Oil Demand Signals: 15 Best And Worst Case Scenarios To Watch

Financial institutions, energy firms and energy-focused organizations around the world are currently adjusting forecasts for oil demand in 2020 given the continued, global spread of coronavirus and its potentially devastating economic fallout.

According to Rystad Energy, by April, global demand could plunge more than 11 million bpd, while energy trading house Trafigura predicts a 10 million bpd demand drop in the short term. For 2020, the International Energy Agency (IEA) projected oil demand could plunge by 730,000 bpd, while JP Morgan puts the fall at 750,000 bpd.

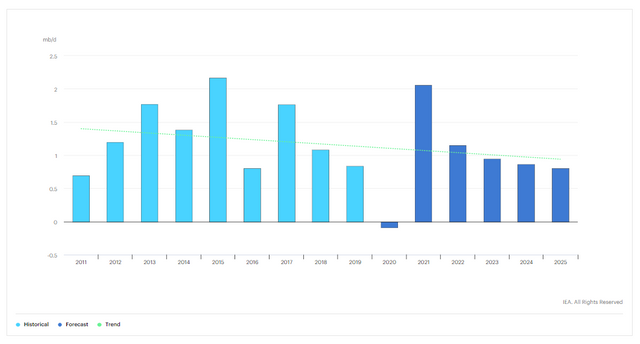

Global Oil Demand Growth, 2011-2025

Chart Provided By IEA

Demand expectations provided by these institutions were already drastically adjusted from earlier numbers and will continue to change as the impact of the coronavirus plays out. At this time of heightened unpredictability, it's useful to keep in mind what’s driving demand forecasts. Understanding the positive and negative signals for oil demand, traders can adjust their own assessments accordingly.

Here are some potential best- and worst-case scenarios for oil demand:

WORST CASE

One or more of the following potential negative signals could play out. Each is independent of the other.

Covid-19 and resulting isolations continue to ravage economies for months and limit transportation globally.

After slowing down, the virus returns just as strongly several months later—much like what happend with the Spanish flu in the fall of 1918.

Saudi Arabia, which committed to producing more oil and exporting more of the commodity from inventory at low prices, did so before identifying customers and becomes unable to find buyers for all of its oil.

China decides to continue decreasing its oil imports—both from Russia and Saudi Arabia—and refuses to fulfill its commitments under the Phase One trade deal to buy U.S. energy products.

People across the globe continue to fear illness, and air travel does not resume in any significant way in 2020.

Countries keep their borders closed.

Severe golbal recession or depression takes hold of world's economy, creating unprecedented dislocation of assets that prohibits a quick recovery.

BEST CASE

One or more of the following potential positive signals could play out. Each is independent of the other.

China emerges from its crisis and takes advantage of cheap oil to fill its existing storage facilities.

Saudi Arabia already has customers lined up for the flood of oil that Aramco (SE:2222) is putting on the market at reduced prices.

China, India and other importers quickly build more storage capacity to buy additional oil at current, cheap prices.

The U.S. fills its Strategic Petroleum Reserve (SPR) with American oil at bargain prices as was indicated last week by President Trump.

The virus dissipates, perhaps because of warmer weather in the northern hemisphere, and does not recur in a significant way in the fall.

Businesses and leisure travelers forgo fear and take advantage of low prices to book travel.

The U.S., China, Europe and other economies with cash or access to capital enact generous stimulus plans to jump-start their economies.

The coming recession is not based on fundamental economic weaknesses in the global economy and the rebound is quick and robust.

BOTTOM LINE

No one can accurately predict the future. Case in point: who predicted in November that a global pandemic would hit?

Instead, consider the positive and negative factors driving oil demand as events unfold. Additionally, consider how supply availability could change. Saudi Arabia and Russia may alter their policies, for example, or U.S. production could drop for a number of reasons.

The reality? We will likely see some elements from both the best-case and worst-case scenarios occur. The near shut-down of large portions of the global economy that has taken in the last few weeks is unprecedented, making it all the more unlikely for a precise prediction to come true.

Instead, consider the positive and negative factors driving oil demand as events unfold. Additionally, consider how supply availability could change. Saudi Arabia and Russia may alter their policies, for example, or U.S. production could drop for a number of reasons.

Join the community in our migration to Hive, a community built blockchain for the community. All Steem account holders will receive equivalent stake on the new Hive blockchain.

Please see this post on SteemPeak for more information.