Income Report for June 2017! $29,154 Profit on $41,633 Earned and $12,479 Expenses!

Would you like to see my June 2017 income report for my business online here on Steemit and the University of Jerry Banfield because I think it's important we talk about money out in the open instead of having it in secrecy and hiding what we're doing and feeling awkward about it?

Read this post or watch the original video from YouTube to learn about my business income report for June 2017!

Thank you very much to @gmichelbkk for converting the transcription of the YouTube video from GoTranscript into this beautiful post for Steemit, which is much faster to read than the video and has all of the highlights in screenshots! Doing the video first and getting help with changing it into a blog post is also about three times faster for me than writing the blog post and then making a video about it!

Income Report for June 2017!

First, I'd like to say thank you very much for all that you've done. This is the best month that my business has had in over a year. I'm extremely grateful for it and I've made some extra payments on my debt.

My wife and I have over $200,000 in student loans still from going to graduate school and law school. I'm very grateful for what you've contributed to this.

I'm honored to be here and continue serving you today.

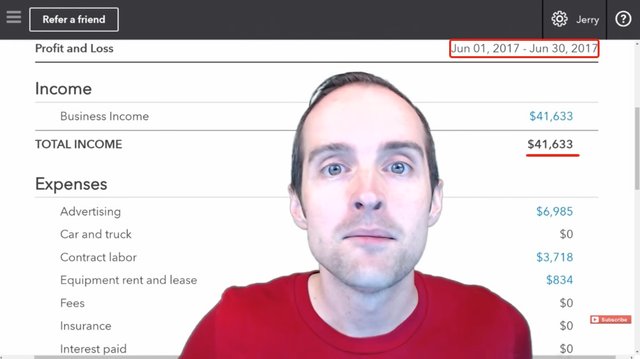

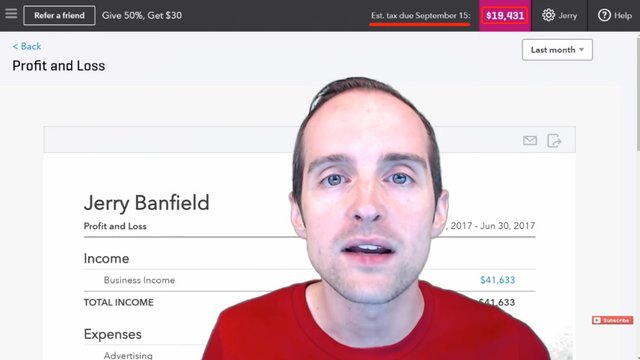

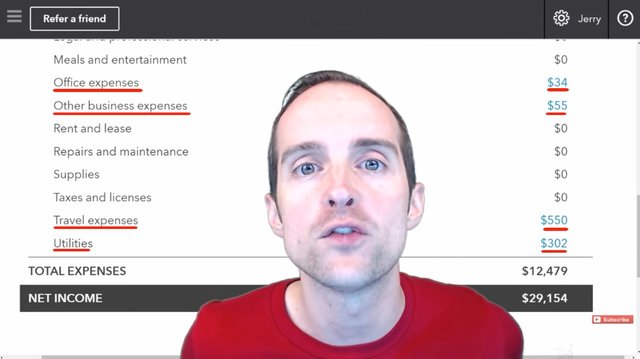

$29,154 Profit on $41,633 Earned and $12,479 Expenses!

Here are the numbers from June 1 to June 30, 2017: $41,633 in total income.

Wow, it's been over a year since I've seen this online. In fact, most of the last year, I've effectively lost money even though I've made a profit technically, if you took out health insurance, debt payments, rent, but I actually lost money. I'm extremely grateful this month for an incredible number.

I'll show you exactly how all this came in.

