100% Proof That A Massive Economic Meltdown Is Closer Than You Think. By Gregory Mannarino

This past Wednesday we heard from the Federal Reserve with regard to monetary policy, and as I predicted they did raise the federal funds rate 25 basis points however, instead of yields rising, they are dropping.

More than a year and a half ago I had said publicly that the Federal Reserve's attempt at trying to normalize bond yields would backfire-and this is exactly what is happening.

It is clear to me that the Federal Reserve has absolutely lost control of what is occurring in the bond market. Remember, this is uncharted territory, we have never been here before in the history of the financial world-so the Federal Reserve actually has no idea of how the market will react in the current environment with regard to their attempt at normalizing interest rates.

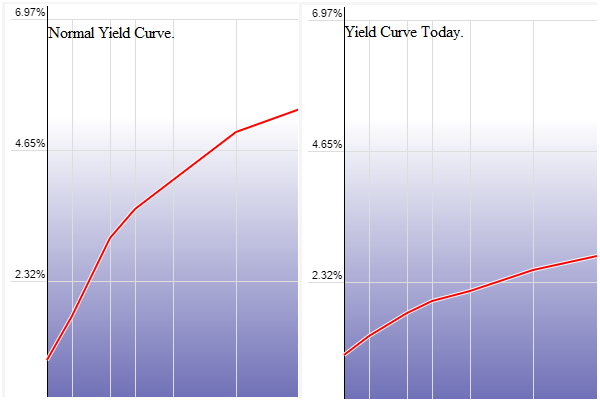

The yield curve as seen in the picture above continues to flatten out, and this trend will continue until the curve inverts.

The last time the yield curve inverted, the 2008 economic meltdown occurred, and the time before that we suffered the.com bubble meltdown.

The fact is we are existing in a multiple bubble economy at this time, worse, and unlike anything which has ever been seen before.

The reason why these bubbles exist is simple: the Federal Reserve has not allowed the market to do its one and only job, and that is to determine fair value.

The Federal Reserve's interest rate suppression cycle has not only allowed, but has been the driving force behind mass malinvestments across the entire spectrum of asset classes and as such, bubbles have been created.

The Federal Reserve has created distortions across the spectrum of asset classes which is frankly beyond belief, worse than has ever been witnessed in the history of finance. What this means is when the yield curve inverts this time, we will experience a meltdown magnitudes greater then the 2008 crash.

The irony is just like last time, the general public has no idea of what is coming and they are just as complacent as well.

In summary.

The federal reserves attempt at raising interest rates is having a paradoxical effect on the market as the yield curve continues to flatten.

I fully expect the yield curve to invert in the not so distant future. What this means is we can expect a market meltdown orders of magnitude worse than the last two times we had a yield curve inversion.

Gregory Mannarino

Greg, I completely agree and have been expecting this roughly since the 2007 bailout. I know you are a proponent of precious metals. I have been for some time, due to their obviously manipulated nature. I want to be in anything that's being held down, but I'm starting to wonder if it's going to be a good place to be when this happens. I feel like silver will still be stuck as a cheap, industrial metal. I think gold will act quite differently, because pretty much all we've ever mined is still out there, but even there I'm losing some faith in future utility vs. what crypto offers.

Thanks for the post.

Hold onto silver for the long haul, not for short term investment. Crypto's have been very profitable in the short term for many people, but they are very unstable. Crypto's rise is based primarily in the lack of trust in the dollar. If the dollar comes back, crypto's will once again return to their low value. I wouldn't bank on crypto's because we have an administration that is set on making America great again. The election of the Trump administration means the US is changing direction.

