Buying a House on the blockchain with SBD!!! The craziest Steem investment I've made to date is NatEstate.

Well put down your drinks because this story should have a couple spit takes. I'm the second investor to help @picokernel buy a house. He's an 18 year old steemit employee living down in VA and he's going to buy a house. I heard about this plan on Discord's Steemspeak channel.

Here's the rough plan. @picokernel is going to crowd source some cash to buy to house. He's going to own a home where he can commute to Steemit. He'll buy some shares himself as part of the down payment, but he'll buy the tokens back over time!

He called the bank this morning and shared the call with the banker on the other end of the line. Fuckin' hilarious. Some highlights.

Bankster: So, where do you work?

@picokernel: Steemit

Bankster: Do you have a W2?

@picokernel: Not right now. I'm still in school, I have a bunch of bitcoin. Have you heard of Bitcoin?

Bankster: yes, I've heard of it... It's been on the news. Where do you go to school?

@picokernel: I'm still in high school.

Bankster- shit hits pants... Pause...

@picokernel: I'm raising the money, we'll be able to pay. Do you think we can make this work?

Bankster: pause... Yes I think so!!!

There is a full recording. I'll post the link in this post- https://drive.google.com/open?id=0B57iVnbv2heONHh3c19SSHdyQ0k

So, I like @picokernel. I wanted to be part of this. @fyrstikken beat me to being the first investor. But I'm the second. If you'd like to get in on this part of history contact @picokernel and chill out with us in Discord.

Here's @fyrstikken 's post- https://steemit.com/steemit-house/@fyrstikken/i-bought-the-first-shares-in-the-natestate-nest-the-first-house-on-the-blockchain-a-home-for-picokernel-in-va-co-owned-by-all-of

Here's Nate's explanation:

"So basically, I am buying a house with my own funds and some of these pre ico funds

and when I buy put a down payment on the house and officially own it, I will release the ICO and give everyone who already paid there tokens

so with these tokens, you own a share of the house

and when I sell the house, you will be entitled to a portion of whatever I sell it for

so if I buy the house at $175,000

I will issue 175,000 nest tokens

and if I sell the house at $180,000, I will buy back all the tokens for that new price

and also being a shareholder has perks because you can vote on certain things

like if we want to install a pool because we think that'll improve the value"

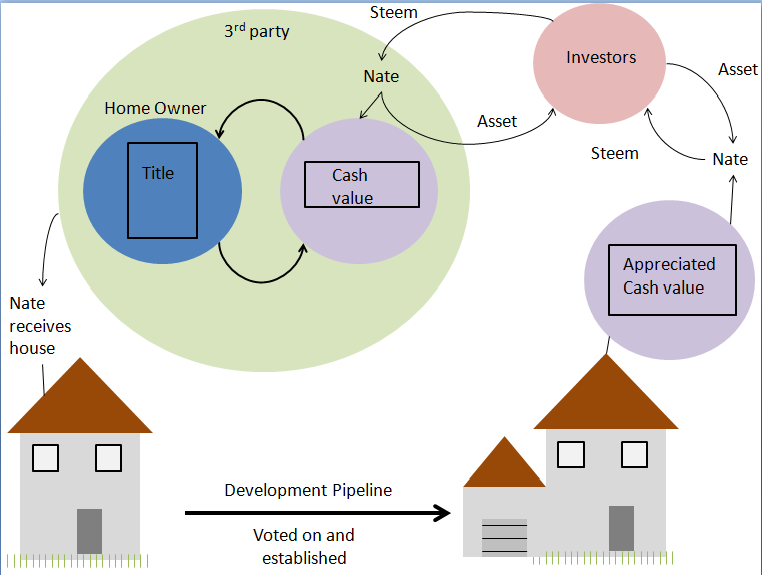

Here's a diagram that may help clarify the plan.

You can find more on that here: https://steemit.com/steemit-house/@mckenziegary/if-you-re-wondering-how-natestate-nest-may-work-here-s-how It was written by @mckenziegary.