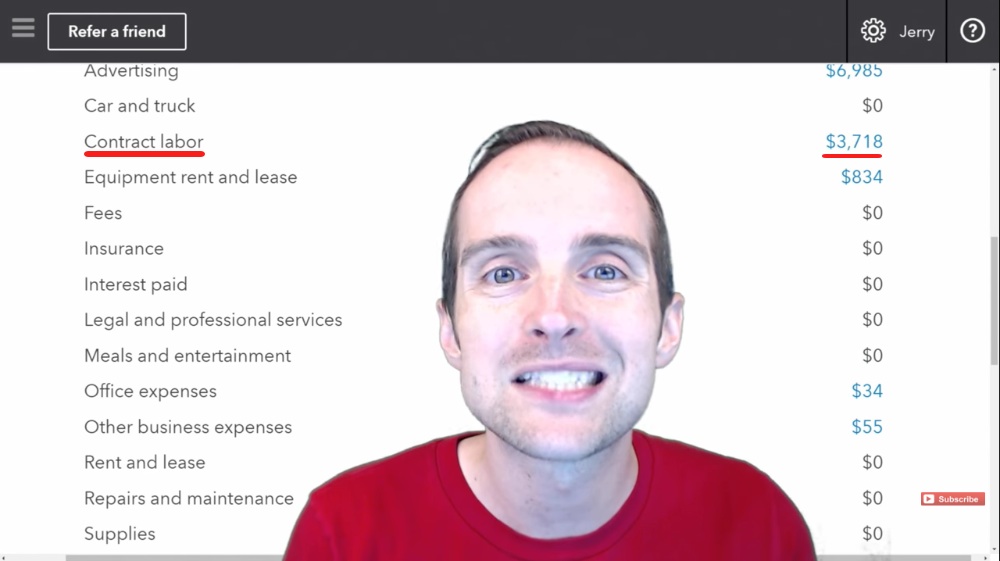

Expenses: $6,985 in advertising, mostly on Facebook and Google Ads. Now, this contributed to some of the income and was a function of the income.

$3,700 in contract labor is the next biggest expense.

I rented some new servers this month and I'm still paying on my Mac Pro that I use in recording my videos and live streaming with.

I also did something a little unusual so far, I traveled. I went to Michigan, both to visit my family and to film some new videos on location with my new camera I bought last month, to see if you like those videos better than just videos shot in the studio.

It seems that the answer is yes so I'll probably be trying a little bit more traveling. I'm going on another trip in July, so I'll film some there. I write it off as 50/50, so half personal and half business. That way I feel good about it. It's not completely personal, it's not completely business, it mixes up a little of both.

I present all of these things because I feel transparency and accountability is good for all of us. For all willing to share what we're doing with our money we are less likely to get into doing things that we're ashamed of. That's why I present this.

The net income is $29,154.

The tax liability on that income is about $8,000 to $10,000 in taxes that I will need to pay. So if you take all of that off, for the first time in a year or so, I've actually made enough to pay my bills, pay down some debt, and build up some cash. I'm extremely grateful for that. Thank you for what you've contributed to that.

Here is where the income came in.

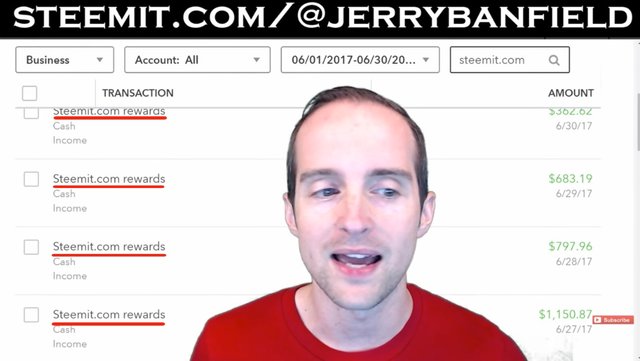

I'll show you the number one new source of income. You've probably seen it, you've probably heard it, you're probably sick of it.

