Gold Losing Safe Haven Status Due to Cryptocurrencies, Monetary Policy

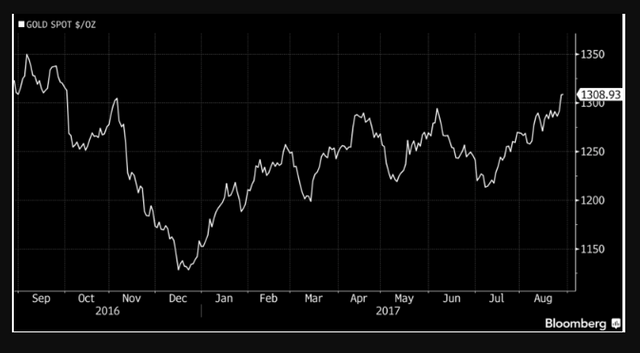

Gold prices jumped 1% on Tuesday morning, fueled via geopolitical and marketplace worries, with the modern North Korean missile release being the instantaneous catalyst.

but, in step with Bloomberg, the soar in gold fees is a ‘too little too past due’ reaction to the overall kingdom of geopolitics and marketplace uncertainties. The precious steel appears to be losing its ‘safe haven’ popularity. conventional models should have gold prices nicely above what they're now, and there are two matters in charge for gold’s exceedingly bad performance.

Eroding Gold

a part of the motive gold hasn’t done in addition to expected is because traders are shifting their budget to digital currencies. Currencies inclusive of Bitcoin have held their fee pretty well at some point of latest crises, which includes Venezuela’s hyperinflation.

Unconventional monetary guidelines by important banks has additionally eroded a chunk of gold’s value. The unwinding of important financial institution balance sheets which need to eventually take place is leaving traders apprehensive. some of them are seeking a secure haven in Bitcoin.

investors have fled the valuable metals and inventory markets in choose of the extra returns and wellknown stability of Bitcoin and other cryptocurrencies. Over $30 billion has flowed out of the stock marketplace within the beyond 10 weeks, stepping into different funding options.