Crypto Morning News - May 20th, 2021

The total market value of cryptocurrencies fell to $1.6 trillion, a 24-hour drop of 26.9%

According to CoinGecko data, the total market value of cryptocurrencies has fallen to $1.6 trillion, a 24-hour decline of 26.9%, and the entire network has liquidated $4.64 billion in 24 hours.

learn more

Bitcoin returns to $40,000 again

Bitcoin has returned to $40,000 again, and is now quoted at $40,369.06, an increase of 3.92% in 24H.

ETH's average computing power reached 604.57 TH/s yesterday, continuing to hit a new high

According to OKlink data, the average ETH computing power reached 604.57 TH/s on May 19th , a new record high again.

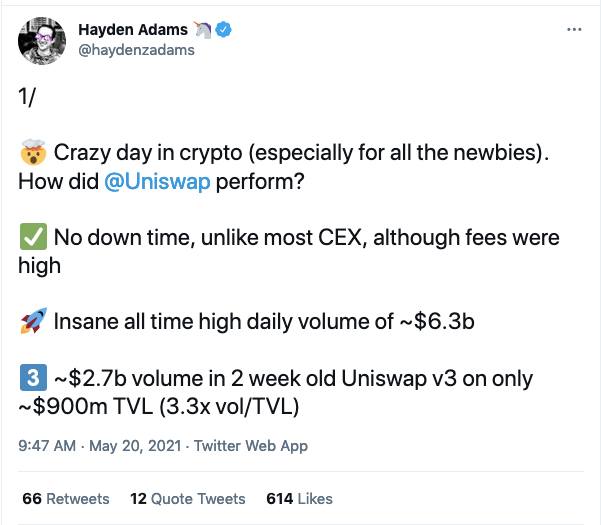

Uniswap founder: Uniswap's single-day transaction volume reached a record high of $6.3 billion. The next step will be to expand capacity and reduce costs

Uniswap founder Hayden Adams tweeted that Uniswap's performance in the volatility of cryptocurrencies did not experience downtime like most centralized exchanges, despite the high gas fees, in addition, Uniswap created the highest ever daily trading volume of $6.3 billion. These data prove that DeFi's needs and value proposition are clear. The next step will be the expansion of L1 and L2 to support more users and reduce costs.

JPMorgan Chase: Institutional investors are leaving the Bitcoin market and investing in gold

JPMorgan Chase analysts believe that institutional investors may replace Bitcoin with gold after the recent collapse in cryptocurrency prices across the market. In the turmoil of the cryptocurrency market, Bitcoin fell to nearly $30,000. Although the cryptocurrency has suffered a sharp drop, the price of gold has risen by more than 6% since the beginning of May. JPMorgan Chase hinted that institutional investors are now dumping bitcoin in favor of gold. Despite the sharp reversal of the Bitcoin price trend, JPMorgan Chase still believes that Bitcoin will rise to $140,000. As previously expected, this is a long-term theoretical goal.

Ethereum Foundation JavaScript team will release EIP-1559/London ready version

The Ethereum Foundation JavaScript team stated that if there are no latest bugs or specification changes, EIP-1559/London ready versions of EthereumJS Block, Tx, VM and Common libraries will be released within the next week.

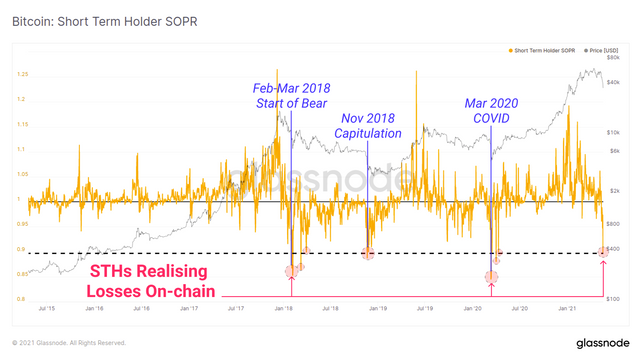

Glassnode: Panic selling by new entrants reaches the fourth highest level since 2015

Data from Glassnode shows that the losses caused by the short-term bitcoin sell-off to short-term holders are of historical significance. The value of the indicator STH-SOPR, which represents the purchase of cryptocurrencies in the current bull market cycle, has fallen to around 0.9. Prior to this, since 2015, the The value has only fallen below this position three times, the beginning of the bear market in February 2018, and the sharp drop in November 2018. The sell-off in March 2020 due to the COVID-19. STH-SOPR considers the degree of profit realized by cryptocurrencies that move on the chain, filters out cryptocurrencies held for less than 155 days, and represents entities that purchase cryptocurrencies in the current bull market cycle.

