Wave analysis 📉📊📈🃏〽 of major cryptocurrencies for 28/01/2019

Forecast for BTCUSD, BCHUSD, ETHUSD, EOSUSDWave analysis of BTCUSD

The BTCUSD continues moving in the global downward corrective wave B that is taking a form of a triple zigzag [W]-[X]-[Y]-[X]-[Z]. Zigzag [Z] is developing in the market. It consists of three parts that are marked with blue letters (A), (B) and (C). Soon, when wave (B) completely finishes, the price will continue declining. Let’s analyze the situation in more detail in Bitcoin 4H timeframe.

Apparently, an ascending corrective wave (B), being a zigzag A-B-C, is developing. The second part of the zigzag wave C, is forming now. When wave C completes, the BTCUSD price should resume rising towards level 4191. The descending wave B may finish at a level of about 3293, where the price may start rising in the C impulse. At this level, wave B will take a form of a zigzag with regular proportion. Summing up, I might suggest that the BTCUSD price expected to decline down to level 3293 in the first days of the trading week; next, the bitcoin trend may reverse and start rising towards level 4191.

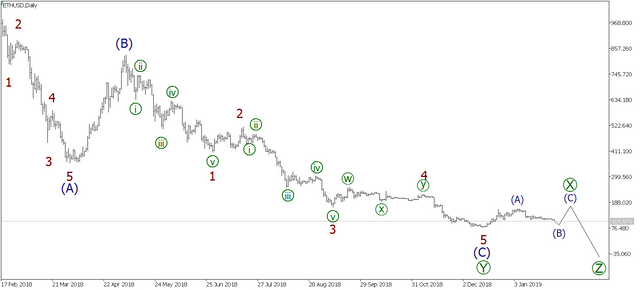

Wave analysis of ETHUSD

For ETHUSD, the final part of the global descending triple zigzag is developing. There is most likely to be constructing the upward corrective wave of the [X] link, which consists of three parts: (A), (B) and (C). After this correction is complete, the ETHUSD price will continue going down in the final zigzag [Z].To see this scenario clearer, let’s analyze a more detailed marking of the ETHUSD market in the shorter timeframe.

The ascending corrective [X] wave continues developing. It is taking the form of a plain zigzag (A)-(B)-(C). The downward wave (B) is highly likely to finish soon, followed by the ETHUSD price rise in the new upward (C) impulse. The trend may reverse near level 99.29. At this level, the size of the descending (B) correction will be 76.4% of the previous upward impulse wave (A). In zigzags, the (B) wave often finishes at this level. After the (B) waves completes, the Ethereum market may grow within the impulse (C) wave towards level 181.95. At this level, the size of (C) the wave will be equal to the (A) wave, which is also a feature of regular zigzags. An approximate trajectory of the possible BTCUSD future movement is presented in the figure.

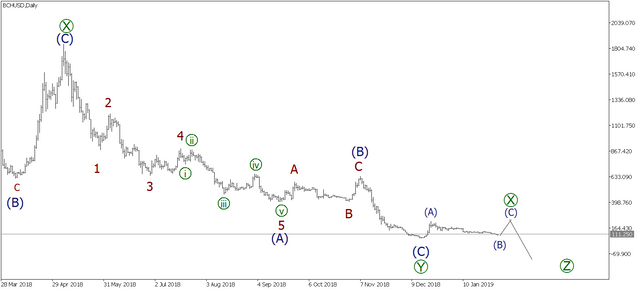

Wave analysis of BCHUSD

The market is still moving down, gradually sliding down in the final part of the descending triple zigzag. There is highly likely to be forming a local upward corrective wave of the [X] link that is taking a form of a zigzag and consists of three parts, marked with the blue letters: (A), (B) and (C). Let’s see a more detailed marking of the last section to clarify the scenario.

Here the situation is similar to that of the other major cryptocurrencies. The market is going down within the (B) zigzag, consisting of three parts: A, B and C. The downward impulse C of (B) is about to finish. This wave may complete at level 107.77, where the size of (B) wave will be 76.4% Fibonacci level of the previous upward (A) impulse. It might be followed by the market growth in the new (C) wave. An approximate trajectory of the possible BCHUSD movement this week is presented in the figure.

Wave analysis of EOSUSD

The market is forming the final part of the downward corrective trend. Currently, the [X] wave is likely to be constructing, which is the corrective link wave, connecting the waves of [Y] and [Z]. Therefore, after the [X] correction is complete, the market continues going down within another downward zigzag [Z]. Let’s analyze the EOSUSD price chart in more detail in the 4H timeframe.

After the completion of the [Y] wave, whose final part took an impulse form, there was the developing of an upward impulse (A) of [X], and a correction to it - (B) of [X]. When the entire descending (B) correction completes soon, the market should start rising with the upward (C) impulse. The wave (B), according to the current market situation, may finish at a level of 1.91, where the internal proportions of the (B) wave, and the size the (B) wave relative to t

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.liteforex.com/blog/analysts-opinions/wave-analysis-of-major-cryptocurrencies-for-28012019/

Thanks for this analysis!

Congratulations @livedailysignal! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOP