DFS Bankroll Management - The Optimal Solution

Introduction

This post is meant to educate on the importance of bankroll management, and leave you with some rules of thumb to help you succeed as a long-term profitable DFS (daily fantasy sports) player. Don't play DFS? This actually applies to MANY things such as poker, the stock market, crypto investments, or any environment in which you take a series of risks, hoping to build your bankroll over time. I will be speaking in terms of 'contests' and 'lineups', which is DFS lingo, but it still applies universally. If you are interested in investing or gambling or anything of the sort, I recommend you read this post.

Let's start with a common misconception.

If I win most of my contests, I will be profitable.

Winning is important! I can't deny that. It's a necessary piece of the puzzle. But it's absolutely useless if you don't manage your bankroll well. Not only is bankroll management important, I would go as far as to say it's equally important as creating good lineups. I know, you think I'm exaggerating to make a point. I'm not.

I always knew bankroll management was important, but I didn't fully grasp how important it really was until I did some analysis. Bankroll management will absolutely decide your fate as a DFS player, and I'll show you the math behind why that is true. But first, let's just run through a quick simulation so that you can see the effect that I'm going to explain.

Simulation

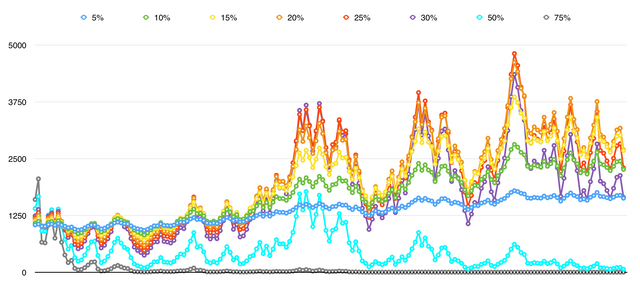

Over the course of 180 days (approximately the amount of playable days in an MLB fantasy season), let's simulate a randomized winning percentage for every day. This will be the percent of contest entries that you win on that day. Let's also assume that you're a good player, and that on average you have an expected win pct. of 60%. Every day, you invest a certain percent of your bankroll into DFS contests. How much will you profit over the course of the season? Well, that depends on the percent of your bankroll that you're investing every day. Let's look at how your profit would look with different bankroll investment percentages.

In this graph, each line represents a bankroll investment strategy. Each strategy had identical win percentages on every day. Each strategy also began with the same bankroll (the graph doesn't show day 0, but they all begin with $1000). The actual average win pct on the year in this simulation was just over 59% (well above average). The only thing differentiating the results for each of these strategies is the percent of bankroll invested on a daily basis.

Here are the final results for each bankroll strategy:

| Bankroll Invested Daily | Starting Bankroll | Ending Bankroll | ROI |

|---|---|---|---|

| 5% | $1000 | $1628.87 | 62.8% |

| 10% | $1000 | $2262.31 | 126.2% |

| 15% | $1000 | $2677.25 | 167.7% |

| 20% | $1000 | $2693.81 | 169.4% |

| 25% | $1000 | $2296.07 | 129.6% |

| 30% | $1000 | $1648.91 | 64.9% |

| 50% | $1000 | $65.61 | -93.4% |

| 75% | $1000 | $0.003 | -100% |

For those that aren't familiar with this effect, this may seem crazy. Winning 59% of your contests, and investing 50% of your bankroll every day, you will lose almost all of your money. Investing 75% will leave you with only pennies. This effect seems obvious when you think about the extremes. Imagine you can roll a die, and you double your money every time it lands on 1-5. You lose your money every time it lands on 6. These sound like amazing odds! In fact, there's an expected ROI of 66.66% on every roll! But if you keep rolling and you re-invest all of your winnings every time, then as soon as it lands on 6, you're done. Your bankroll is at zero, and you have nothing left to invest to build it back up. This is an extreme example, but it may help to wrap your head around what's going on.

The top performing strategy for the bankroll simulation was the 20% investment strategy, closely followed by the 15% investment strategy. This is not a universal answer though. The higher your winning percentage is, the more you can afford to invest daily. And vice versa. So what is the universal answer? Luckily, this was solved in 1956 by a researcher at Bell Labs, by the name of J. L. Kelly, Jr.

The Kelly Criterion

From Wikipedia:

The Kelly Criterion is a formula used to determine the optimal size of a series of bets. In most gambling scenarios, and some investing scenarios under some simplifying assumptions, the Kelly strategy will do better than any essentially different strategy in the long run

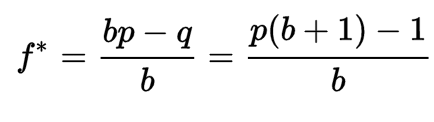

As long as we're concerned with a series of bets, this formula will give you the optimal bet size in relation to your bankroll (if you're not interested in formulas feel free to skip to the example):

where:

f* is the fraction of the current bankroll to wager, i.e. how much to bet;

b is the net odds received on the wager ("b to 1"); that is, you could win $b (on top of getting back your $1 wagered) for a $1 bet

p is the probability of winning;

q is the probability of losing, which is 1 − p.

Example

Let's say you have $100 in your account. You believe that, given your history and today's lineup, you have about a 60% chance of winning vs. any given opponent. FanDuel typically pays out about 1.8x the invested amount to the winner of a 50/50 or head-to-head (you get your money back plus 0.8 times the money you put in). So here is the calculation you would do:

investment percent = (0.6*(1.8) - 1) / 0.8 = 0.1

total investment = $100 * 0.1 = $10

The optimal investment would be $10. And when I say optimal, I don't mean "suggested, to be safe" ... I mean mathematically optimal to maximize your long-term profit. If our assumption of a 60% win percentage was accurate, then investing any more or any less on a day to day basis will guarantee lower returns over a long enough time period. If you recall, these were the same assumptions we used for our simulation before. We can see here that our simulation were actually a little too optimistic!

Conclusion

I don't have the data on this, but if I had to guess, I would say a VAST majority of DFS players, investors, and gamblers suffer from over-investing. You can be the best player in the world, but if you invest too much it doesn't matter. Be realistic about your expected win pct, and use the Kelly Criterion to come up with your own ideal investment percent. Most likely, no DFS player should be investing more than 15% per day.

|

|

Great article. My experience with Kelly Criterion and Bankrolls comes from some stocks, MLB betting and poker. I have a few nuanced things to say: