The Monetization Of Desensitization – Mainstream Narrative v Zeitgeist

Without going too deeply into the weeds, I want to begin by pointing out the multitude of issues we are currently facing.

Suffice it to say, there is a lot going on. Unfortunately, much of it should be inconceivable for a community that considers itself as advanced and civilized as we do. I will leave it at that.

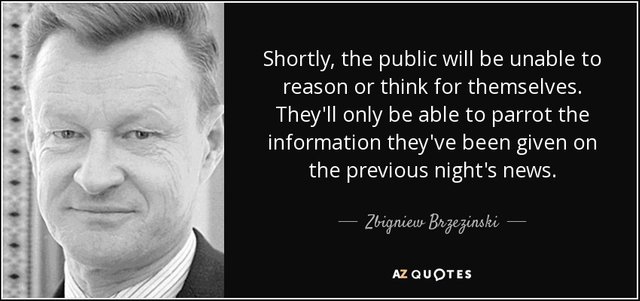

My point being that we have been desensitized to the things that ought to matter the most.

Whether this desensitization comes as a result of intentional origins ("Deep State control") or is inherent within man’s nature (perhaps our overwhelming world is too much for our pre-programmed brains), we’ve allowed ourselves to become desensitized to the largest sources of suffering in our species.

Is it too far fetched to state that it's likely a combination of these two aspects (control and nature), in addition to a myriad of others that are the source(s) behind our desensitized world?

In place of these issues, we plaster over them with this sort of noise.

Pretty ground breaking material, I know.

The reason I believe this desensitization has reached new heights is because of our internal code that drives us to compete for survival. Only the fittest survive, and for better or worse, fitness is defined primarily by material means these days.

The other matter, mental health, ties directly into all of this by the way. And it goes without saying that we have a mental health crisis on our hands. This is manifesting itself in drug addiction, suicide, depression, anxiety, PTSD, shootings, homelessness, and countless others that will only become clearer with time.

We are living in a zeitgeist of uncertainty, fear, and above all else, competition. Even if the majority do not like to acknowledge it, it is evident that they are aware of it, at least subconsciously.

And I will admit to it, myself. 9/11, the 2008 Great Financial Crisis, the resulting conflicts, surveillance states, and a predominantly money-hungry culture have had a very influential impact on the course of my life, just as they so clearly have on the courses of the lives around me.

Focusing in on the matter at hand, finances, the 2008 GFC has had a lasting impact that can still be felt in markets today.

Many are becoming overly complacent in the post-2008 financial world of ours that has priced risk using the cheapest valuations in history. In other words, risk is severely undervalued.

This is a result of many things, but the main culprit lies in the tweaking of interest rates by central banks by means of saturating bond markets with “printed” money.

Of course, interest rates are the price of money. They serve as a baseline pricing mechanism that the global marketplace uses to price other assets with various risk profiles.

Which is a roundabout way to say that the Honey Nut Cheerios you buy are priced in such a way that General Mills takes into account current, and projected, interest rates. Interest rates determine the price of everything. Most importantly, risk.

What many fail to recognize is that financial risk is directly linked to the many other incarnations of risk: social friction, political upheaval, armed conflict et. all. So it literally, and figuratively, pays to pay attention to financial risk.

Taking into consideration the zeitgeist of our times, the collective consciousness of post-2008 men and women of all demographics, the fact that we have been desensitized to some of the largest sources of suffering in our world, and I firmly believe that Bitcoin is being undervalued right now.

Of course, I use Bitcoin in reference to the currency itself, but also as a proxy for the wider digital asset space.

Now, I can hear some of you saying, “Great. Another article on Bitcoin.”

That's right. The price has corrected to a range that is returning to levels of health and sustainability. Of course, the coverage of the space will lead you to believe that now is a dangerous time to be getting in. There are hacks all the time. It is not safe. It’s not backed by anything. It’s rat poison.

All that noise aside, I just want to point out that of all things to be desensitized to in this life, I find it foolhardy to be desensitized to your financial prospects. As I have stated before, personal finances are merely an extension of your well-being, a proxy for the likelihood of your survival.

This is not to say that the pursuit of money is everything in life (remember money reflects your time ), but I do not think I must explain myself in saying that it is not very often I encounter an individual who wishes he, or she, had less money.

So, desensitize yourself to the fear and the misinformation being spread around with regards to the world around you. Whether it be in politics, social issues, religion, war, and yes, crypto assets, like Bitcoin. Instead, sensitize yourself to the issues that truly matter. Peace of mind, friends, and health are a fantastic place to begin.

When you really think about it, the largest structural trends with the most momentum these days are those that help people re-align their sensitivities. Yoga (mindfulness), clean eating and juicing (detoxing), social media ( finding friends), dating services (finding love), and all sorts of shared economy services (sharing with others).

While people may be saying one thing, it pays to pay attention to what they do instead.

And what I see people doing is asking more questions, working to understand more complex structures like that of our monetary system, that of our political system, that of the concept of nation-states, looking to increase incomes via entrepreneurial means, learning new skills on the side, and looking to hedge and to adapt to a changing world all while finding a tribe or community to share their experiences with.

All of what I see plays bullishly into an alternative asset that draws its capital from a base of individuals who, more so than anything else, are looking to adapt and evolve.

Much like investing in the commodities space, anytime you can invest in a commodity at, or below, the price of production then you are placing yourself into an opportunistic position to capitalize on rising prices. Of course, the major risk in this assumption is that said commodity demand with outpace supply (and as always, timing), which is clearly going to be the case with Bitcoin as evidenced by people’s actions, not their words.

Do us both a favor, would you? If you have yet to do so, create a plan for starting a position in Bitcoin in this price range ( approaching the cost of mining ,or cheaper) and share this article.

For anyone reading this who thinks, "Can this argument not also be applied to gold and other precious metals?" You are right, it can be.

I am not saying go all-in on crypto, but instead, view them as call options on a narrative that is, again, increasingly skeptical of anything and everything that was established within the last 50+ years. Or, to keep with convention of the commodities space, treat Bitcoin as you would a speculative miner who has substantial leverage to the price of the underlying narrative.

DISCLAIMER : This content is for informational, educational and research purposes only. This post is not to be taken as personalized investment advice.

@maven360 you were flagged by a worthless gang of trolls, so, I gave you an upvote to counteract it! Enjoy!!

Appreciate it @flagfixer!