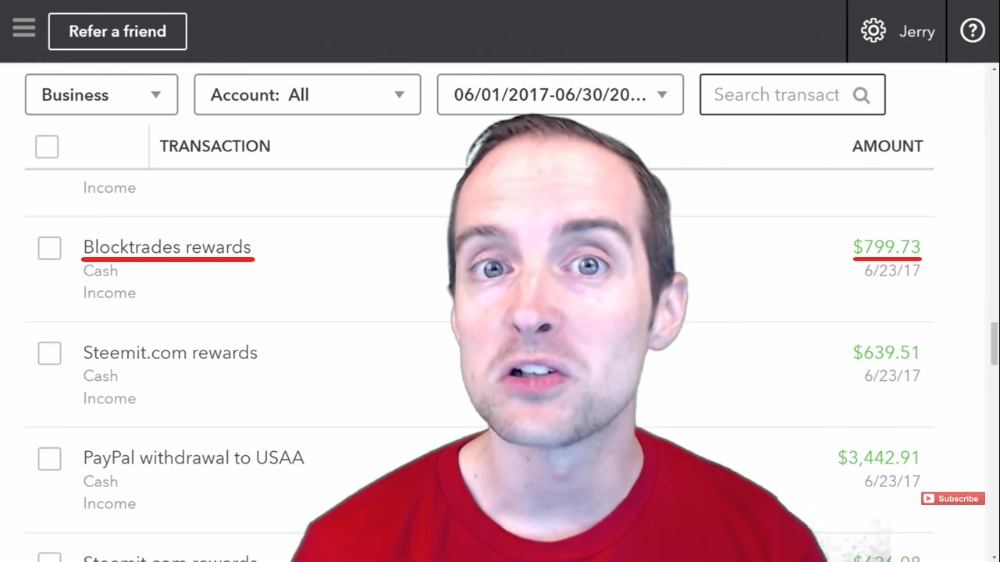

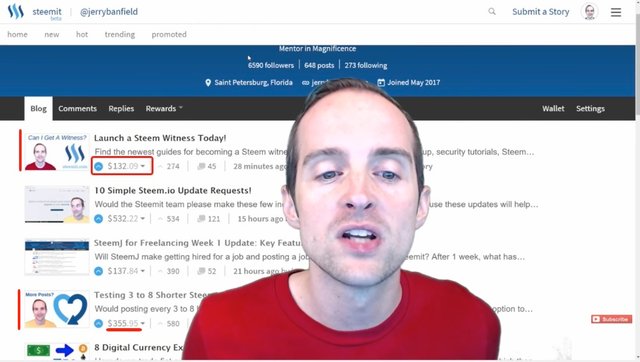

This is where the number one new source of income, the single largest source of income which has seemed to come out of nowhere. Literally, I wasn't doing Steem for most of May 2017. All of the sudden, Steem brings in a ton of income from these blog posts. It's wild. Steemit is one of the best opportunity I've ever seen online. You can see exactly what I'm doing with it at steemit.com/@jerrybanfield.

This isn't something unique to me, this is something my friends are starting out on and earning money on. This is something lots of others are doing great with. It's just a social media website where you actually get paid the real value you contribute to the website.

That's it, and it's based on a cryptocurrency.

It's awesome!

That's the number one single source and you'll see all these different rewards coming in from Steemit. This is mostly post author rewards.

This is the cash value equivalent for taxes. I actually powered up a lot of this Steem to give my account a higher balance. I'm paying tax on every single author payment I get on the day I receive it and for the full amount I receive it. This is the most conservative tax strategy that I can see to take, and I figured that will help me sleep the best at night.

I have rewards from Steemit almost every day. Steemit has therefore accounted for the majority of the income single-handedly in one month.

Now that's just crazy!

I'm extremely grateful.

Steemit is now the primary thing I'm doing. I'm thinking everything I can do to be of service to the Steemit community. It's paying the best and it makes sense to focus my efforts there.

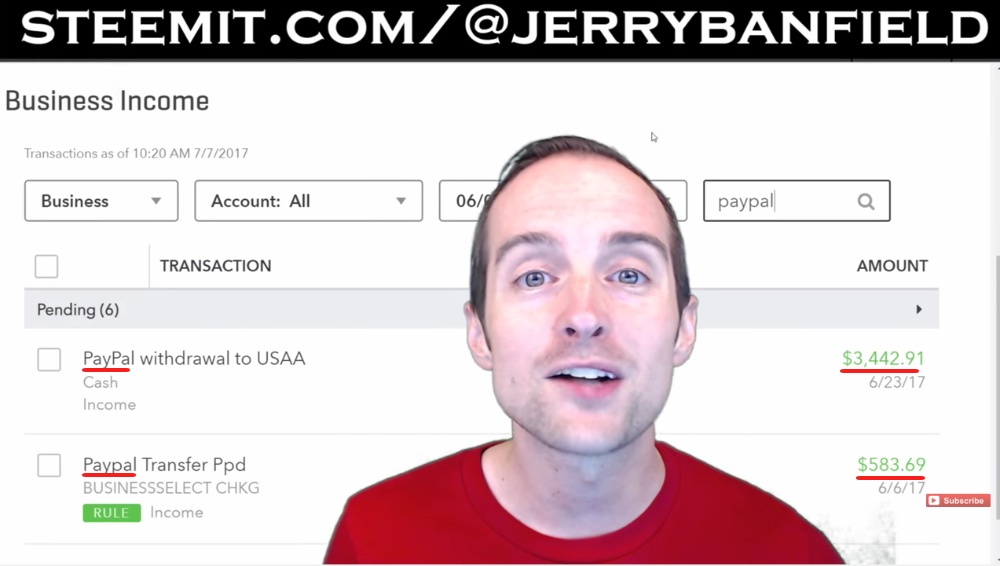

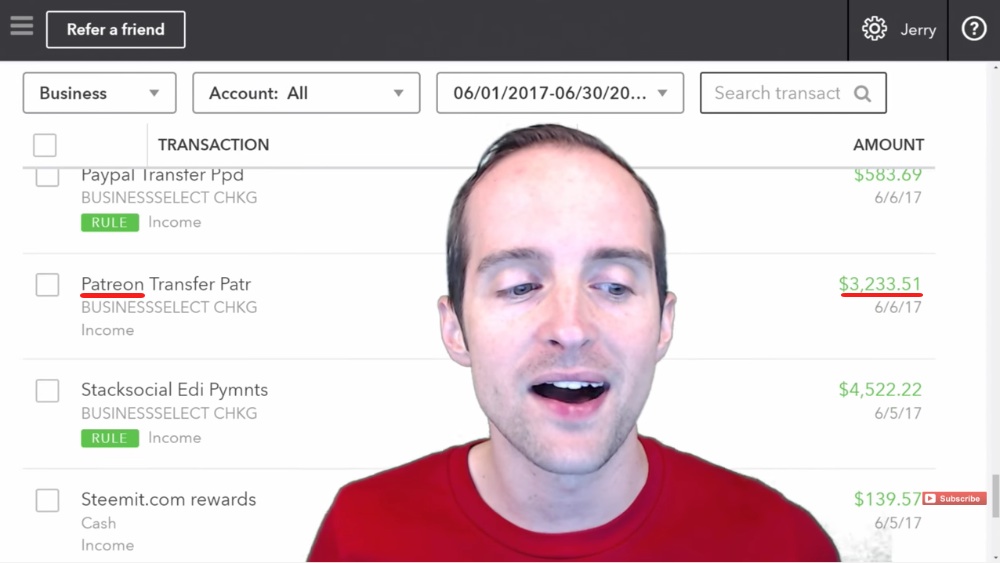

Then, I just had two PayPal transactions this month which is unusual. PayPal transactions are from my online courses.

Then, Stripe.

Most of the Stripe sales are from my online courses as well along with Patreon. Each of these made a significant amount of income as well.

I'll roll through and show you the full picture of all transactions.

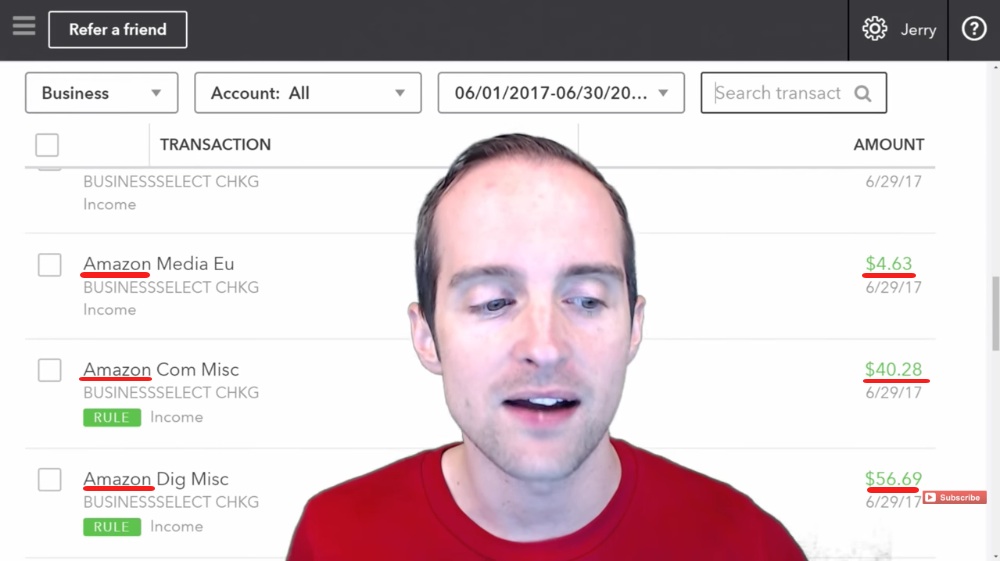

A lot of these small Amazon transactions are from having videos on Amazon, selling books, and I've got also Kindle books and CreateSpace paperback books, so tons of small Amazon payments on here.

Now, the Audible is from audio book sales. I'm very grateful because this is a much higher number than recently on the audio books, which is great because I've stopped even trying to promote the audio books actively.

If you've bought one of my audio books, thank you very much for buying one of my books on Audible. If you love listening to audio books, they might be a great format as well.

I put this in as BlockTrades rewards, you might call it a little exploit or a little inconsistency I found. I essentially took about $4,000 of my money, gave it to Bittrex exchange, traded it with BlockTrades and came out $799 ahead doing it that way.

