Project Metavault Announcement

Metavault.Trade is a new kind of Decentralised Exchange, designed to provide a large range of trading features and very deep liquidity on many large-cap crypto assets.

Traders can use it in two ways:

- Spot trading with swaps and limit orders.

- Perpetual Futures trading with up to 30x leverage on short and long positions.

Metavault.Trade aims to become the go-to solution for traders who want to stay in control of their funds at all times without sharing their personal data. Its innovative design gives it many advantages over other existing DEXes:

- Very low transaction fees.

- No price impact, even for large order sizes.

- Protection against liquidation events: the sudden changes in price that can often occur in one exchange (“scam wicks”) are smoothed out by the pricing mechanism design relying on Chainlink price feeds. All-in-one platform: Spot and Leverage trading.

Trading

Metavault.Trade is a cutting-edge Decentralised Exchange platform that doesn’t require registration. To start trading on Metavault. Trade all you need is a Web3 wallet

Open a Position

To open a position, click on the “Trade” button in the header.

You will be taken to the trading panel. Click on Zone 1 to choose the currency you want to trade.

Overview

MVLP consists of an index of the assets used on the platform for swaps and leverage trading. Users can mint MVLP by adding any index asset to the liquidity pool (LP) while MVLP is burned each time a user removes any index asset from the LP.

MVLP holders earn rewards in the form of MATIC and esMVX tokens.

The MVLP token is designed to supply the liquidity required for leverage trading. As such, MVLP holders are the liquidity suppliers and they make a profit when leverage traders make losing trades. On the contrary, they make a loss when leverage traders make profitable trades. Past PnL data and other stats can be viewed on https://stats.metavault.trade/.

Minting and Redeeming

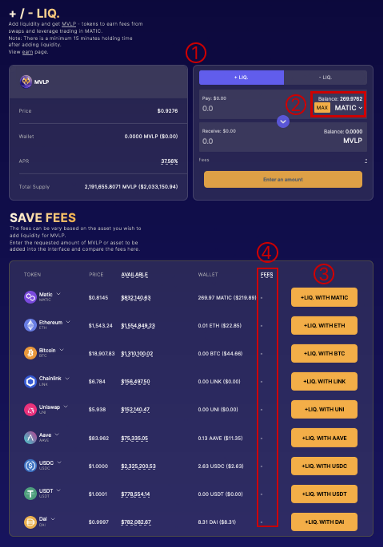

MVLP can be minted and redeemed by going on the “Buy” page from the header and clicking on the “+ LIQ.”, “- LIQ” buttons in the MVLP box.

In box 1 you can choose to mint (“+ LIQ” button) or redeem (“- LIQ”) MVLP. You can choose any index asset to spend or redeem using either button 2 or any of the buttons in zone 3.

After having chosen an asset, enter an amount in order to see the fees required in zone 4.

The price for minting and redemption is calculated based on the total worth of assets in the index including profits and losses of open positions / MVLP supply.

Being able to provide/redeem the assets the most/less sought after by the protocol will allow you to lower your fees.

Please note that minted MVLP immediately starts accruing rewards and that there is a holding time of 15 minutes after minting before you can redeem MVLP tokens.

Tokenomics

MVX is the Metavault. Trade’s governance and utility token.

Token Information

MVX token address: 0x2760E46d9BB43dafCbEcaad1F64b93207f9f0eD7

After staking MVX, you will receive staked MVX:

MVX staked token address: 0xaCEC858f6397Dd227dD4ed5bE91A5BB180b8c430

Staking

Staked MVX generates three reward types:

- MATIC

- MVC

- Multiplier Points

30% of swap and leverage trading fees are converted to $MATIC and distributed to the accounts staking MVX.

Treasury Assets

The MVX-USDC LP liquidity is provided and owned by the Protocol (MVX Treasury). 100% of the fees from this trading pair are converted into USDC and deposited into the MVLP as Protocol-owned liquidity of the MVX Treasury every Friday.

Supply

The maximum supply of MVX is 10,000,000. Minting beyond this maximum supply is controlled by a 28-day timelock, an eventuality that will only be considered if the demands of the protocol necessitate an increase in the supply.

Circulating supply changes are dictated by the number of tokens that are distributed through other DEXs, vested, burnt, and spent on marketing.

