Global Asset Return 2018 An Assesment of Most Assets and Their Returns in 2018. The Good, Bad and Ugly.

2018 has come and gone, and with that, I thought it would be a great idea to find out where assets were moving in 2018. Did you make or lose money or currency? 2018 has been quite a bad year with the majority of assets losing.

Global stock markets have started what very likely is a rout that could turn into a crash in 2019. The first tremors began in February this year. Here are the global stock returns from the biggest exchanges worldwide. As of 3rd of January 6 pm CST. You can find the interactive chart here: https://bit.ly/2Ryhm9S

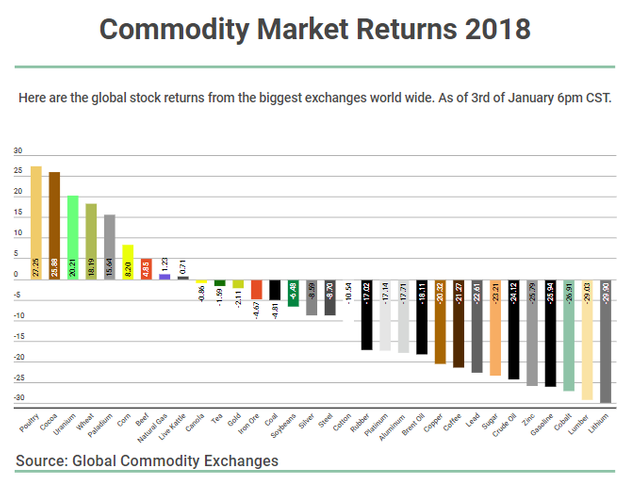

Global markets of all assets have had a deflationary pressure, and few of the major commodities saw a positive return in 2008. Here is the chart of major commodities and their performances in 2018 using January 03rd prices. To see the interactive chart click here: https://bit.ly/2sa9Y6u

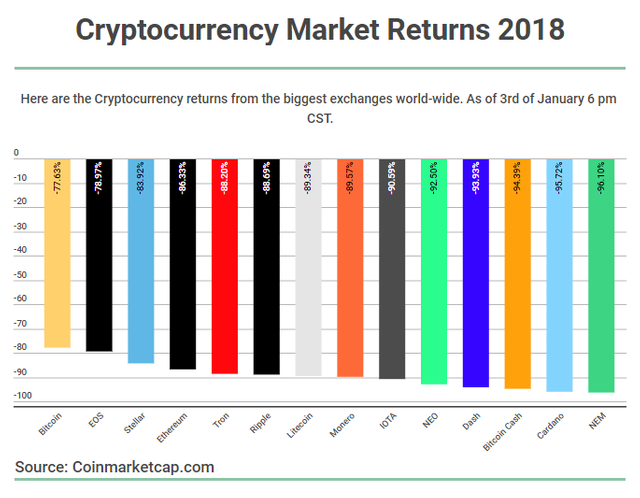

The Cryptocurrency markets have been a bloodbath YOY in returns. But if you are a longterm investor, you HODL and hope that your or hopefully several of your crypto holdings currencies gains market adoption. We don't give advice here at WAM, but here are the facts about 2018's Crypto returns using Jan 7th, 2018 to Jan 3rd, 2019 pricing and then calculating the loss from those dates prices. As you can see some currencies withstood the crash better than others and are some of the potential adopting currencies and Tokens for the future developments of Blockchain and Crypto. Find the interactive chart here: https://bit.ly/2Qkspz6

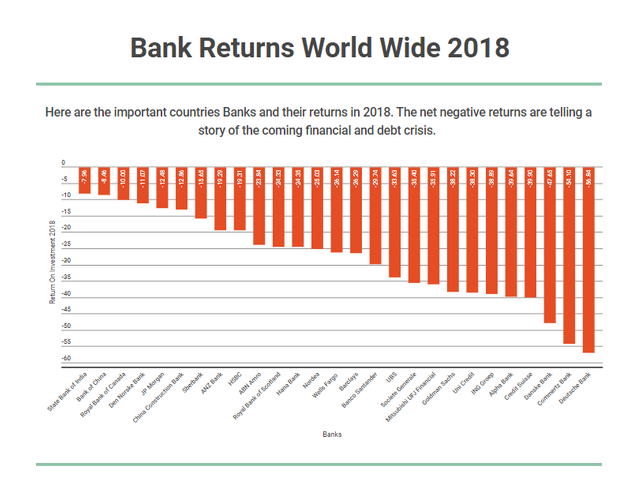

And I thought last we should look at whom the cryptocurrencies fight to destroy their old and outdated control system. The banksters, are banks stocks performing good or are they some of the worst performing stocks in the world. What I found looking at most global exchanges I noticed a huge problem in the bank stocks showing that the systemic risk for a massive system crash is getting more likely by the day. It is up to you to make sense of these numbers, but I thought you should have the facts, and hopefully, they could help you make some right decisions this year.

Peace, Love and Voluntaryism,

John Sneisen