Today's Cryptocurrency news

The recent Bitcoin uptrend has certainly introduced a lot of new people to cryptocurrency. Over in Japan, it is no secret that Bitcoin and some altcoins are extremely popular. In fact, one corporation has shown it is willing to pay its employees’ salaries in Bitcoin. GMO Internet Group’s new payroll system will be available to all of its 4,700+ employees. Whether or not anyone will sign up for this service remains to be seen, though.

GMO INTERNET GROUP LAUNCHES BITCOIN PAYROLL

Even though Bitcoin has suddenly appeared on many people’s radars, there are still issues when it comes to obtaining cryptocurrency. Using an exchange or broker can be a tedious process, mainly because there are very few platforms supporting instant purchases. Bank transfers are expensive and can take several business days, which is far from an ideal situation. Using a Bitcoin ATM is another option, but the commission of 5% or more is too steep for most consumers right now.Earning Bitcoin is another option worth exploring. Employees can use third-party services like Bitwage to convert (part of) their salaries to Bitcoin without their employers being any wiser. It is a great solution, but it’s still somewhat clunky for most people. The involvement of third parties is always a risk, even though most of these services are perfectly legitimate. GMO Internet Group, one of the Japanese giants embracing Bitcoin, has come up with a better solution for its employees.More specifically, employees of GMO Internet Co. will soon be able to receive part of their salaries in Bitcoin. The new in-house Bitcoin payroll system will launch in February of next year and will subsequently be rolled out to all other branches of the parent company. That is a pretty big and surprising development, even though Japan has shown a very keen interest in Bitcoin for several months now.Facilitating salary payments in Bitcoin is not an easy feat. The world’s leading cryptocurrency is notorious for its wild price fluctuations which have only become more violent over time. These days, a US$500 or even US$1,000 price swing is not unheard of. GMO Internet Group will have to use some sort of exchange rate – probably the one maintained by GMO Coins – with the conversion taking place on the day when the salary is paid. This option has an upper limit of 100,000 yen right now, although that may change over time.It is rather significant to see such a major conglomerate open the door to Bitcoin adoption. In most cases, companies want nothing to do with cryptocurrency, mainly because such payroll features introduce a lot of hassle. If GMO Internet Group’s effort proves successful, however, we may see similar options pop up all over the world. Getting paid in fiat currency will always be preferred, even though such currencies lose purchasing power every year without any chance of recovering the lost value. Bitcoin is a risk as well, but it also has a fair amount of upside potential.For the time being, it remains to be seen if there is any interest in such a feature. Japan has become a hub for all cryptocurrency activity, and Bitcoin can genuinely thrive in this part of the world. If employees can have part of their salaries paid in Bitcoin, things will only improve from here on out. Japan also has a vibrant merchant ecosystem where Bitcoin payments are readily accepted, both online and offline.

Saudi, UAE Central Banks Team Up to Test Cryptocurrency

The central banks of the United Arab Emirates and Saudi Arabia are reportedly launching a pilot initiative that will see the two institutions test a new cryptocurrency for cross-border payments.Regional news sources such as The National and Gulf Digital News report that Mubarak Rashid al-Mansouri, the UAE central bank’s governor, unveiled the initiative at a meeting of the Arab Monetary Fund (AMF). Though a press release tied to the Dec. 13-14 meeting does not directly relate to cryptocurrency, it does reference that financial technology topics more generally will be up for discussion among the group of central bankers and financial regulators.According to GDN, al-Mansouri praised the effort as a first for the region.“This is the first times[sic] the monetary authorities of two countries cooperation to use blockchain technology,” he said.As quoted by The National, al-Mansouri described the project as a “digitisation of what we do already between central banks and banks.”The involvement of Saudi Arabia’s central bank is notable, given that the institution to date has not commented on the tech or indicated that it was looking into potential use cases.By contrast, the UAE is home to a number of private and public sector-driven initiatives, including Dubai’s Global Blockchain Council. A number of financial institutions have explored uses of the tech in recent months, include Emirates NBD, which is developing a blockchain-based service for validating bank cheques.

Bitcoin Cash Price Eyes the $2,000 Target as Bitcoin’s Struggle Becomes More Apparent

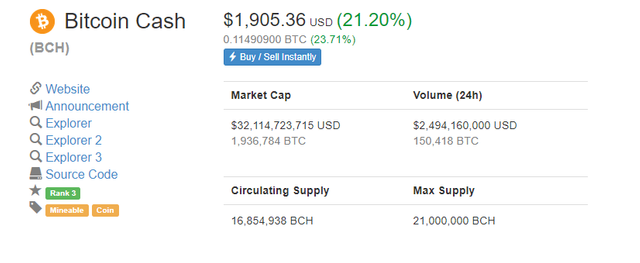

With all cryptocurrencies surging in value right now, a lot of people are making solid money without lifting a finger. That is also one of the most popular aspects about cryptocurrency, as it is nearly passive income. The Bitcoin Cash price, for example, has increased quite a bit over the past week. Maintaining the $2,000 level is pretty difficult for now, though, but things may improve in the next few days and weeks.

BITCOIN CASH PRICE SURGES ONCE AGAIN

Ever since the launch of Bitcoin Cash, it has become rather evident this altcoin would continue to amaze a lot of people in the future. Especially now that Bitcoin is struggling so much, things have certainly evolved in an interesting direction. Bitcoin Cash is shaping up to be a more than viable alternative to Bitcoin itself when it comes to faster transactions, low fees, and a global peer-to-peer currency.The current Bitcoin Cash price certainly reflects this bullish sentiment right now. Thanks to a solid 21.2% gain over the past 24 hours, things are certainly looking good for Bitcoin Cash holders. There is still a lot more momentum in the tank, by the look of things, although it remains to be seen if we will see a Bitcoin Cash price of over $2,000 on a permanent basis. BCH Also gained 23.71% in value against Bitcoin itself, which is pretty impressive at this stage.Even though the Bitcoin Cash price of over $2,000 could not be sustained for that long, it is evident we may see another run in the next few hours and days. When the Bitcoin Cash price surpassed $2,075, the price was pushed down to $1,802 in quick succession. Profit-taking will eventually create a dip and a new buy opportunity. Those who bought the dip have made some decent profits, and there may be more gains on the horizon.

With almost $2.5bn n 24-hour trading volume, the demand for Bitcoin Cash is very real right now. It is evident people are taking this altcoin a lot more seriously than they did in previous weeks. While it is doubtful this altcoin will overtake Bitcoin in the near future, no one can deny this altcoin is making its mark on the cryptocurrency world as a whole. It is evident BCH is not going away anytime soon, and that can only be considered to be a good thing.The vast majority of Bitcoin Cash trading volume originates from Bithumb, which is the driving force for most other cryptocurrencies right now. They are well ahead of Bitfinex, and HitBTC is the surprising third name on the list of exchanges ranked by trading volume. With two major fiat currency pairs in the top three, a lot of new money is flowing into cryptocurrency as we speak. We can only hope to see this trend keep up in the future, although nothing has been set in stone at this time.It is hard to predict what the future holds for the Bitcoin Cash price. More specifically, there is certainly a very real chance we will see another major Bitcoin Cash price surge in the very near future. Things are certainly looking pretty good for all major cryptocurrencies, even though some altcoins still suffer from major price suppression as well. It will be interesting to see how things will play out in the future, as this is not the last surge we will see for Bitcoin Cash or any of the other top altcoins.

good

Thank You

gd one

Thank You

Great Content

Thank You

nice post