Stock Market Following EXACT Pattern of 1987 and 1929! What Will Be the TRIGGER Event?

Many investors and analysts are starting to believe that the financial system is looking weak and that a market correction is overdue. The Fed has responded by starting they will continue to increase rates this year multiple times. In addition, we see repeated patterns of weakness and volatility and then a rescue by some unknown force. I wonder who that could be?...

LOOK THROUGH MY BOOKS!: http://books.themoneygps.com

SUPPORT MY WORK: https://www.patreon.com/themoneygps

PAYPAL: https://goo.gl/L6VQg9

BITCOIN: 1MbAUXsHa8XRFMHjGurd7L5nRDYJYMQQmq

ETHEREUM: 0xece0Dd6D0b4617A8D94cff634C64155bb1cD8C2C

LITECOIN: LWh6fji4WrJT7FAbFvFSZ9jVNCgVM3dHod

DASH: Xj9RXrvhXbaL3prMDvdzAxM8gDB2vDiZrh

MONERO:47q5qDPkDBLRadwcSXDsri3PNniYRYY1HYAhidXWAg8xXHFFZHFi7i9GwwmZN9J5CJd8exT4WARpg2asCzkuoTmd3dfcXr6

STEEMIT: https://steemit.com/@themoneygps

DTUBE:

T-SHIRTS: http://themoneygps.com/store

PROTECT YOUR CRYPTO WITH THE TREZOR: https://goo.gl/keoFei

Sources Used in This Video:

https://goo.gl/UpprQe

Deficit nears $600 billion in first half of 2018 | TheHill

http://thehill.com/policy/finance/382033-deficit-nears-600-billion-in-first-half-of-2018

dow - Google Search

https://www.google.ca/search?q=dow&source=lnms&tbm=fin&sa=X&ved=0ahUKEwiD8qXDvafaAhXK6oMKHSX_Dj4Q_AUICigB&biw=2560&bih=1366#scso=uid_2V3IWvPPC8awjwSdypHoDQ_5:0,uid_Le_IWv3_NI29jwTNkLToBw_5:0

2018-04-06_12-15-28.jpg (890×469)

Dow plunges more than 500 points as trade war fears rattle Wall Street

https://www.cnbc.com/2018/04/06/us-stock-futures-dow-jobs-data-tech-and-politics-on-the-agenda.html

Market volatility is reminiscent of the 1987 crash: Art Cashin

https://www.cnbc.com/2018/04/05/market-volatility-is-reminiscent-of-the-1987-crash-art-cashin.html

Guggenheim investment chief Scott Minerd sees a recession and a 40% plunge in stocks ahead

https://www.cnbc.com/2018/04/06/guggenheim-investment-chief-scott-minerd-sees-a-recession-and-a-40-percent-plunge-in-stocks-ahead.html

1200x-1.png (1200×675)

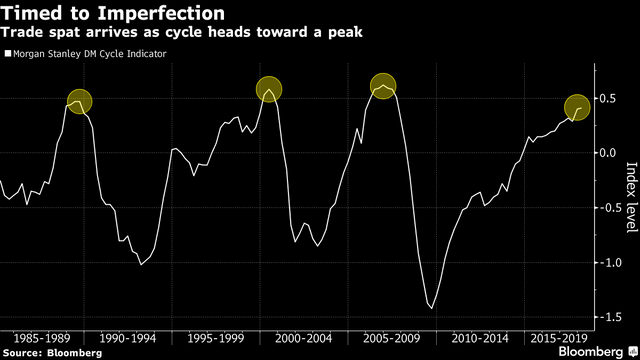

A $60 Billion Manager Mulls Selling All U.S. Assets On Trade War - Bloomberg Quint

https://www.bloombergquint.com/markets/2018/04/06/a-60-billion-manager-mulls-selling-all-u-s-assets-on-trade-war

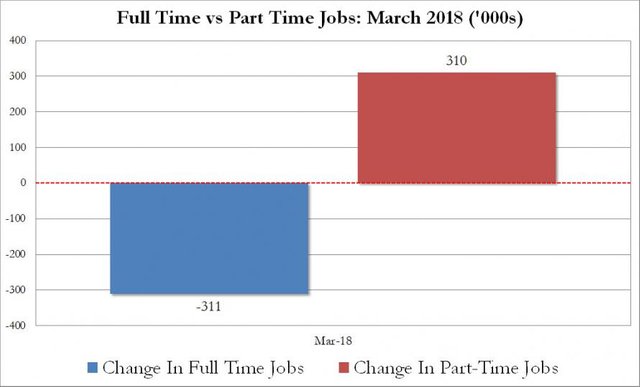

full vs part time 2018 march.jpg (890×538)

Chats by Ex-Deutsche Bank Metals Trader Reveal Spoofing ‘Tricks from the Master’ - Bloomberg

https://www.bloomberg.com/news/articles/2017-06-05/chats-by-metals-trader-reveal-spoofing-tricks-from-the-master?cmpid=socialflow-twitter-business&utm_content=business&utm_campaign=socialflow-organic&utm_source=twitter&utm_medium=social

▶️ DTube

▶️ IPFS

In your opinion, will the Fed persist in increasing interest rates this year if the market continues to see increased volatility?

I believe they will. They took their sweet time when the market was going up and up for years.

I've been moving my investments into silver and silver miners. The silver to gold ratio is at a peak, just the market in general. I see the potential for massive gains for silver from this current low price.

If I am wrong, I don't see how silver could go too far lower than where it is today.

So massive gain potential, little loss potential. I like those odds.

Now to just wait for the catalyst to push over the tower of cards.

That seems like a good plan, I think I will start moving some money into precious metals too. Seems like this is a very risky and volatile time in the market, and a recession may already be in motion. What silver miner stocks do you like best?

I own shares in AG, GPL, and SVM at the moment. A few months back I wrote out a post about silver miners, if you are interested.

https://steemit.com/investing/@getonthetrain/my-top-5-silver-mining-investment-picks-for-2018

The Fed will have to increase rates if wage growth continues to rise as it could drag other metrics higher as well. However, it could ultimately lead to cracks in the debt market which would impact company’s ability to buyback shares and the whole market base could come down as well. See you below...