The Ultimate Guide to Trading on Nash.io

Contents

- How to open a Nash.io account

- How to fund your Nash.io account

- Nash.io interface guide

- What is a market order

- When should you use a market order

- What is a limit order

- When should you use a limit order

How to open a Nash.io account

Before opening a Nash.io account, you need a regular email account. If you have one, you can go to https://nash.io/ and click on Sign up in the top right corner of your screen. Then follow these steps:

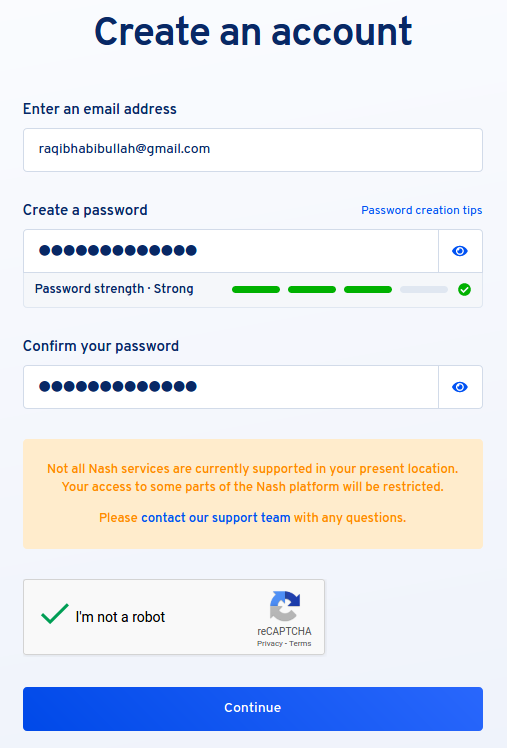

Step 1. Enter the email address that you would like to use, and choose a safe password. When you are ready, click on Continue. You will receive a verification email shortly.

.png)

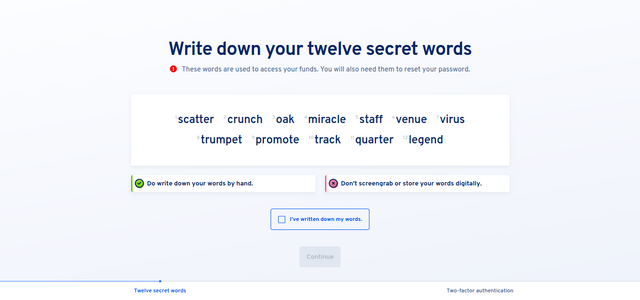

Step 2. Please write down your 12-secret words or take a screenshot. It's useful if you want to reset your password at any time. Click on Continue to the next stage.

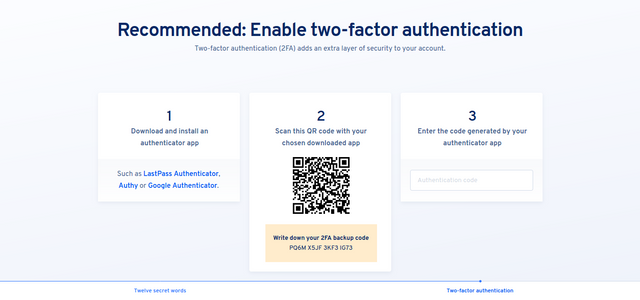

Step 3. Enable two-factor authentication to make your account safer. And that’s it, you’re ready to trade!

.png)

How to fund your Nash.io account

In order to begin trading cryptocurrencies on Nash.io , you will need to deposit funds into your Nash.io account.

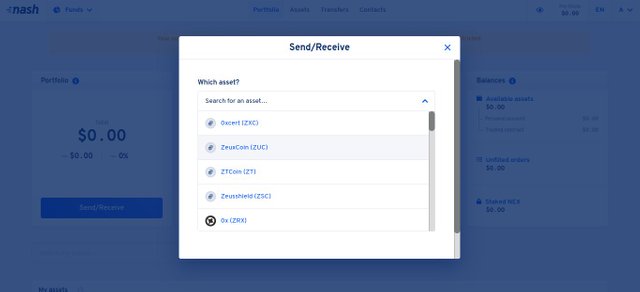

Once you are on the portofolio page, click on Send/Receive. Once on the Send/Receive page, you will be able to select which coin you wish to deposit.

The coin selection is on the top side of the screen, and the deposit details will be displayed on the bottom side.

After you select which coin you wish to deposit, your deposit address will be displayed on the screen

.png)

Now that you have your deposit details, you can send the transaction and you should be able to see the balance added to your Nash.io wallet shortly.

