EUR/USD 📉📊📈〽rate is up above figure 14 base

EUR/USD rate is up above figure 14 base

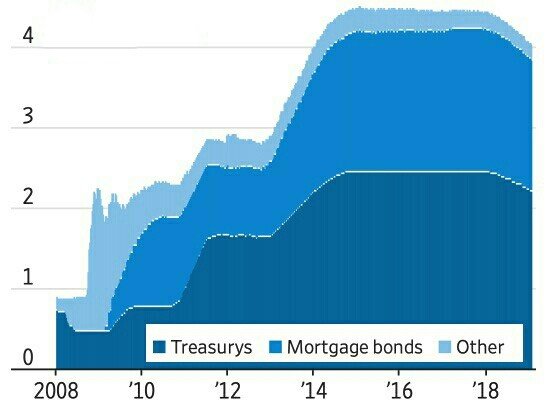

Investors started selling the US dollar off due to the talks about the Fed’s plans to wind down the balance sheet at a slower pace than it has been expected before, as well as the rise in stock indexes, resulted from corporate reports and the end of the story of the US government shutdown. If most FOMC members suggest the necessity of a long pause in the hiking the federal funds rate, then it makes no sense to discuss it at the Fed meeting in January. Another matter is winding down the balance sheet. A slower pace may be taken as another signal of slower monetary restriction. A very unpleasant piece of news for the U.S. dollar.When in October, 2017, the Fed started normalizing the balance sheet, policy-makers estimated that its size should be reduced down to $1.5 trillion -$3.5 trillion from $4.5 trillion in the following three or four years. According to the poll of Wall Street Journal experts in December, the size of reserves should have been reduced to $1 trillion within the next 12 months. It corresponds to $1.7 trillion in the middle of January and to $2.8 trillion in 2017. If so, the balance sheet will reach the limit of $3.5 trillion, suggested by the central bank in 2017, already in 2019. If, like in case with the interest rate, they take a pause now, nothing disastrous will happen. On the contrary, it will somehow cud down the bond yields and support the economy.Dynamics of Fed balance sheet

The latter, based on the PMI drop, is facing some troubles. Such component of US PMI as new export orders was down to two-year low in December. And the reason is not only lower foreign demand (first of all due to China) and Import tariffs, introduced by other countries, but also the US dollar revaluation. During the past year, the USD was 7% up, provoking the criticism of the White House. It must be admitted, that Donald Trump reaches his objectives. He used to speak about too aggressive hiking if the federal funds rate, and about lack of necessity to wind down the balance sheet amid the weak inflation growth… Eventually, the Fed has found reasons to take a break in the monetary normalization. Will the central bank really go after the greenback?Pretty decent corporate profits for the US companies and the end of the longest shutdown of the US government supported the US stock indexes. Finally, foreigners had to close dollar long positions, formed within hedging against the risks of the S&P 500 correction. In addition to the rumours about slower winding down of the Fed balance sheet, to encouraged the EUR/USD bulls to draw the eur to usd rate higher than figure 14 base.The highlights of the week, ending Feb. 1, will be the FOMC meeting, the report on the US employment, the final round of the US-China trade talks, as well as the Brexit vote in the UK parliament. If the Fed sounds dovish and the US strong employment data for December are revised, the EUR/USD rate will be more likely to go on rolling back towards 1.143 and 1.146. It is only important that the escalation of US-China trade battle wouldn’t hold the euro bulls back.

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord