Why You Should Pursue An Education In Finance

The average household credit card debt In the U.S. is $15,263, according to Nerdwallet. The New York Daily News put the total national student loan debt at an unbelievable $1.2 trillion, while Statistic Brain claimed that since 2008, more than 14 million homes have been foreclosed.

It’s difficult today to disagree with the need for financial education for the majority of us. Recently, America has had the challenge of a housing crisis, the retirement savings crisis, and the student debt crisis. That’s a bunch of money problems for one decade.

Certainly, our economic system has its flaws. A lot of us lack comprehension of the fundamental personal finance viewpoint which makes us particularly vulnerable to those economic flaws. There’s a palpable necessity for financial literacy, and a lot of people concur that teaching financial literacy in schools is the solution.

What Is Financial Literacy?

According to Investopedia, "Financial literacy is the confluence of financial, credit and debt management and the knowledge that is necessary to make financially responsible decisions – decisions that are integral to our everyday lives. Financial literacy includes understanding how a checking account works, what using a credit card really means, and how to avoid debt. In sum, financial literacy impacts the daily issues an average family makes when trying to balance a budget, buy a home, fund the children’s education and ensure an income at retirement."

Lack of consumer's financial literacy, according to Investopedia is not only a problem in developing economies but also in developed economies. Consumers worldwide are unable to show a strong understanding of financial principles that will help them understand and take financial decisions, deal with financial risks efficiently and avoid financial pitfalls.

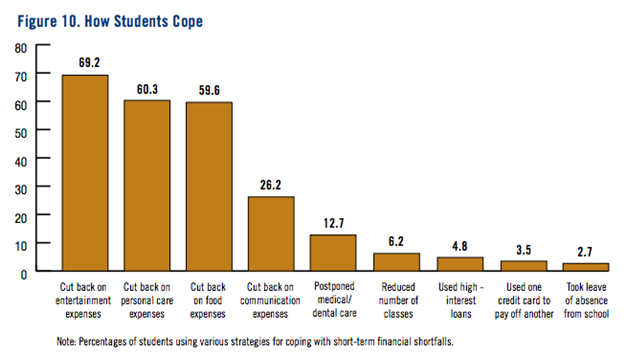

Research has shown that financial education does have an impact in helping students manage their finances more effectively. A study by the University of Arizona’s which followed the money behavior of college students includes an excerpt on how students cope with short-term financial shortfalls:

The University, after studying the students’ level of financial knowledge, concluded:

“Parental direct teaching, high school work experience, and high school financial education all related to students’ having more financial knowledge by their first year in college…Our research findings suggest that parents, schools and the marketplace would do well to partner to help children and young adults develop positive financial attitudes and behavior.”

Importance Of Financial Services Course

If you are going to get a financial education, you might just as well get a degree in financial services at an accredited university. A financial service course will equip you with skills that will empower you financially for the rest of your life if you desire to be successful.

If you are working or don't have the time to attend classes you might want to consider taking and getting an online bachelor degree in financial services which are Flexible, affordable and 100% online

With a financial services course, you will become skilled at money management information that will help you for the rest of your life. A number of the things you will gain knowledge of in a course like this include, but are not limited to:

• Investment options

• How to prepare for retirement

• How to make/read financial statements

• How to create and follow a budget

• How to balance your income and expenses

Basically, financial Services classes present you with all the information needed for you to maintain financial responsibility. Effectively overseeing your finances is not a simple task. As you grow older, you have more and more variables to contend with. Things like paying for your child’s college expenses, pensions, retirement and so on are just a few of the situations you have to plan for. Being prepared with a financial education is the major tool you need to ensure you handle these situations the right way. It is a no-risk, high-reward class that will benefit you well beyond your college years.

In addition to benefiting from financial intelligence for the rest of your life,

Your degree in finance can help you become eligible for many jobs in financial services, including, portfolio management, banking, investment advisory, insurance, and more.

As a graduate in financial services, you can work in a number of organizations including:

Bank branch operations and management

Commercial banks

Customer services

Financial planning

Financial services sales

Governmental regulatory firms

Insurance firms

Investment advisory firms

Mortgage services

Personal financial advising

Portfolio management

Career opportunities for finance degree graduates include:

Account Executive

Analyst

Client Manager

Financial Consultant

Financial Planner

Financial Services Representative

Financial Specialist

Personal Banker

Portfolio Manager

Investment Officer

Most careers in finance entail finding efficient ways to manage organizations and individual funds to create wealth and enhance the organization's or individual's value.

Unfortunately, financial education and thus financial literacy have not been given the priority it deserves. Financial education is a worthwhile investment that will equip students with vital knowledge and information that will serve and protect them in the future. Financial education can make us less vulnerable to any flaws in the economic system. Financial education similarly could go a long way in fortifying our economy by shielding us from a lot of the economic calamity that is currently plaguing us.

Also data analysis anddata interpretation as a career.