China's Coming Government and Real Estate BUBBLE Explained!

It has been a while since I posted on Steemit. But, I thought I get it going by doing a little in-depth analysis of China and its growing debt bubble as it continuously grows and pushing China's potential position to hold a world reserve currency. Josh and I have been on the road for the last week and wrapped up a bunch of interviews at the Red Pill Expo in Spokane, Washington. Lots of great interviews to come.

Okay, let's look at what China has been up to under the radar as their debt bubble is ever increasing.

Let's start with looking into China's past and where they came from. China used to be one of the great powers when they began printing paper currency in 1024. Through almost 600 years six empires rose and fell with their currency printing and excessive rise in debt. They always misused the powers to print paper out of thin air, and after their years of terrible experiments, they finally moved away from fiat paper to gold and silver. It became very apparent when the Europeans started trading with the Chinese as they loved gold and especially silver which the Europeans shipped from Mexico and other South American countries to the Chinese for trade through Macau.

China had turned away from paper money for now, but after many centuries goes by, and history is forgotten.

Let's go to China of today. A place where a supposed communist country has opened up and embraced a market economy according to academics. First of all, there is no free market in China, and their leadership is communistic and technocratic. China is slowly moving towards putting themselves in a position to run the world and take over world empire status from the US. And what better way to do it than having a currency called the Yuan, honouring the great Khans empire. It is a fitting name for their currency as I believe that is their goal. They might want to fight the Ottoman Empire that Erdogan so desperately wants to rebuild, but China has sure positioned themselves in a place to become a leading empire if the populace gets sick and tired of their surveillance state and revolt. But that remains to be seen.

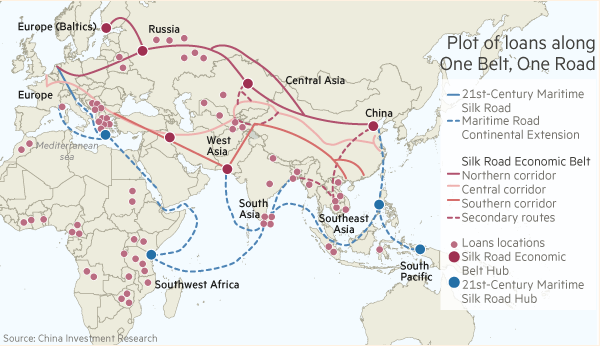

With Chinas ever reaching currency the Yuan positioning itself to lead China into a new era of empire building much like the US. From currency swaps with other countries to trading oil and gold in Yuan to lending money and shipping currency overseas. To the move to create the financial infrastructure needed to be an empire with the AIIB and BRICS and the grand scheme of the One Belt, One Road project.

If you like communism you will love the rise of China, and that is why the global government organization called UN is excited about their rise as they are hoping for a Communist technocratic controlled world.

Let's take a look at the problems I see in China that is developing that could potentially topple the rise of China.

One of the most significant problems in China is their construction to prop up their economy. The debt cannot increase forever as the debt will eventually strangle their economy. Here are some of the numbers from Chinas rise and potential fall as their debt might get out of control in their economy.

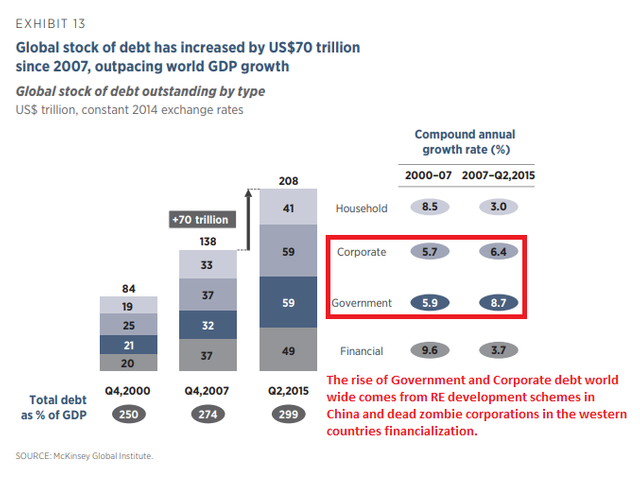

First I wanted to show you what is happening on a global scale and how China has been involved in increasing both Corporate debt and government debt worldwide.