Then, I posted and told the founders of BlockTrades on Steemit exactly what I was doing and how they could fix it, so that no one else could do it including me.

I made like $800 in a couple of hours doing this and I put that in as "BlockTrades reward." I am strict with my taxes. I put every single thing in there. Then if I get audited, I can say, "Here's all the paperwork, you can do whatever the hell you want with it." I've paid the tax in all the money I've made, even if it's through something like the BlockTrades rewards.

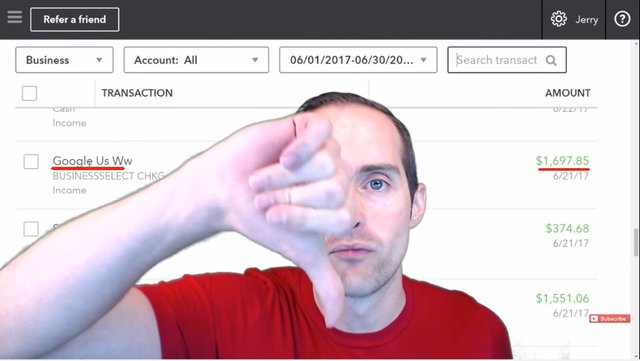

This is my Adsense revenue from Google including $20 a month from my website, and then the rest of it is from YouTube.

I'm grateful that the YouTube ad revenue is back up after several months of a complete plummet. Most of everything else on here is related to online courses. Patreon is from my partners program, and I've got a couple of clients in Patreon too.

There we go, that is all of the income.

That's all of the income then for the entire month.

I'm extremely grateful for this incredible amount of income and that's why I spend so much of my time and effort to be of service to you here and I keep showing up.

You hear about people making money online and I could just put it out like I made $41,000, which is accurate, but at the same time, it's a function of how much you spend out of what you make.

I spent $12,000 out of that $41,000, so that's $29,000 in income.

However, if you look, it says $19,000 in estimated tax due.

That's not even including for the June payment with all the Steemit income. I made the June payment much earlier, but now I need to pay another $10,000 in tax on top of what I already did pay.

I actually have about a $29,000 tax bill coming for September, which assuming I keep making similar to this is no big deal. If the income goes down, the tax bill will go down a little bit too. The taxes are absolutely massive, although they could be bigger. They're bigger in some countries. So the taxes are a very relevant consideration here.

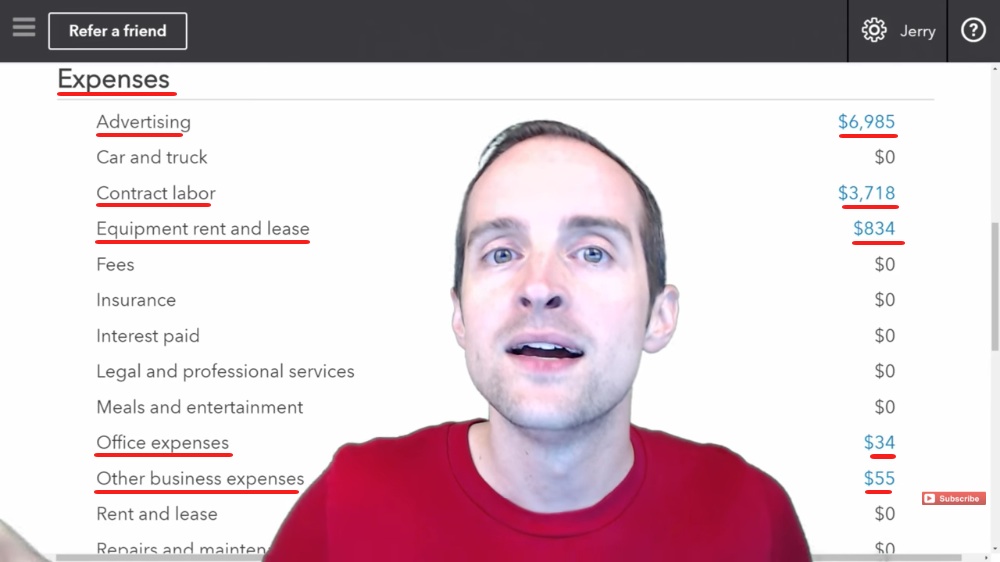

Now, I'll show you the expenses.