I'm planning a witness run. Please consider supporting me.

Congratulations Nate! it was awesome being in the discord hearing you recording the entire process it was so exciting all the way up to @frystikken purchasing the first shares!

It's hilarious right! "I'm in high school!" Nate, 2017!

this is amazing! love it!

This is a war story!

Crytpo vs The Banks

The battle of @picokernel

From the front lines!

Crypto for the win!!!! :)

Yeah, if an 18 yo can pull this off then we all can!

Nice house! :D Maybe someday I'll buy a house with SBD

Keep it up... Who knows whats out there for us...

true that!

A look from behind the scenes. Nice!

A teenagers dream, stable and independent.

This is quite interesting and I'd consider getting in, but there are some questions.

I'm assume Nate will be paying the annual taxes on the property? How about maintenance over the years, replacing a roof let's say.

Will those costs devalue someone's coins or are they separate from them. I noticed he will crowdshare decisions on upgrades, but those are luxuries as opposed to maintenance which is necessary.

Etc. etc., inquiring minds want to know....though this stuff may be in the recording, gonna listen to it now.

Great questions! More details to be worked out for sure.

Cool, look forward to it. I've been investing and studying up on real estate for several years so am more than happy to pitch in on any items/questions that need to be ironed out as well.

@picokernel @fyrstikken

these were my exact first thoughts too! lol

Not sure if it was in any of the posts but @picokernel answered those questions. He would be paying the taxes and any maintenance out of pocket.

yeah, but that wouldn't make for a very good business model...

while he eats the $15,000+ in taxes, repairs, maintenance, closing fees, broker fees... not to say this model can't work with a bit of modification. ie. find a house with ROI potential minimum 10%+ that you can rent out, pay excess as dividends after a predesignated expense buffer is accumulated, upon sale, distribute proceeds via a buyback. Perhaps we can call this "new structure" a crypto REIT. lol

Well yes, that is loosely what it looks like.

I'm sure there will be expansion of the idea. From what it looks like - as it sits now basically the tokens are a the equivalent to a loan that pays for the remaining balance on the home, they have no interest but can make appreciation.

Very basic. I'm sure it will be evolved if they push this project forward.

also recently commented this on another post, but especially in the United States, here are a few other potential "issues" to be aware of...

the real key to "legality" (in the United States, at least) is to determine if ICOs pass the "Howey Test"...

Link: What Is the Howey Test?

You may also find these helpful as well:

Link: Appcoin Law: ICOs the Right Way

and for a really in-depth PDF overview...

Link: A Securities Law Framework for Blockchain Tokens (27 page PDF)

You can't do it in the US as stated, The ICO is irrelevant to what the scheme constitutes, which is a real estate invest fund.

As such real estate investment law applies and the investment scheme needs to be wrapped in a proper legal infrastructure of partnerships. Additionally it is almost guaranteed that you must supply needed disclosure documents, KYC, and a qualified investor questionnaire. You should contact a qualified attorney to determine how this structure needs to be setup, otherwise your going to have problems, and not just with the government. A US citizen can take you to court and sue you personally if you don't take the proper steps to insulate yourself in the means that the law provides. There are certain people who will sue if they know they can win a suit, they can claim you swindled them. They will show the court all the steps you should have taken and didn't. Just things to think about...

Well I'm speechless.... for about 16 different reasons.

Most jerks will claim "oh yeah, that's been done many times before"....

Really? NO IT HASN'T. :)

A first. Very creative to even think of something like this.... wow. Just so very cool... Imagine that...

haha,

@picokernel: I'm raising the money, we'll be able to pay. Do you think we can make this work?

Banksters thinks: "Bitcoin has to be safer than all those derivatives we own"

Bankster: Yes I think so!!!

Someone promoted your post. Promotions help every steemians.

Your reward is an upvote and 0.426 SBD extra promotion.

Good job, see you next time in

Promoted! ;)Very cool. It looks like steemit will be helping me build my own house, but buying one is way cool too!