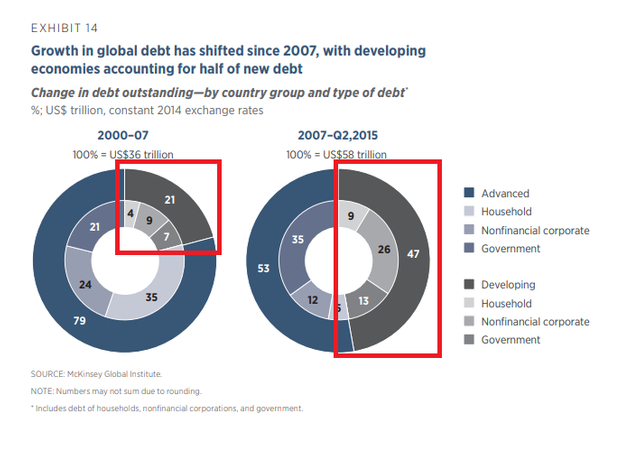

Global debt has increased a lot since 2000, and with numbers from 2014, it is becoming clear that most of the debt came from countries that haven't hit peak debt yet and are getting into the same scams as the western countries see today.

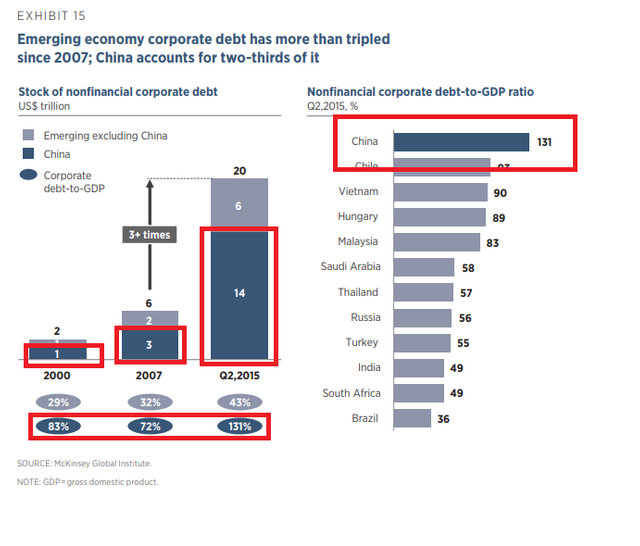

The growth in Chinese corporate debt is starting to become excessive, and as you can see, there is a mass amount of debt being created by the Chinese. In more charts to come, we will go more "indebt" to see what kind of debt is being printed out of thin air and if over time this can cause a lot of problems. Chinas corporate debt is high and has rapidly increased in the last decade.

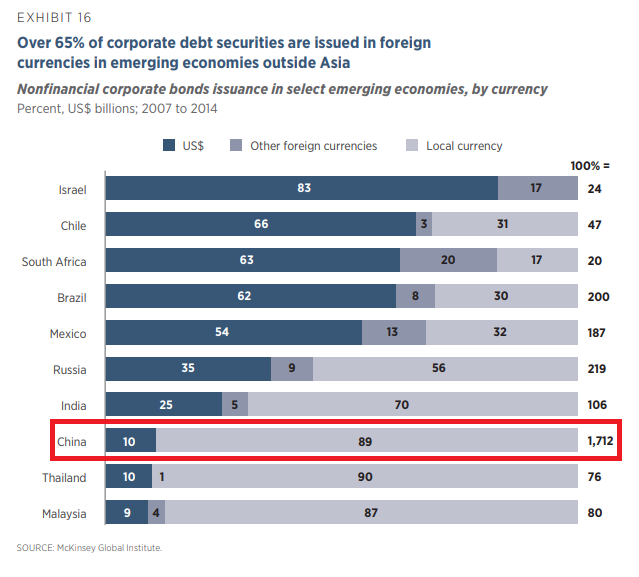

If you take a look below, we can see that China from 2007 to 2014 issued $1.712T in corporate bonds and only 10% was issued in US Dollars. It is a clear sign of the intentions of the Chinese to keep out of the dollar and help them print a lot more money than they would have by using US Dollar denominated debt. This issuance is to create an investment mechanism, so people are more willing to move over to the Yuan denominated investments as they plan to leave the US in the dust.

