The World Debt Super-Cycle In 2017

The world has never been more in debt.

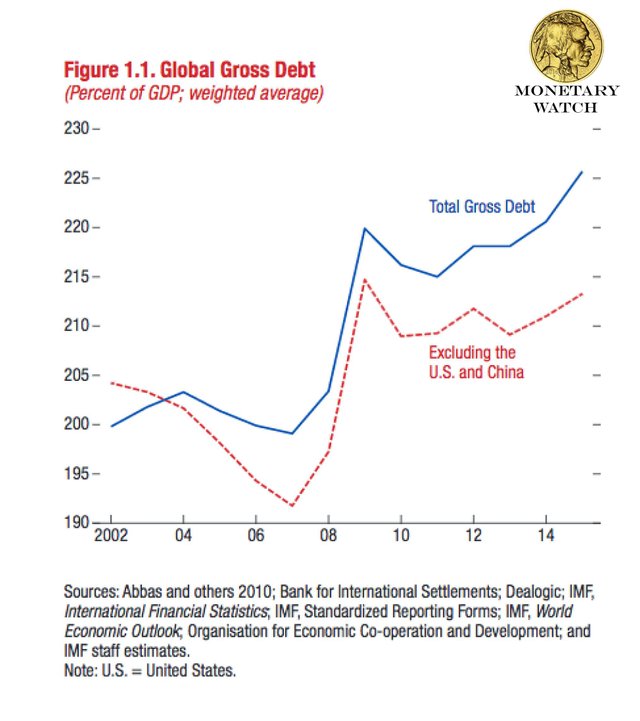

According to the International Monetary Fund, total non-financial sector debt has hit $152 trillion worldwide, the highest gross debt ever recorded. The debt-to-GDP ratio is also at an all-time high of 225%, up from 200% 14 years ago.

After the Financial Collapse in 2008, Central Banks had a decision to make.

(1) let asset prices fall to their true market value

(2) increase savings rates

(3) force companies to write off bad debts

or

(1) prop up asset prices by trying to blow a new bubble by giving banks trillion accompanied by taking interest rates to 0% (or below)

(2) re-write accounting and reporting rules to let the big banks and other giants keep bad debts on their books (or other “second sets of books”) and to hide the fact that they are bad debts

(3) encourage consumers to spend spend spend

The Central Banks doubled down on the latter.

Claudio Borio, head of the Bank of International Settlement’s monetary and economic department, said: “Persistent exceptionally low rates reflect the central banks’ and market participants’ response to the unusually weak post-crisis recovery as they fumble in the dark in search of new certainties.”

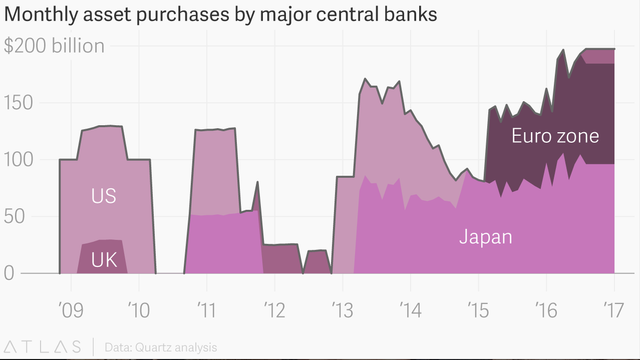

Now here we are in 2017, Central banks around the world are still spending nearly $200 billion a month on emergency economic stimulus measures, pumping this money into their economies by buying bonds. The current pace of purchases is higher than ever before, even during the depths of the financial crisis in 2009.

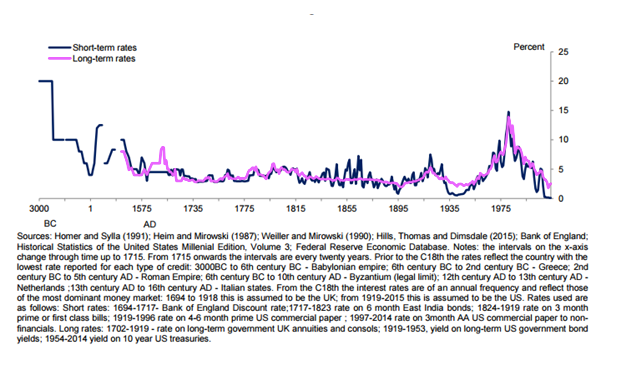

World interest rates are now the lowest in human history. With nearly $9.1 Trillion already yielding negative rates

Where do the Central Bankers go from here? Criticism is mounting, as inequality is spiking worldwide as a result of these policies. We’ll address next steps in part 2…