How I beat NSE – NIFTY in 41 Months

How I beat NSE – NIFTY in 41 Months

Dear readers,

This is an experiment made by me with Indian Rupees 360,000.

360,000 INR = 6624 USD when I started this experiment During the First week of January 2013.

As per the latest INR to USD conversion rate 360,000 INR = 5386.19 USD.

Objective

With 360,000 INR as investment with 36 to 42 Months of duration I need to beat NSE-NIFTY benchmark Indices using a bank term deposit and My 10 mutual funds.

Disclaimer

This blog post describes my own experiment. I am not a qualified financial adviser. Please do your own research and apply your own knowledge before you attempt my methods described here. I am not affiliated with any Mutual fund companies or Banks and I am just a customer to them.

The Method

- On January 2nd 2013, I opened my savings account with State Bank of India ·

- on January 3rd 2013, I made an annuity deposit of INR 360,000 · SBI Annuity deposit would pay me back INR 11,400 during the first working day of every month (starting from February-2013 to March-2016) ·

- The return on investment (ROI) of this annuity deposit is 14% in 36 months (3 years) OR 4.66% per year.

- Instead of this Annuity deposit, if I kept my money in Savings account the ROI would be 4% per year.

- From the INR 11,400 that I received from the SBI annuity deposit, I invested them in 10 mutual funds through SIP route (Systematic Investment Plan) of INR 1000 each.

- Total investment period 41 months, Total Investment was INR 410,000.

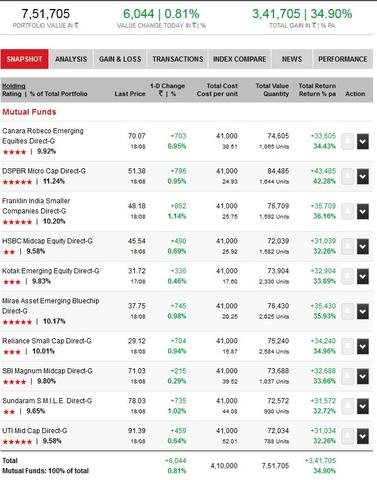

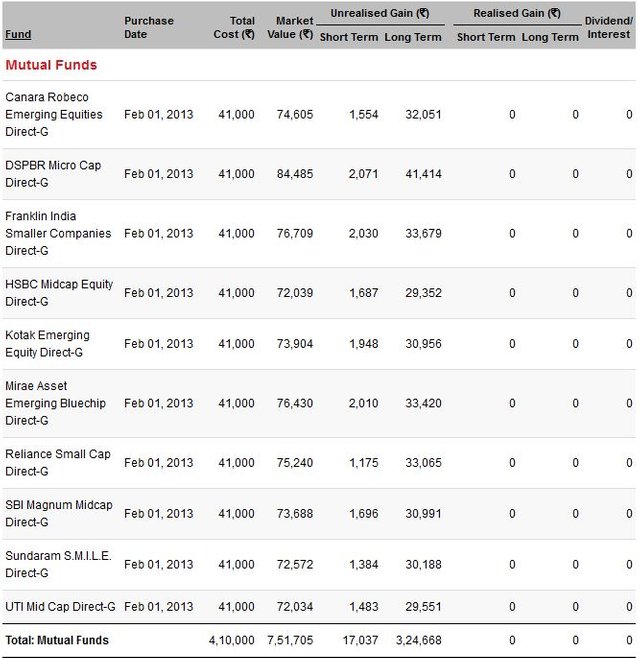

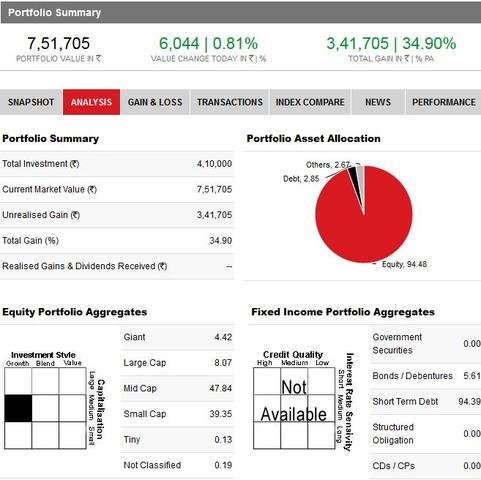

- After 41 months (As of today August 19th 2016) my portfolio value is INR 751,705.

- My profit As of today August 19th 2016 = ((751705-360000)/360000)*100 = 108.81% ·

- The CAGR (Compound Annual Growth Rate) of My investment in this method from February 2013 to August 2016 = ((((751705-360000)/360000)*100)/41)*12= 31.85 % ·

- The CAGR of NSE – NIFTY from February 2013 to August 2016 was 9.96% · Please refer the Data sheet derived from NSE website

- Screenshots from my Portfolio :

- I beat NIFTY CAGR by 21.89 %