MVX allocations are:

- 1.2 million for marketing, partnerships, and community development

- 6 million reserved for rewards (as esMVX which can be converted over time to MVX)

- 1 million for liquidity on Uniswap (reserve held in the MVX-Multisig)

- 300,000 for the MetavaultDAO team (linearly vested over two years with a three-month cliff)

- 1.5 million allocated to presale

- Presale

MVX token price at launch: 1 USDC

- GMX community sale = 200,000 MVX at 20% discount (0.8 USDC/MVX), 200 slots

- Whitelisted public presale = 1,000,000 MVX at 10% discount (0.9 USDC/MVX), 500 slots

- Metavault DAO community sale = 300,000 MVX at 20% discount (0.8 DAI/MVX), 300 slots

- Total $ to be raised in presale: 1,060,000 USDC + Metavault DAO Treasury allocation from MVD -> MVX sale

- -> 500,000 USDC paired with 500,000 MVX initial liquidity V3 Pool

- -> 60,000 USDC as marketing budget

- -> 500,000 USDC as initial MVLP liquidity (owned by the MVX Treasury)

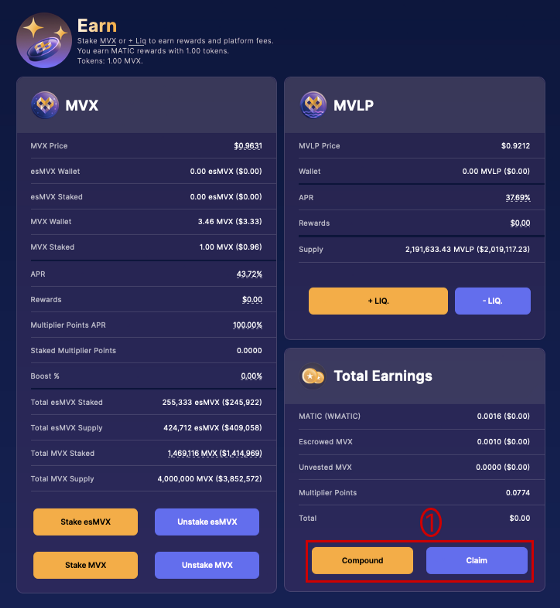

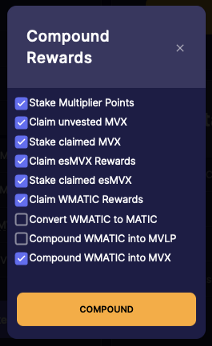

Compound or Claim rewards

Users can claim rewards anytime by going to the “Earn” page and clicking on the “Claim” button in zone 1, the “Total Earning” box.

Claiming will transfer any pending esMVX and MATIC rewards to your wallet.

The platform also has a one-click way of compounding all rewards. This will be very helpful to users who want to maximize their earnings.

Clicking on the “Compound” button will send a batch transaction with only one confirmation needed. You will see a recap of all the transactions that will happen before confirming the transaction in your wallet:

- Claiming and then staking unvested MVX and/or MVC.

- Staking MPs.

- Claiming WMATIC rewards and converting them to MATIC.

- Claiming WMATIC and compounding them into MVLP or MVX

Please note that compounded or manually staked esMVX can be unstacked for vesting at any time.

Quick links and info

The earn page also has an “MVX” and an “MVLP” box. Each of these boxes shows the following information:

- Token price.

- User assets.

- Rewards info (APR…).

- Total and staked supply.

Each box also shows direct links to all actions available to the users regarding the tokens.

MVX box:

- Buy, stake, unstacked MVX.

- Stake, unstack, vest (available soon) MVC

- Transfer account to another wallet (see dedicated section)

MVLP box:

- Add, and withdraw liquidity.

Vesting

It is possible to convert esMVX to MVX through the vesting process, which involves reserving the average of MVX and MVLP that was used to earn the MVC.

While vested, a small amount of esMVX gets converted into MVX every second.

This MVX is claimable immediately.

If the account misses the MVX or MVLP required to vest, the user has to purchase these tokens again.

Tokens may get deposited into a user’s vault at any point during vesting.