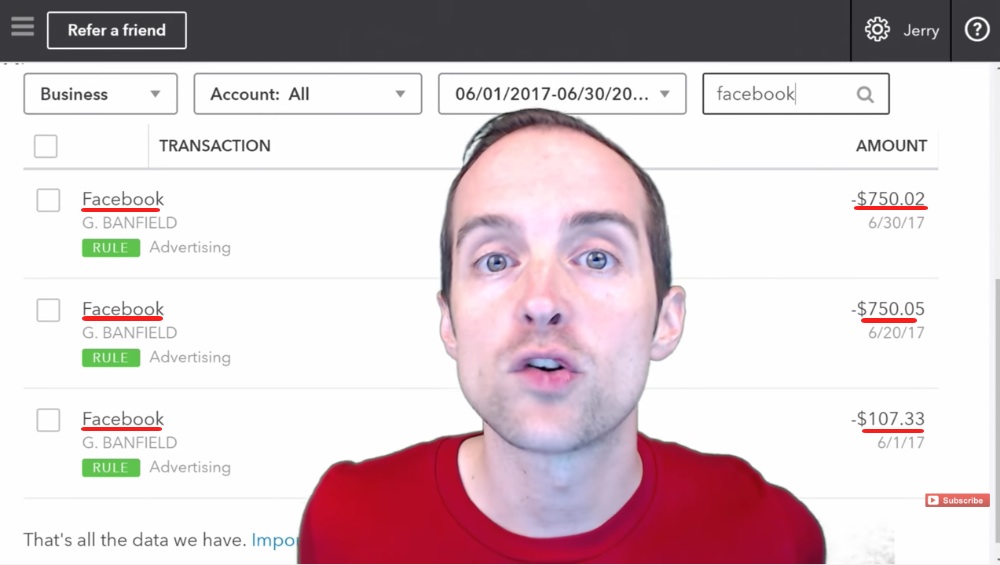

The main expenses here are Facebook advertising.

I am grateful that I got crowdfunded on Steemit. About $4,000 on Steemit was crowdfunding for Facebook advertising, which I've now spent about $1,000+ so far.

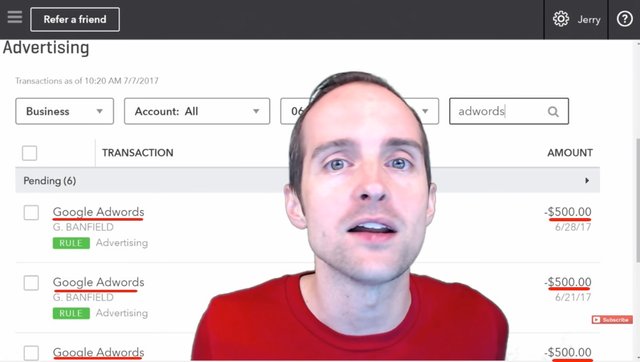

Then the other main expense is for Google AdWords. I've also spent thousands of dollars on Google AdWords.

These ads are what helped me.

You look and you might say, "Oh God, Jerry is getting this big audience."

The ads are a huge part of how people are following me online. In fact, you almost certainly have seen an ad of mine, at some point. What I mainly do with ads is try to keep you connected once you've seen something once, like you searched for a YouTube video and found it. I've also advertised through the Steemit crowdfunded campaigns as well.

