6.4 TRILLION DOLLARS PRINTED.. WHAT HAPPENS NEXT?

The US has decided to print 6.4 trillion dollars, to help with the coronavirus pandemic. Experts suggest this is likely to increase to 10 trillion in the coming months,so I will use this going forward.

This is a big number, but an abstract one without context.

Currently in circulation, there are 14 trillion dollars in existence worldwide.

An extra 10 trillion would increase the amount of dollars by 71.5%. This would mean the buying power of ever dollar should be 71.5% less. However things don’t work like that in real life. It takes time for the dollars new value to trickle down to the average person.

The first time that most will notice it, is when they try to buy something at the local shop, and find the cost is 71.5% more. And in reality this wont happen over night.. just a steady increase over weeks or months.

The people that gain the most in this situation are the first to spend it. This will be the government, as they buy goods to pay for hospitals/armed forces etc. In this scenario they are getting the old value for the currency before it was inflated by 71.5%

Basically, if you think of a dollar being a share of the US economy, any you hold have just been diluted by 71.5%. But its not just Americans that hold US Dollars.

China, Japan ,Russia, India and South Korea are all in the top 10 biggest holders of the US currency. They will all be effectively paying into the US economy with a 71.5% loss of value to their holdings.

The question is... What happens next?

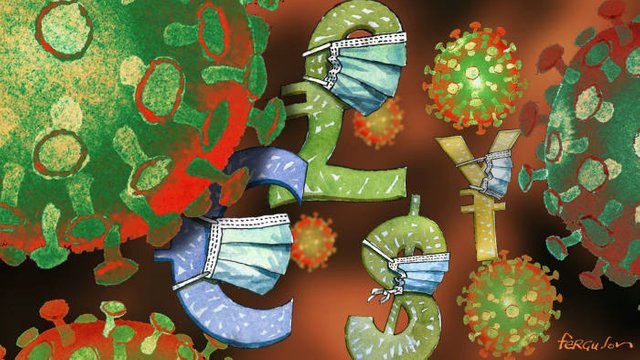

The US is not alone in printing more money. Virtually every country is taking the same measures...200billion UK pounds have been printed...and the European banks are looking at an extra trillion being introduced into the economy. So exchange rates between countries should stay similar. This depends a lot on the percentage of extra cash being printed and the strength of that economy.

With this massive world wide money printing, one thing is inevitable. The ticket prices of everything will go up. Food will be more expensive to buy in the shops, Travel will cost more, and the price of living will go up.

The ticket cost of goods will have to change to account for the extra currency in circulation.

When people return to work, they will need more money from there employer in order to experience the same lifestyle they once led. However most companies will have been significantly damaged by months of closures, and debts. They will be under pressure to cut staff, and unlikely to be increasing salary’s.

The average person will have less money in their pocket and this means less spent on non essentials such as entertainment. The struggling cinema/restaurant and bar industries will be hit, as less people go out.

This will mean huge parts of the economy with many low paid workers will risk unemployment. It will be a slow road for any economy to survive this level of money printing.

There is light at the end of the tunnel. Firstly there are jobs that were not impacted by this such as supermarkets/ online delivery/ offices workers that work from home.

They will be expecting increases in wages in line with inflation. This should be the 71.5%in the US... I’d say most will have trouble getting that in one go, but over 5 years it has to happen.

There people will stimulate the entertainment industry, and eventually everything will return to normal. And of course there are those that have enough wealth to not worry about this. But, how many of those people do you think have kept their wealth in cash in times of such money printing?

Companies that are cash rich, do not want to loose 71.5% of its value. So expect the likes of Apple/Amazon/Microsoft to start making big acquisitions in the near future.

We live in uncharted times, but one thing never changes.. the rich will look after their wealth. It will be either bitcoin/gold/property that are set to boom as state fiat currencies are printed all around the world.

Nick