its all doom and gloom we gotta try live our lives people

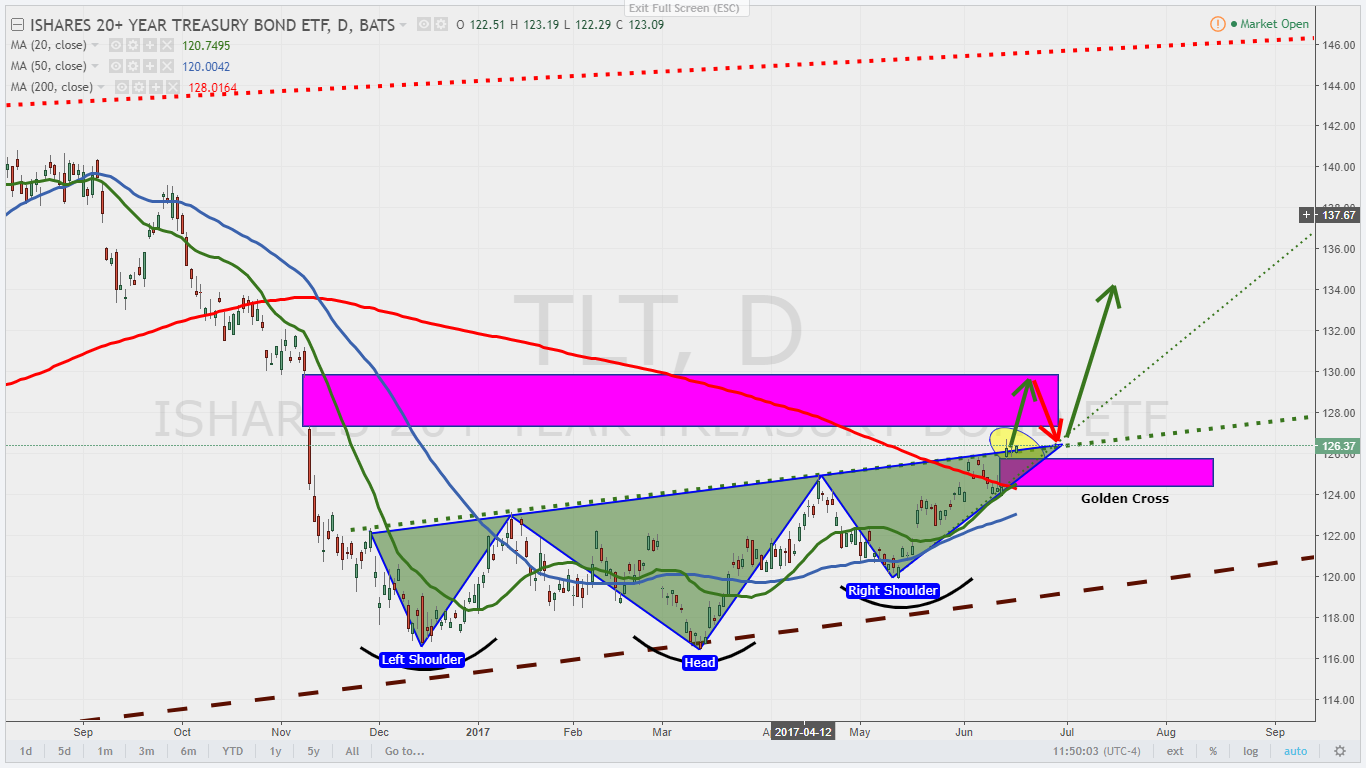

TLT... Inverse H&S and ABOVE the neckline.

TNX BELOW 3rd touch support.

I agree this is going higher. about to close out my naz future short from 1PM.

you have a good one. BTW I see what you are saying that it appears to be a INV H&S nice reversal catch.

chris

could you explain what these graphs are showing in layman's terms? What is the "Neckline"? How do you interpret this? Thanks in advance

TLT chart... Inverse head and shoulders is VERY BULLISH. So, we should see money pull out of equities and pile into 20-year treasuries (TLT). As for the second chart (TNX), it looks BEARISH which means money pulling out of equities and into treasuries.

Do you think this pullback out of equities also relevant for Miners and PM? What are your thoughts on that?

Thx!

that's a fine explanation - thanks for taking the time maestro :D

hey man, yeah its true there is a ton of stuff on that price chart the Maestro posted, its almost too much to explain, however the concepts arent hard to understand, they are just numerous. Best idea may be to search investopedia.com for key words he uses like "neck line," "chart pattern," "support line," or trend line,

in brief though, so that I may offer some resolution to your question, is that the neck line is the bottom trend line of the head and shoulders pattern, when price breaks it, it is considered a confirmation of the pattern and therefore a good predictor of future price action. Not all patterns are 100% but it seems to me that a head and shoulders pattern, when confirmed, is pretty legit.

let me know if this helps

Followed & Upvoted

Follow back please :) and upvote one of my blogs thankyou ;)

@thecrytotrader

Hey Greg, long time youtube sub! :)

"so the Federal Reserve actually has no idea of how the market will react in the current environment with regard to their attempt at normalizing interest rates."

I would like to suggest that they do?

😨

It's been happening. For almost a decade, we are living in the worse collapse that's coming soon 😳😬😀

agreed

Greg, I have enjoyed your interviews with USAwatchdog, but as much as we all know these "free" markets are currently run by the Fed, they will only collapse because of an event that the Fed can't control. But, in that event, you will have the worst crisis of all, a crisis of confidence in the system. It is easy to see how "Fed Up" people have become. Good Luck!

Exactly, and the Fed. Has lost control of the debt market.

Yeah, but remember this is not just the Fed. It is the BOJ, ECB, the SNB (I am in Geneva and shocked at the amount of US equities the SNB has purchased). During the housing crisis, the biggest borrowers of Fed funds were UBS and Credit Suisse. 2 Swiss banks. These guys all together have a lot of fire power. Don't get me wrong, the situation makes me furious and I am looking for signs that they truly have lost control.

Maybe we won't know they have lost control until the whole world knows it; I think like recessions we will only prove it by lagging indicators. Obviously, the Swiss think that nothing will unseat the US as issuer of the world reserve currency. I still think that things may unravel in the fall. Like Rickards believes, the IMF will then try to backstop the world with the SDR, maybe with inclusion of gold and silver in the basket. But I think China will not want to go along with anything tied to the debt-based US dollar; they have spent decades building the world with development projects, the US elites have spent decades destroying the enemies of Israel, and making Daddy Warbucks rich. We live in interesting times.

People will want nothing to do with the Bankster's SDR. I used to think Rickards was right on that SDR stuff - The Banksters will be Anathama when this next economic tsunami rolls in. The new currency will be Cryptos. So, get your ETH/BTC (and Silver) Now. Miniing shares will also do very well for a while.

good post

Thank you Greg for the heads up! Also thanks for the recommendation of this site

Greg you are on the top of your game on this and that you for all that you do

Yep! At some point this whole things gonna come crashing down or we're gonna be paying a wheel barrow load of paper for a potato while living under a huge military regime not being able to piss without having our chip checked. Don't forget the shitter tax each time you go..........

Exactly. Hyperinflation is coming and Soon.