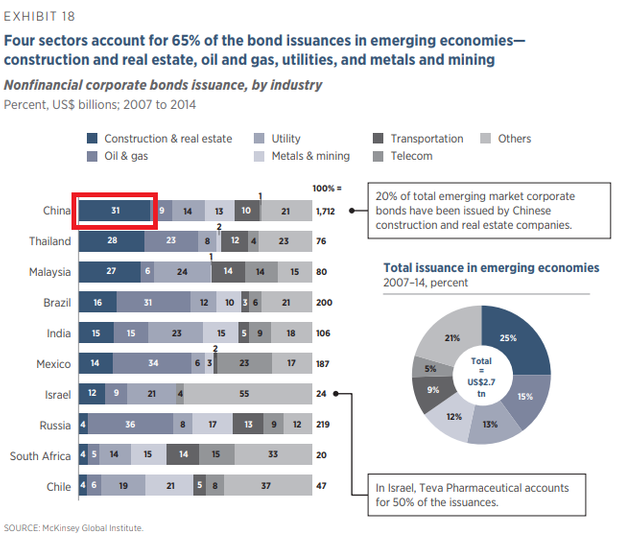

When we look at all the corporate debt issued as much as 31% of the total debt making China very vulnerable to the problem that they have with building massive ghost cities to prop up their GDP growth.

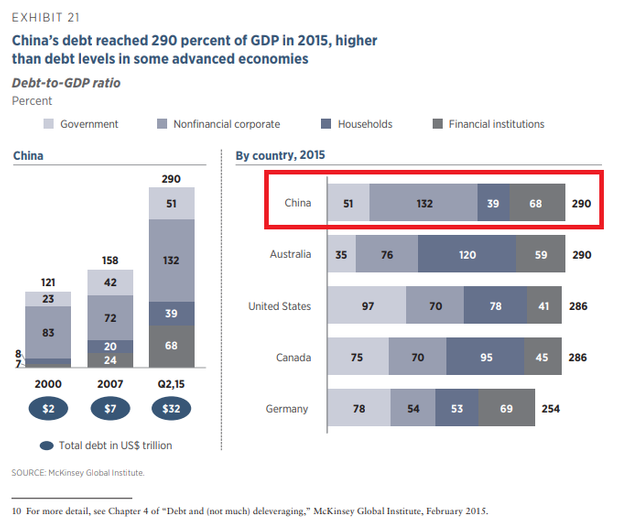

As you can see China's total debt is almost 3x the economy, but this is numbers from 2015. So we are more likely to be above the 300% mark as we speak.

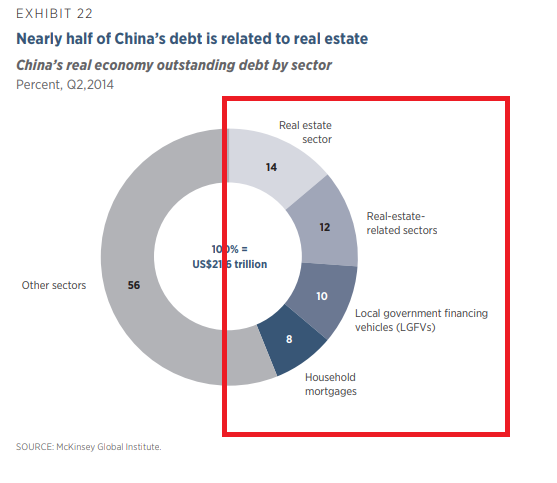

As of 2014 the total issued debt that is related to real estate was 44%.

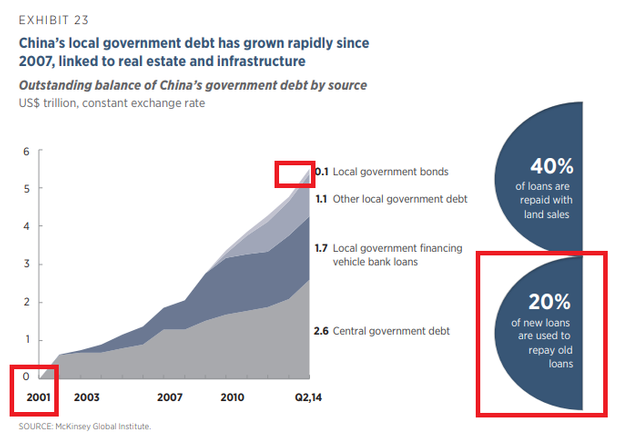

As of 2014, China's government had rapidly increased their debt. \Since 2001 the debt level has risen by 650%+ which is an insane rate of destruction of the Yuan's value. They are also attacking other currencies by cheapening their own trying to outcompete the world. It is also worth making the case that China is using 20% of their debt to pay debt payments.

