The US debt will rise to at least $30 trillion within ten years

The new budget presented by Donald Trump earlier this week shows that the US government wants to spend considerably more money in the coming years to stimulate the economy.

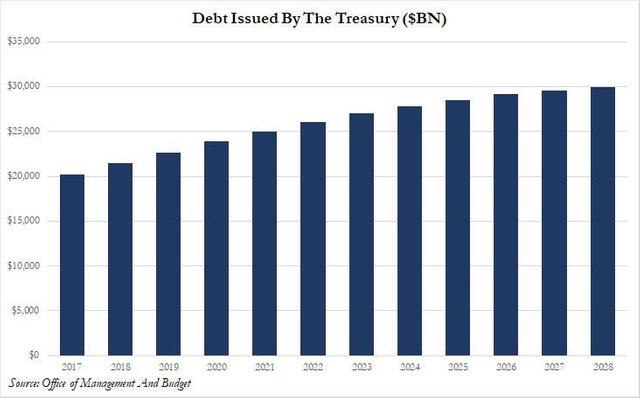

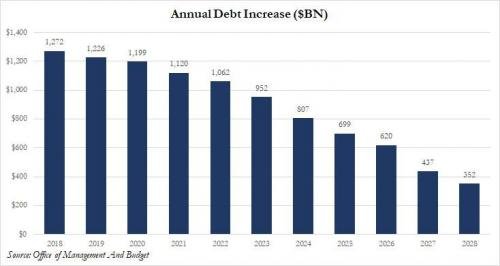

A combination of tax cuts and new investments in infrastructure and the army, among other things, will bring next year's budget deficit back to over $1 trillion for the first time since the start of the financial crisis. But wait, there's more: it will only get worse from there, because the government wants to spend structurally more money than it receives in the years ahead. As a result, the US debt is expected to pass the $30 trillion in the year 2028, according to the Office of Management and Budget. An increase of $10 trillion.

Trump's own 'Office of Management and Budget' anticipates that US debt will increase by at least $1 trillion dollars for at least the next 5 years.

Trump increases the budget deficit to stimulate the economy, but I highly doubt whether this is a sustainable policy. The US economy has been growing again in recent years and my fear is that further stimulus will lead to overheating of the economy. Trump's stimulation can cause both wages and inflation to rise to fast.

The financial markets were already anticipating Trump's plans, as interest rates on 10-year US government bonds have risen from 2.4% to more than 2.9% since December. It is therefore questionable to what extent foreign countries will be willing to finance the US deficits.

I think the Office of Management and Budget is even on the optimistic side with its projections. A recession has not been taken into account. The total debt in 10 years will probably be substantially higher than what is projected above.

In the end, the US government is simply bankrupt. We all know that the government is never going to repay its public debts. As long as the music is playing, should we keep dancing? The last recession is 9 years ago, so the music has been playing for quite some time now. Historically, a recession hits around every 7-10 years, so I don't expect the music will keep on playing for multiple years.

Never forget when and why Bitcoin was created in the first place. Back in 2008 when the banks began to collapse there was no alternative international payment network. Without the banks we couldn't pay each other. But thanks to Bitcoin, now we can! Bitcoin is not created to make money. Bitcoin is here to change money. I believe the next recession will skyrocket Bitcoin to new highs far above the current high. The best time to buy Bitcoin is when the music is still playing. Make sure you have an exit plan.

"Paper money eventually returns to its intrinsic value: zero." ~ Voltaire in 1729

Sources used:

https://www.zerohedge.com/news/2018-02-12/us-launching-crisis-level-spending

https://www.investing.com/rates-bonds/u.s.-10-year-bond-yield

SteemBlockExplorer.com - SteemNow.com - CoinMarkets.today

¯\___(ツ)____/¯ Follow me @penguinpablo

Ballooning debt and a continuously devaluing currency! What could possibly go wrong?

Decentralized cryptos are the only hope the average millennial has of escaping the debt trap of the legacy financial system.

Because how could this be a bad idea...? /sacrasm

To all traders out there seeking for a good trading strategy and have been going through difficulties in winning trades, I will like to share with you all a solution to your problems by introducing you to an amazing trading strategy and tool I was also introduced to, which has won me thousands of dollars lately.As an IPM investor I have made over $452000 in my first quarter, been the most secure trending investment .contact me and i will show you the secret and strategy also i will assist you for free contact me via my e mail ([email protected]).This is a top secret you need to learn for a good Payout. I guarantee you 98% ..Regards.

All very true PP. Now to rub salt in the wounds...

US Government Debt now at $21T up from $20T in 2017.

10 year bonds were 2.4%, now 2.9%pa.

Approximate interest expense 2017 - $480 Billion!

Estimated interest expense 2018 - $609 Billion!

Increase in interest expense, year on year = 26.88%

And this 10 year bond rate is rising daily!

US is toast!!

SK.

The U.S. is basically bankrupt, but too big to fail (for now anyways)...

I have heard this debt issue for a while now. I thought the economy was going to collapse before now. Some people said governments around nd the world might have to provide helicopter money to stimulate the economy. I sometimes order if cryptocurrency is a form of helicopter money.

Yeah, and the problem is that other countries have accepted these debts to be expressed in US dollar. So basically if the US wants to devaluate their debt, they just have to print a few more dollars...

It is time debts are noted in BTC ;-)

it is because we are the world's reserve currency, that we can print all we want without devaluing the dollar. If this changes, we will go bankrupt; immediately.

That might indeed happen.

Yes, and a big part of that is the requirement that all crude oil sales take place in USD. We've brought down governments for their announcing plans to sell their oil in some other currency. We Americans rarely even see all that our govt. is going to prop up our access to cheap imports and global dominance of our corporations. But it is so fragilely balanced. Just takes one country to big or too connected in NATO to decide to upset the apple cart, and it all comes tumbling down.

We have a few years left before this whole thing comes crashing down.

2020 and 2024 are BIG years for bitcoin and crypto...get in before the party is over

man the whole global fiat system is a big ponzi and those people want say crypto is a ponzi. ironic

also how can you escape debt if you have to pay interests for interests? its not possible

Well that s why long term crypto will have success. Everyone who has invested now or who will buy within next few years will still make a awesome ROI if Bitcoin will replace Fiat.

Only Problem is that banks and governments will try everything to keep their printable fiat money.

yeah thats absolutely right! these are the guys who try to spread FUD all around making it harder for open minded people like us, especially for people who are new in the scene which leads to big concerns in the whole community

Ha! I just wrote basically the same thing, then scrolled down and saw your post! Yep.

If I may play devils advocate here, they want to run the economy hot. The fed will be unwinding some 4 trillion off its balance sheet while trying to normalize rates. With a projected 3, maybe 4 rate hikes plus some fed balance sheet unwind, it will be akin to almost 4 rate hikes which will or the brakes on the economy. To offset this, trump will run the economy a little hot and devalue the dollar. GDP fell last quarter anyway, down to 2.6, so there is room to run a little hot.

All in all, their theory is it’s better to let the economy run hot than to hit a recession or depression. People are more likely to riot if there’s no food than if food costs 10% more.

Also with complete control of the dollar, they can practically do whatever they want. Print more or devalue it or whatever. The deficit is simply a ledger, but there’s not natural law that says reach this level and all hell breaks loose. Control is more important than substance here, and we all know there’s no substance in the dollar other than as some ideo. So while all this is may seem alarming, it’s not. Imho.

what GDP growth rate is that deficit projection based upon?

That's a good one. It's definitely based on growth without taking a recession into account.

at what rate of growth would we see the projected deficit?