Personal Finance - An Easy to Use Excel File to Track Outstanding Loans

With the start of the new year, many people are gearing up to put their self discipline to the test with new fitness goals, learning new skills, and reading more books. One of the other most commonly picked New Year's Resolutions is to become not only physically fit, but financially fit as well. And whether you're attempting to finally lose that 20 lbs or finally wiping debt off the table, the best way to do it is to start with a plan. After all, like the great Benjamin Franklin said, "If you fail to plan, you are planning to fail."

So while I can't follow you around smacking your credit card out of your hand every time you go to make that purchase that you don't really need, I can give you one of the many tools that I've created for myself that I strongly believe helps me stay on track with my own goals.

By following the above link, it should take you to the Excel file that I've created and should give you an option to download it. If it doesn't please let me know. This is my first time posting a Dropbox link, so there may be a learning curve involved lol.

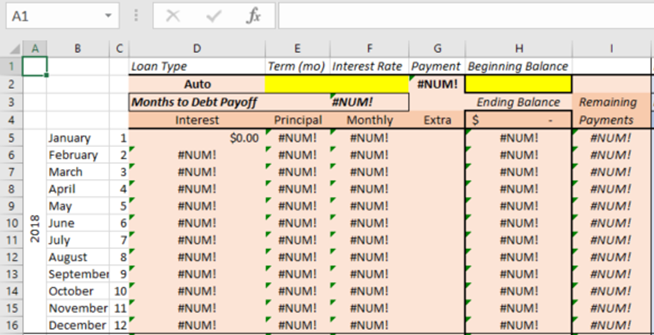

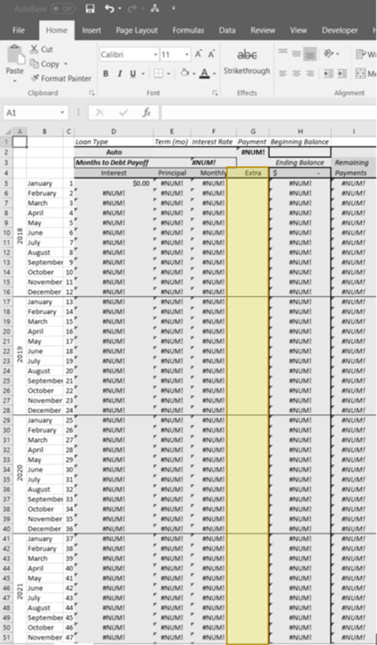

Once you've downloaded the file, it's pretty straight forward. There are several cells for each type of loan that are highlighted in yellow. These are the only cells that you need to fill out in order to populate most of the spreadsheet.

If you like the idea of what I've put together, but not quite the format, I've also left all of the formulas available for you to see in case you want to change a few things but don't want to spend time researching different excel formulas.

Keep in mind, this isn't some ultra fancy financial app. I'm sure there are plenty of websites and apps out there that can supply this same information in a very "pretty" way. With this spreadsheet however, it's very easy to play with the numbers and change things on the fly.

What will it look like if I add an extra payment here?

What if I increase my total payment to this loan?

How many payments do I have left after making this payment?

How long will my credit card take to pay off?

How much will I pay in interest?

Breaking Down the Spreadsheet

The spreadsheet supplied only includes 4 different loans, but you can easily copy/paste/insert the columns to create additional loan types.

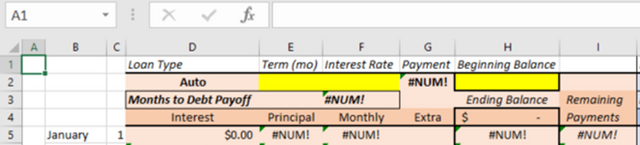

...with that being said, we'll start with the cells highlighted in yellow. These are the minimum cells that you'll need to input values for in order to populate the spreadsheet. I only included the Term (in months) as a required cell for the auto loan, because absent for rare exceptions, an auto loan is fixed; whereas credit cards and students loans can fluctuate in the minimum required payment, interest rates, and adding on additional debt (which we don't want to do!).

The Extra column is also left blank for you. These cells would be used in the case that you want to make an extra $50 payment here or there to different loans.

Aside from that, it's pretty much plug and play! Remember, just because cells auto-fill doesn't mean you can't make changes if necessary.

For example, it's entirely possible that on 2/1/18 your credit card company is requiring a minimum payment of $100. Plug in $100 into M2 to begin with it, as well as your total outstanding balance and your interest rate. This will populate the entire loan data for you. Now, let's say on 6/1/18 you look at your bill and see that the credit card company is now requiring a $150 payment. Instead of changing M2 to $150 (which would change all of the data), just change cell L10 (and all other cells after it in column L) to the new payment amount.

The same can be said if you have an emergency and you have to add $1,000 to your credit card. While this spreadsheet is better for only paying down debt, sometimes things happen and you have to put money on your card. If that happens, don't change the Beginning Balance in cell N2. Instead, just change Ending Balance of the month you're currently on so that the data going forward is accurate.

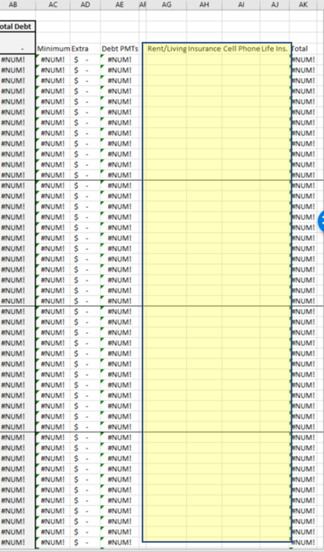

Columns AG-AJ are more related to fixed living expenses. I have this as a running tally just so I can see my overall required expenses so that I can plan accordingly for the month.

Hopefully this helps some of you!

Feel free to leave me any questions, comments, or tips that you think I should implement going forward!

Loans are for weaklings! :P

hahaha well... speaking only for myself here... some of my loans are because of poor decisions to live beyond my means, some were out of necessity, and some were for emergencies.

Did I neeeeeed BFGs on my Tahoe... probably not lol. Did I need student loans to graduate in 4... yes :D

But for most people... I agree. Aside from a 15 year mortgage, there are very few things that people need a loan for. Having said that, for those of us that do have loans, I think my spreadsheet is particularly useful for organizing your debt in a way that is visually appealing and beneficial in terms of mapping out how you're going to get it paid off.

You should add some photos cuz I am too lazy to download and set up the spreadsheet when its mostly out of curiosity. Sounds cool tho, having some kind of digital document (for me is a text file) really helps with organizing the finances, I completely with the premise of your post.

Thanks for the input! I've updated the post to include some screen shots throughout the article :)

educative

Thanks! What did you think of the spreadsheet?

Great work!

Thank you!

If you're looking for a convenient way to track outstanding loans, an Excel file can be a great tool. You can customize it to suit your needs, whether you have multiple loans with varying interest rates or payment schedules. However, if you prefer a more streamlined approach, you might consider checking out https://apps.apple.com/us/app/same-day-loan-no-credit-check/id6448627235 It offers a user-friendly interface to manage your loans efficiently, helping you stay on top of payments and interest rates with ease.

Good day. Car financing services are provided by different companies, and therefore many people think about which one is best to choose. Among the wide variety, Westlake Financial Services stands out for its excellent offers and affordable interest rates and can meet the needs of almost any client. To get the best financing terms, anyone can contact westlake financial services customer service and they will try to offer an option that completely suits the client.