Nash.io interface guide

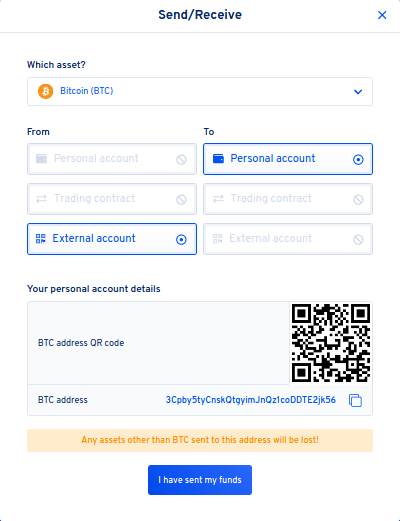

- This is where you can get access to the main menu and monitor the current balance. If you wish to deposit or withdraw, you can also do that from here. Also, you can check various other trading pair data.

- This is your chart. In this area, you can see a real-time visual representation of the current order book depth by clicking on Depth.

- This is where you can see live order book data. The sell order book data is on the top side of the screen, and the buy order book data on the bottom side.

- This is where you can see a live feed of the trade history of Nash.io.

- This is where you can monitor your trading activity.

- This is where you can enter your orders, and switch between different order types.

What is a market order?

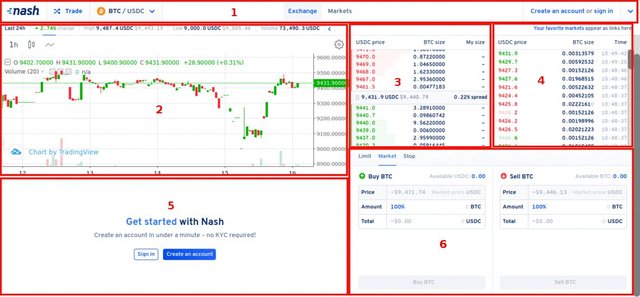

A market order is an order to quickly buy or sell at the best available current price. It needs liquidity to be filled, meaning that it is executed based on the limit orders that were previously placed on the order book.

Unlike limit orders, where orders are placed on the order book, market orders are executed instantly at the current market price, meaning that you pay the fees as a market taker.

%20Nash.png)

When should you use a market order?

Market orders are handy in situations where getting your order filled is more important than getting a certain price. This means that you should only use market orders if you are willing to pay higher prices and fees caused by the slippage. In other words, market orders should only be used if you are in a rush.

Sometimes you might be in a situation where you had a stop-limit order that was passed over, and you need to buy/sell as soon as possible. So if you need to get into a trade right away or get yourself out of trouble, that’s when market orders come in handy.

However, if you’re just coming into crypto for the first time and you are using Bitcoin to buy some altcoins, avoid using market orders because you will be paying way more than you should. In this case, you should use limit orders.

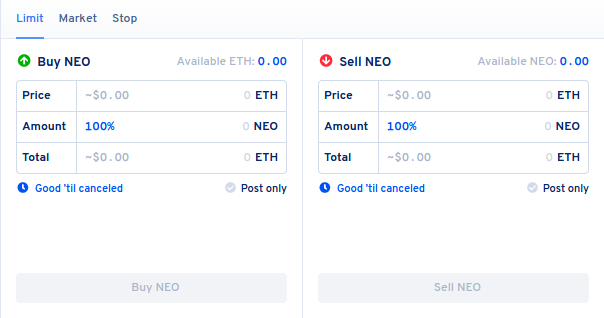

What is a limit order?

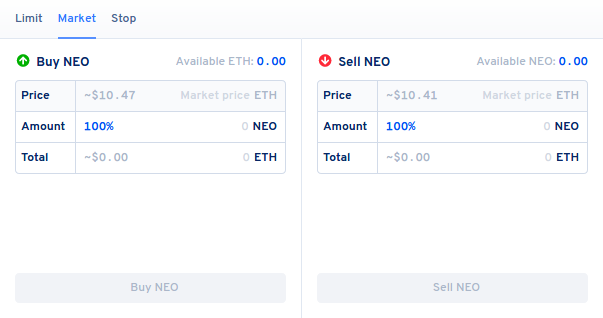

A limit order is an order that you place on the order book with a specific limit price. The limit price is determined by you. So when you place a limit order, the trade will only be executed if the market price reaches your limit price (or better). Therefore, you may use limit orders to buy at a lower price or to sell at a higher price than the current market price.

Unlike market orders, where trades are executed instantly at the current market price, limit orders are placed on the order book and are not executed immediately, meaning that you save on fees as a limit maker.

%20Nash(2).png)

When should you use a limit order?

You should use limit orders when you are not in a rush to buy or sell. Unlike market orders, the limit orders are not executed instantly, so you need to wait until your ask/bid price is reached. Limit orders allow you to get better selling and buying prices and they are usually placed on major support and resistance levels. You may also split your buy/sell order into many smaller limit orders, so you get a cost average effect.