The Dangers of Emotional Trading & Trading in General

You know, there have many thousands, if not hundreds of thousands of traders that have mastered the art of technical analysis, proper risk management and everything else you can think of related to smart investing. But, one key attribute of all the few successful traders is that they’ve mastered the psychology of trading with repeated victories and/or repeated losses.

Often times, individuals are so vested in the money that they forget that trading, like everything else is an algorithm with high probabilities and low probabilities. Trading in stocks or the foreign exchange market involves the belief and the absolute belief in a system. A system that assesses your affordability, risk assessment and patience. Here are some of the absolute essential steps you need to take to ensure you don't become a statistic.

Step 1 : Save Enough Money. Do not fall for the small investor’s account trap. You will always think about money in terms of how MUCH YOU CAN MAKE. Instead, think about how many times you can be correct. A dollar or a thousand, it shouldn’t entice you. Your concern should be how accurate your strategy was. Save at least $3000 before you enter the stock or forex market.

Step 2 : Invest no more than 20% of your funds into your total portfolio of stocks and no more than 4% of your account in Forex. This is essential that you do this. Make sure you do NOT have extra money in your account lying around—otherwise, you will always rationalize the decision to put in extra until you are out of money and frustrated.

Step 3: Pick a stock, currency pair or any trade based on TECHNICAL ANALYSIS. I do not care how good or how promising a stock and their earnings report looks like. Japanese candle sticks and its mastery will certainly help your accuracy by over 50%, guaranteed. Trade WHAT YOU SEE, NOT WHAT YOU THINK! If a stock is super promising, but the technical analysis says its vague, trading sideways or not very strong, go onto the next stock. There are hundreds of other opportunities, WAIT FOR IT!

Step 4: DO NOT CHANGE YOUR PHILOSHOPHY OR ACCOUNT LEVERAGE even if you’ve executed 5 successful trades in a row, or for have experienced tremendous success for half the year, DO NOT CHANGE YOUR APPROACH. Often people get super excited and grow confident to the point where they feel that they are ready to start investing more. DEFINITELY NOT! Unless you were able to make 4x your account value, there is no reason to change your strategy.

Step 5: Emotional Trading will kick in when you lose your money. When you lose, its natural for you to want to make your money back. We all do it or have done it. It isn’t worth it. Take the loss. Wait for the next viable opportunity using the SAME algorithm you put your faith into. If an algorithm demonstrated 75 percent success, how do you know the first 4 trades weren’t part of the 25% inaccuracy? Don’t shift gears midway—it will destroy your sanity. You will start to over think trades, overthink your everyday choices and then soon enough everything.

Step 6: Learn to read Entry and Exit Prices. You can identify great trades, but undisciplined mindsets face a difficult time holding onto their money. Most experienced traders who have lost money in the market have cited greed and/or improper exit strategies to be the reason that they are on the losing end. Identify entry points and technical proof as to why that should be your entry point. Set forth an exit point based on proper technical analysis. If it shoots up beyond your exit point, you should STILL EXIT the trade. When you abandon a rule when your up, there’s a strong chance you will do it again in the future. Stick to your entry and exit points for short positions and long positions.

Step 7: Accept Defeat and Accept Loss. This means do not stare at the computer 24/7 after you’ve had a loss. Move on and wait for the next trade PATIENTLY, not anxiously.

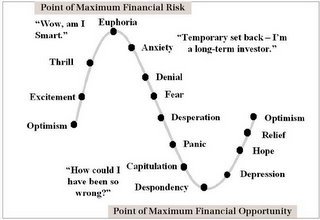

Another profitable strategy is to find a reliable way to guage overall emotion in the market and to take the contrarian perspective (trades).

One way is to wait for big media outlets to start mentioning "strong investment opportunities", then to take the next counter-trend signal as the sign to take profits or to enter the counter-trend trade. In the emotion-filled world that runs the markets, big media is the slowest of the laggards, except for the dumbest of the dumb money that throws their paychecks at the market after getting the tip, that is.