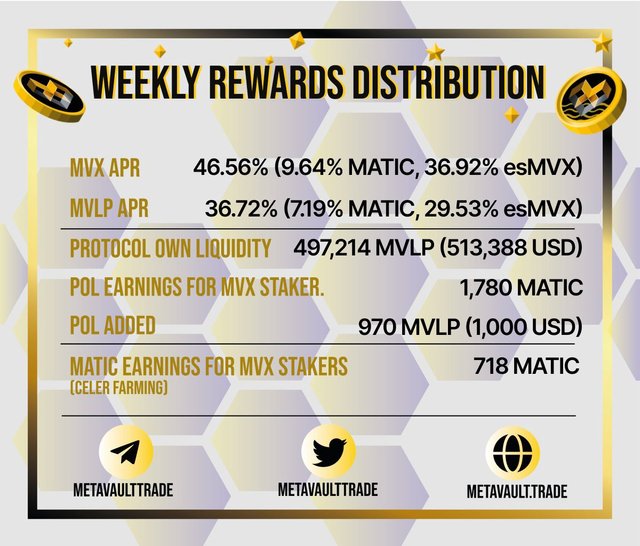

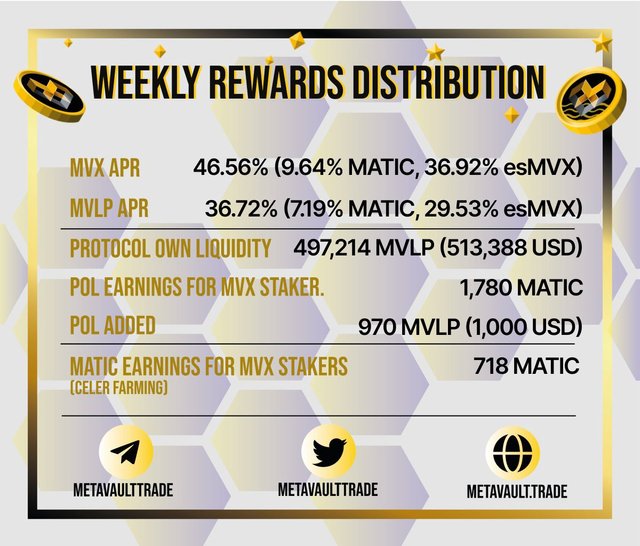

Distribution Rate

Distribution rates change on a monthly basis.

June 2022: 50,000 esMVX for MVLP provider & 50,000 esMVX for MVX Staker

July 2022: 60,000 esMVX for MVLP provider & 60,000 esMVX for MVX Staker

August 2022: 50,000 esMVX for MVLP provider & 50,000 esVMX for MVX Staker

September 2022: 50,000 esMVX for MVLP provider & 50,000 esVMX for MVX Staker

Detailed Rewards Mechanics

MVX holders are strongly incentivized to stake their tokens on the platform because this gives them three different types of rewards. They get:

- A share of the platform fees — is paid in MATIC.

- A new token: esMVX, generates its own rewards.

- Multiplier Points (MPs) are yet another way to boost your MATIC earnings even more.

Let’s examine each one of these rewards and how they add up in detail.

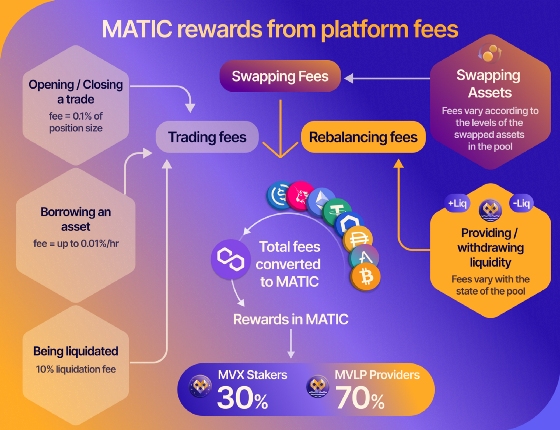

MATIC rewards from platform fees

This is the simplest form of reward and the easiest to understand: MVX stakers will get 30% of the fees collected from across the platform in the form of MATIC.

In the case of blockchains other than the Polygon network, the rewards are paid in the native token of the blockchain, e.g. NEAR in the case of Near Protocol.

Metavault.Trade generates revenues by charging traders small fees when they use the platform for the following:

- Swaps — fees vary according to the levels of the swapped assets in the pool.

- Opening and closing trades — fee of 0.1% of the position size.

- Borrowing to leverage trade or short an asset — fee of 0.01% * (assets borrowed) / (total assets in pool), deducted at the start of every hour.

The other situations earning fees for the platform are when:

- Traders with leveraged positions are being liquidated — a fee of 10% of the position.

- The liquidity providers mint or redeem MVLP — this is called the “rebalancing fee”, it depends on the state of the pool.

The chart below summarizes the platform fees and how they flow back to MVX and MVLP stokers after being converted to MATIC.

Social media

Website : https://metvault.trade

Telegramm : https://t.me/MetavaultTrade

Twitter : https://twitter.com/MetavaultDAO

Medium : https://metvault.medium.com

author :

lecattrongly1

You've got a free upvote from witness fuli.

Peace & Love!