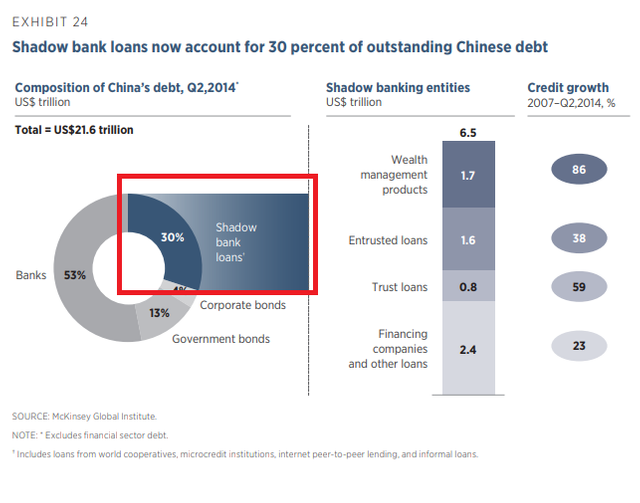

I quickly wanted to get into Shadow Banking in China as it has a significant amount of debt issued and is not "regulated" like a bank, therefore, it is more problematic to see the potential risks in the banks. A shadow banking system is a group of financial intermediaries facilitating the creation of credit across the global financial system but whose members are not subject to regulatory oversight. The shadow banking system also refers to unregulated activities by regulated institutions. Shadow banks in China accounts for as much as 30% of Chinas total debt.

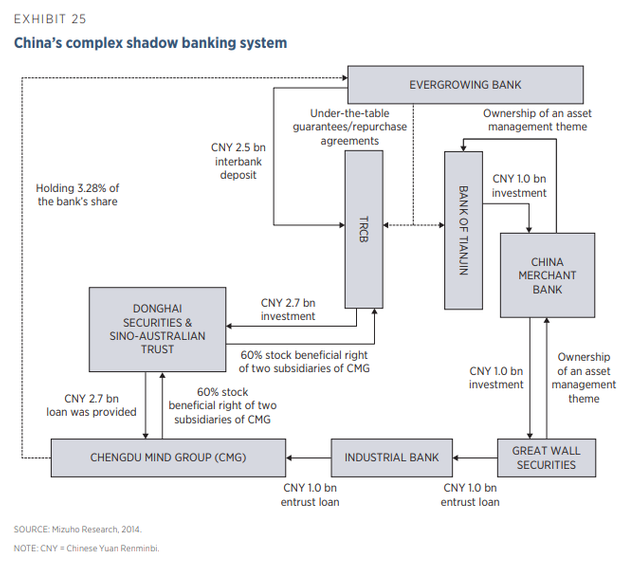

Here is how the Chinese Shadow banking structure works. It might be a little overwhelming, but it is worth exposing.

To sum it up at the end it has become quite apparent that China has created a lot of, especially with their real estate debt. There is a lot of risk in China based on their rapid debt growth, but China is set to become the new world reserve currency, and it's creating a massive debt-ridden infrastructure to make investors and Wall Street happy as they can game the system.

China has also put themselves at a place where they have potentially more gold than the US as the last exit strategy when the fiat hit the fan. It remains to see in the Fiat Currency Yuan will live to "celebrate" the 1000 year anniversary of paper money Fiat.

Peace, Love and Voluntaryism,

John

The world is so interconnected today and if countries like China or the U.S.A. goes bust, the world will follow suit. It doesn't matter whether you are in Canada or Pakistan, you will suffer. That's the reason why the smart ones buy physical gold and silver.

History repeats . But now this time everyone involved has enough firepower to destroy the entire world , so I guesss history doesn’t really repeat . At least not exactly . Let’s just hope cooler heads prevail . Thank you 🙏 ✌️❤️👊🏻

very interesting and informative article. I wouldn't be surprised if China wants to issue state crypto currency like Russia is thinking about it. At the same time I think China understands very clearly how world got depended on it's manufacturing right now, so it's not only about to outcompete in cost of production, but also it's about to get more countries to become more dependent on physical manufacturing of things