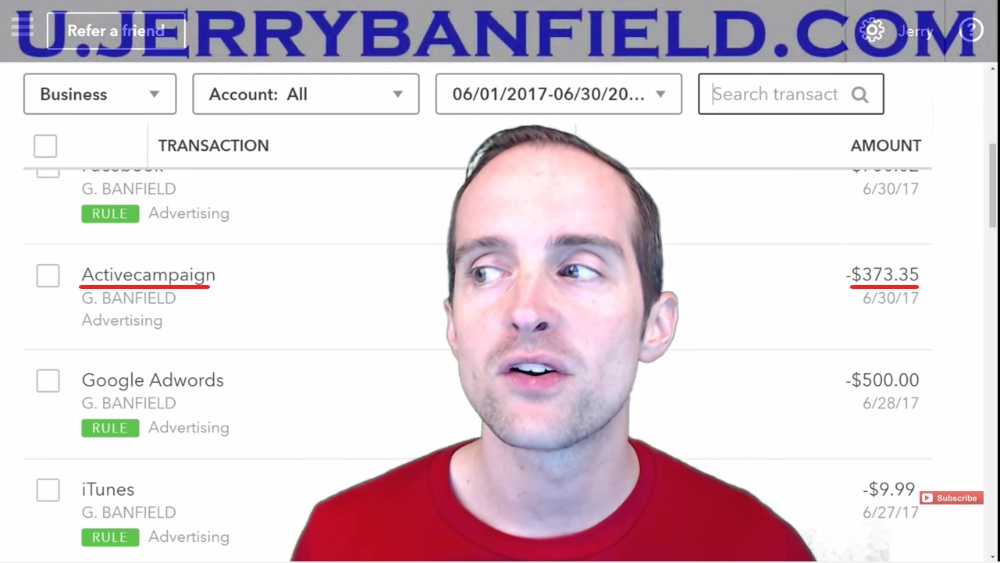

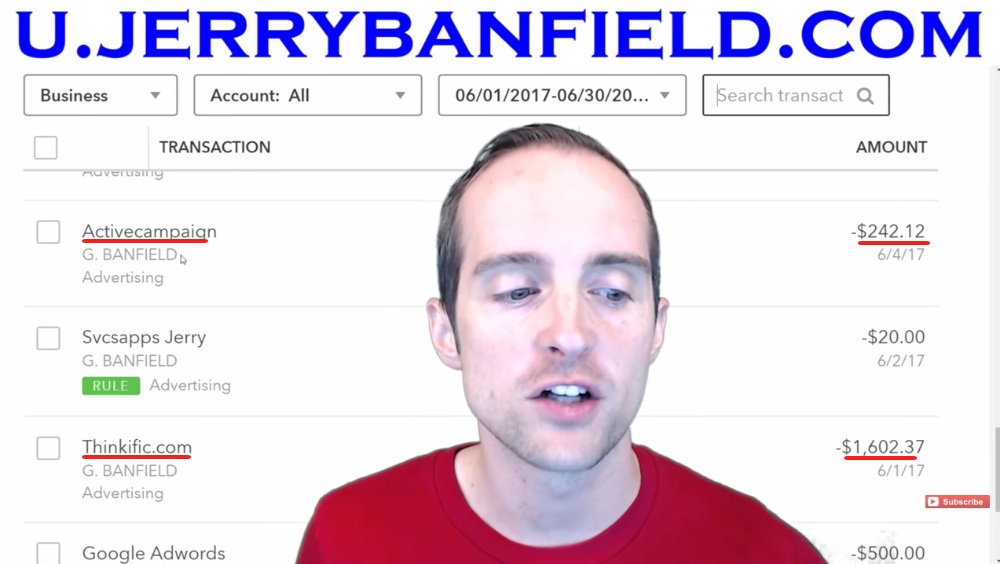

Now, I've got a couple new and big expenses for my new University of Jerry Banfield, I launched, which includes email marketing with ActiveCampaign.

So, I've got email marketing here and I've also got iTunes, and the iCloud Drive. Any Amazon expenses are things I've ordered for my business.

I have my personal and my business credit cards on Amazon, so if I order something, like a new camera for my business, I've got to separate the business and the personal expenses.

I've got the hosting for my website, Kinsta, which is awesome. I also ordered t-shirts on Redbubble for advertising, like the one I have on.

I ordered Serum, and then made a video about it. I ordered some of my books on CreateSpace. I have my podcast hosting, my twitter help, my Google apps, then I've got another ActiveCampaign charge to upgrade my email marketing. A huge charge here for Thinkific to upgrade my account to one of their highest levels because I need all the features on there.

Now, you can see that at the University of Jerry Banfield or u.jerrybanfield.com.

These are the largest single components of all of my expenses and the advertising expenses provide a significant impact on the bottom line.

They say, "You have to spend money to make money," when it comes to advertising. Doing good advertising helps. I'm running ads right now on Facebook and they are producing about a two plus return on investment. So every dollar I spend, gets me about two dollars in sales right now. I've scaled those ads about as much as I can for the moment, but I'm going to show more about that soon.

Travel expenses, something like a car rental on there, a few straightforward things like that.

Utilities, I write off half or so of my cell phone bill, which has six cell phones. One of which is primarily used to talk to my friend, Joseph about our business stuff, and then all of my business calls are made on my cell phone, which I try to minimize. Then, my Mom has two cell phones and she pays me on Patreon. She pays for her cell phones through my business, so her cell phones are out of my business as well on the expenses.

I also write off about 70% of my Internet bill because it is mainly used for my business, with a speed of 300 megabits up and down, which we would not need nearly that much without me uploading videos every day.

Then I've got Contract labor.

I've paid several friends to help out with my business.

My friends are working mainly on writing Steemit posts, not writing them from scratch, but taking transcripts from videos and editing them, taking screenshots, to make them the best quality post, and then I will post them on Steemit, because I like the option to read and watch.

This post was written like this and instead of just putting my videos out on Steemit, I put my videos out with a transcript that costs anywhere from $40 minimum to $100 on a longer one. Then, I'm grateful that I'm getting amazing earnings from Steemit, so it makes sense to keep paying for the transcripts and put the transcripts with the videos to get the best earnings and the best experience.

So, the majority of my contract labor is paid to my friends and to GoTranscript to help me turn videos like this into a written post, which often, you can skim through a written post and get the ideas out of it, anywhere from 5 to 10 times faster than watching the entire video. Then, if you really want the full in-depth picture, you've got the video right there too.

So, that's my total expenses, $12,479.

One of the two greatest assets currently is posting these new posts on Steemit.

I'm grateful that in the first 30 minutes, this Steem post has already been upvoted for $132. Now, this is the product of weeks of research and there's a lot of users active on Steemit every day.

Usually, the first few hours determine most of the value of the post, and it won't just go up for a whole week, more than likely. This post from yesterday has $355, it got to that amount in a few hours, and then it hasn't gone up much after that. So, the first few hours on Steemit tend to produce a lot of the value.

The lowest value post I've had so far on Steemit was $20. I'm going to test another one just like it, to see how much it gets with this new reward system. I posted a little photo diary and got $20 on that. So, we'll test another one like that.

The other main asset of my business here is the University of Jerry Banfield and the two of these account for the majority of my income.

I sell access to my video courses.

Now I've gotten some critical feedback on my "Cryptocurrency Mining Opportunity" because I sell access to information that's available for free.

Well, guess what? I do that in lots of my courses.

You are paying for me to have a video course, doing tutorials, showing you about something. If you just want to Google stuff and read things, feel free to go do that, but take my courses if you want my perspective on things with videos that are exclusive.

The videos that I put in my courses on the University of Jerry Banfield are here first if there's some new secret or great system I've got, before I share that on YouTube. Then some things are only here first, and then I put them out for free later, but the videos are exclusive to my University. I've got thousands of videos here, many of which are not available anywhere else, on all kinds of subjects. I've got about 40 courses on my website at the moment.

I've got a cool subscription you can get and the main purchases. There's one time purchases, then I've got an "all courses for life" bundle and an "all-access monthly" bundle, depending on whether you want to spend more today and get the very best deal or spend less today and then subscribe.

I'm extremely grateful if you've signed up on the University of Jerry Banfield. I am honored to finally have my own school and especially if you're a member there, I appreciate it. If you've been upvoting posts on Steemit, thank you very much, I'm extremely grateful for that.

I appreciate you reading about this June 2017 income report. I love you, you're awesome. I hope this has been helpful for you and I hope you have a wonderful day today.

If you found this post helpful on Steemit, would you please upvote it and follow me because you will then be able to see more posts like this in your home feed?

Love,

Jerry Banfield

FFS -- $19k in taxes..

Imagine if you could funnel even half of that back into your business.

Thanks for the transparency! I'd love to see someone else with a big name on Steemit do something similar ;)

Love that you peeled back the curtain and showed us the inside scoop. Really enjoyed reading and watching!

:O Those were many different sources of income... Certainly making me want to improve myself in this respect.

Yes @fisch on internet had lot of things of income sources just we want to check out!!

Thanks for the transparency!

"My wife and I have over $200,000 in student loans still from going to graduate school and law school. I'm very grateful for what you've contributed to this"

How does this even happen... what did you both study?

Give me a upvote, comment and follow... me I am just a little minnow I could do with you help :)

Jerry, if you are not selling everything you pay taxes on, aren't you afriad of getting loses back at the end of the year (if they should add up). Lets say steem is at $.50 on Dec. 31st and you paid all these gains on all these coins you made through the year, how are you going to explain to the government (that don't understand crypto to begin with) these loses? I really feel when it comes to the steem part of your income you only claim once sold or this can turn into massive confusion, when I know all you want to do is the right thing!

Wow! You're on it! Gotta love a guy who knows exactly what he's doing on his taxes! And I love that your Mom pays her cell phone through your Patreon. Great to be honest, even greater to be very shrewd while being honest. "Wise as serpents, harmless as doves" :)

Earn and..

Haha :D

:P

Haha so funny

WOW! So inspirational your honesty amazes me. Just know your improving lives with the help you provide people including me . Thank you!

Congratulations! @jerrybanfield you are doing exceptionally well with the earnings, please teach us all the secrets how you are achieving all this.BTW are still holding Dash masternodes?

For all the work you do you deserve the wealth