Tesla, Inc. (TSLA) Stock Analysis

Tesla, Inc.(TSLA)

Company Description

Tesla, Inc. designs, develops, manufactures, and sells electric vehicles, and energy generation and storage systems in the United States, China, Norway, and internationally. The company operates in two segments, Automotive, and Energy Generation and Storage. The Automotive segment offers sedans and sport utility vehicles. It also provides electric vehicle powertrain components and systems to other manufacturers; and services for electric vehicles through its company-owned service centers, Service Plus locations, and Tesla mobile technicians. This segment sells its products through a network of company-owned stores and galleries. The Energy Generation and Storage segment offers energy storage products, such as rechargeable lithium-ion battery systems for use in homes, commercial facilities, and utility grids; designs, manufactures, installs, maintains, leases, and sells solar energy systems to residential and commercial customers; and sell renewable energy to residential and commercial customers. The company was formerly known as Tesla Motors, Inc. and changed its name to Tesla, Inc. in February 2017. Tesla, Inc. was founded in 2003 and is headquartered in Palo Alto, California.

| Valuation Metrics | Tesla, Inc. |

|---|---|

| Price | $330.9 |

| Daily Range | 7.35% |

| Opening Price | $308.25 |

| Daily Price Range | $306.65 - 339.90 |

| Bid | 326.62 x 1800 |

| Ask | 327.00 x 1000 |

| Fifty-Two Week Range | $244.59 - 387.46 |

| Trading Volume | 26,989,309 |

| Average Trading Volume | 11,567,510 |

| Market Capitalization | 56.449B |

| Beta | 0.84 |

| P/E Ratio (TTM) | N/A |

| EPS (TTM) | -16.14 |

| Earnings Date | Oct 24, 2018 - Nov 5, 2018 |

| Forward Dividend & Yield | N/A (N/A) |

| Ex-Dividend Date | N/A |

| Target Price | $323.58 |

| Sharpe Ratio | -0.7 |

Summary Statement:

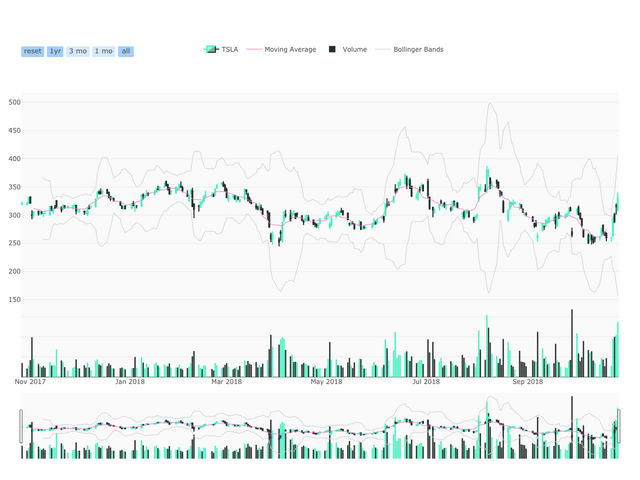

Tesla, Inc. currently trades at a spot price of $330.9 with a one-year expected target price of $323.58 meaning an expected forward return over the next year of -2.21%. Some important measures to look at is the company's beta of 0.84 the company's Sharpe ratio of -0.7.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=27444752