Co-founder of CoinGecko: Bitcoin price may still reach $100,000

CoinGecko co-founder and COO Bobby Ong said that excessive leverage is the main reason for the disruption of crypto trading platforms such as Coinbase. In addition, he believes that the crypto market has been in a “bubble field” in recent weeks, with prices rising too fast and It was too urgent, and Musk’s tweets about “Tesla no longer accepts Bitcoin” and the news of China’s regulatory policies were the main catalysts for this decline. He also stated that even if there are fluctuations, the price of Bitcoin may still reach $100,000. (From Sputnik)

Argentine crypto exchange Ripio buys more than $10 million in BTC and ETH

Cointelegraph reported that Sebastián Serrano, CEO and co-founder of the Argentine crypto exchange Ripio, stated that the Ripio Group purchased more than $10 million in Bitcoin and Ethereum (more than 150 BTC and more than 2,000 ETH). Ripio has used its own funds to buy and hold cryptocurrencies for many years.

Vertalo completes $5 million in Series A financing, and Coinbase and others participate in the investment

CoinDesk reported that Vertalo, a start-up company dedicated to the issuance and management of digital securities, completed a $5 million A round of financing. Coinbase, Tezos Foundation, Wedbush Capital and others participated in the investment. This round of financing ended on May 13th.

Musk’s average holding cost is only $25,000, and the Bitcoin crash has not yet fallen to Tesla’s holding cost price

According to Tesla's financial report, the fair market value of the company's Bitcoin holdings was $2.48 billion on March 31st, 2021, which means that if the company cashes out the cryptocurrencies, it is expected to make a profit of about $1 billion. On March 31st, the Bitcoin price was reported at $59,000, and $1 billion of the market value of $2.48 billion was profitable, indicating that the average cost of Tesla's Bitcoin holdings was only less than $25,000 per unit.

Wells Fargo recognizes cryptocurrencies as investable assets and is expected to partially open its crypto products in mid-June

According to Decrypt, Wells Fargo has joined the ranks of many other institutions and launched cryptocurrency products. The product may be open to qualified wealthy investors in mid-June. Despite offering new products, an executive at Wells Fargo still believes that cryptocurrencies carry "a lot of risks." The Wells Fargo Investment Institute has become the latest institution to recognize cryptocurrencies as "investable assets." Darrell Cronk, president of the Institute, said: "We believe that the cryptocurrency field has just gone through a developmental evolution and maturity, which makes it now Has become a viable investment asset."

Vice President of the European Central Bank: Crypto assets are not "real investments"

CoinDesk reported that Luis de Guindos, deputy governor of the European Central Bank, believes that because it is difficult to discern the potential value of crypto assets, crypto assets should not be classified as "real investments" and investors should be prepared for more price fluctuations. He said: "When it is difficult for you to find out what the real investment basis is, then what you are doing is not a real investment."

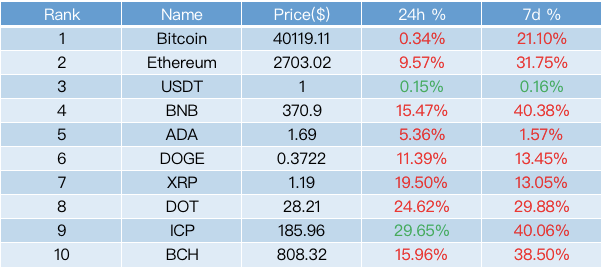

MARKET DATA - TOP 10 [ from CoinMarketCap ]

THANKS ALL