depending on the exact time a person jumped on to the hype makes all the difference between a happy investor or a sad investor. There are plenty of skeptics that claim Bitcoin is a ‘fraud’ or ‘Bitcoin will almost certainly end badly’ like Jamie Dimon (CEO of JP Morgan) or Warren Buffet (CEO of Berkshire Hathaway, 3rd richest person in the world who I respect very much). There are also other people like John McAfee (who will eat his d*ck if Bitcoin does not reach $1,000,000 per coin by 2020) and the Winklevoss Twins who are huge promoters of Bitcoin and have put their money where their mouths are.

There is much debate about the future of Bitcoin: Is Bitcoin headed to $0 or $1,000,000?

Before you make a snap judgment about bitcoin, let me share my take on the digital asset.

*****BLOCKCHAIN TECHNOLOGY*****

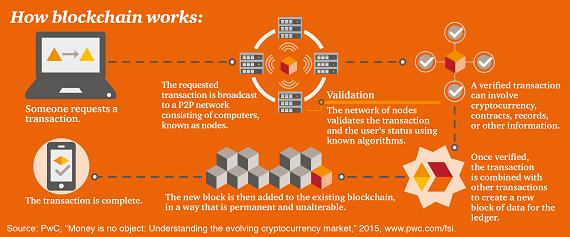

If you have heard about ‘blockchain’ technology, then you have probably had someone try to explain this technology to you – most likely ending up in you being more confused than before.

Blockchain technology is real and it is here to stay. The most basic concept behind blockchain technology is that financial transactions are placed onto a shared database that is spread across people/nodes (or miners) who verify transactions (or blocks) as a group. Blockchain allows the data to be more secure through cryptography along with the ability to decentralize data from major banks and corporations. The decentralization of data being shared across many separate computer systems allows for people to cut out the middle man in a money transaction.

This is huge! With Blockchain, payment systems do not require an intermediary when trying to send money from one person to another.

For example, Venmo (owned by Paypal) allows for people to send money to other people directly (as long as they are both using Venmo) since Venmo is the trusted source that does all of the book keeping and data storing. Venmo is the system that makes sure that the same amount of money has been deducted from one person’s account and added to another person’s account. The risk associated with using institutions like Venmo is that there is a high risk of centralizing everyone’s data in a single location. There have been numerous hacks of major corporations in the past, the latest being the Equifax hack in the summer 2017 where hundreds of millions of people’s information were stolen by hackers!

Blockchain allows for this type of risk to be mitigated as people will be able to control their own money and have much more confidence in the security of their personal information. Blockchain technology is highly complicated, so complicated that top Universities (like Stanford) around the country are adding Master’s level blockchain courses to their curriculum.

*****BITCOIN*****

Bitcoin is just one of thousands of cryptocurrency on the market today, albeit Bitcoin is definitely the largest by far when measured by market cap. Bitcoin (and most currencies) is not backed by any sort of intrinsic value besides people’s confidence that Bitcoin has value. Bitcoin is akin to gold in the sense that gold doesn’t really have any intrinsic value besides the fact that humans like shiny metals.

As long as more and more people begin to believe that Bitcoin has value, Bitcoin’s price will go up as that is what happens typically when supply is constant and demand increases. Yes, you heard me correctly, Bitcoin’s supply is limited, there will only be 21 million bitcoins created in the entirety of the world. Only 21 million individuals out of 7 billion people in the world will be able to boast the fact that they own a whole Bitcoin.

Bitcoin is an interesting cryptocurrency as it is really the first of its kind. Being the first cryptocurrency to be widely adopted comes with benefits and shortcomings.

A few benefits are:

Bitcoin’s price will be more stable as it is the most widely known cryptocurrency

Bitcoin is already being used by companies like Square, Robinhood, Overstock.com, and several other companies that now accept Bitcoin payments

Bitcoin is listed on every exchange, small and large

Bitcoin is unlikely to disappear as it is a globally adopted phenomenon

A few downsides of being the first major cryptocurrency are:

Bitcoin was not built for mass scalability

Bitcoin is not the most private coin in terms of hiding your identity

Transactions are very slow compared to faster blockchains like Litecoin (LTC), BitcoinCash (BCH), or Ethereum (ETH)

Transactions are costly compared to other cryptocurrencies when using Bitcoin due to the lack of foresight of mass adoption

Difficult and inefficient to mine today

If you want to learn more about the inner workings of Bitcoin, you can find their white paper here.

*****CRYPTOCURRENCIES AND ALTCOINS ******

******

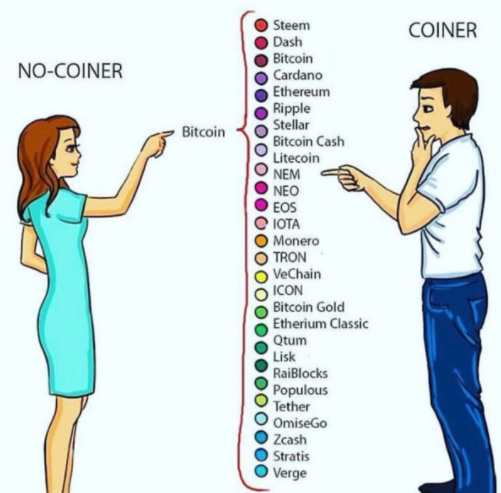

As I mentioned above, Bitcoin is just one of the thousands of coins out on the market today. Coinbase, the biggest exchange in the U.S., allows for the trading of 3 other cryptocurrencies: Litecoin (LTC), Ethereum (ETH), and BitcoinCash (BCH). Coinbase allows these three altcoins as they have passed some standard defined by Coinbase. There are other exchanges like Quoine, the biggest exchange in Japan, allowing people to trade 8 different cryptocurrencies or Binance, the biggest exchange in the world, allows you to trade hundreds of cryptocurrencies. Bitcoin is simply a proof of concept that shows the world that cryptocurrencies and altcoins are here to stay.

There may be much skepticism about Bitcoin and cryptocurrencies in the U.S., but abroad in places like Japan or South Korea, cryptocurrency is becoming widely adopted and accepted as a real form of payment.

If you believe in the future of Bitcoin as a currency, then there has to be an argument made for other cryptocurrencies also potentially providing value. Maybe you’ve heard of the popular security coin, Monero. Or perhaps, you have heard of Steemit.com which rewards content creators with Steem Dollars for simply using their website. The list of altcoins goes on and on; Ethereum, Litecoin, Dogecoin, Tron, Verge, Populous, ICON, EOS, Ripple, IOTA, Siacoin, and so forth.

If you want to see a list of the top 100 cryptocurrencies, then hop onto coinmarketcap.com – they list the most popular coins by market cap. There is a ton of research to be done on this up-and-coming field of cryptocurrencies, blockchain technology, and altcoins.

Stay tuned for my next article where I review how to invest and how not to invest in the crypto blockchain mania.

—

Thanks for reading and as always, if you found this article helpful, informative, or just slightly entertaining, then hit the like button, comment, subscribe, follow, and SHARE!

Jack

P.S. This article is not meant to be taken as investment advice as I am not aware of your specific personal financial situation and/or risk tolerance. This article is meant to be supplementary to your own research, do not solely invest based on the information above.