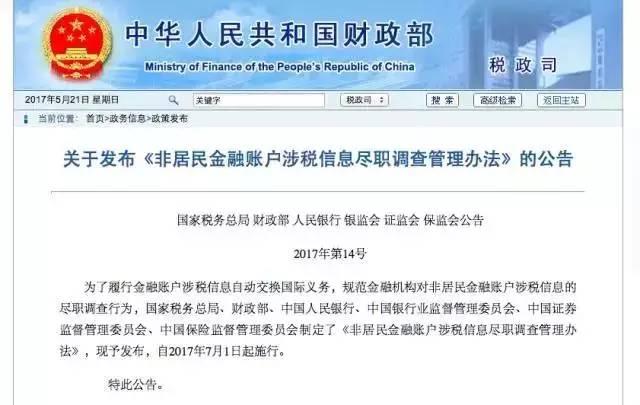

China's last bid to curb capital outflows - Crypto markets must observe the important date : July 1st!

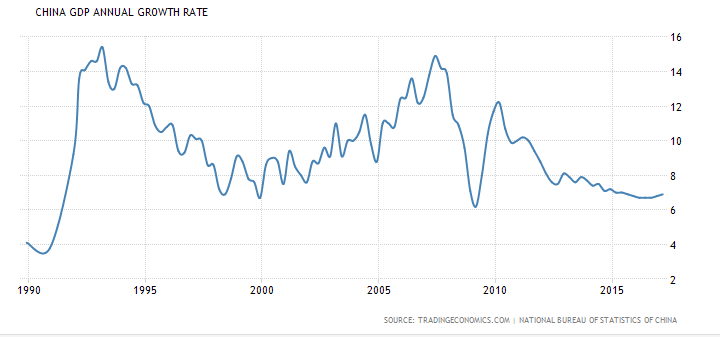

China has been embattled with aggressive devaluation of the RMB as the economic growth has slowed to the lowest level in over 25 years. Meanwhile, the USD has surged on the back of strong economic growth in the US.

New policy on foreign exchange and cross-border remittance comes into effect July 1st

Source

For those unaware of what the policy entails. These have been in place for a while but not officially enforced as the government has given financial institutions a lead time of several months to implement systems safeguarding their policy.

As of July the 1st, the rules officially go live.

The policy states :

Individuals are limited to exporting $50,000 per year.

Transactions are capped at $10,000 each, and once per day

Individuals must fill out a large transactions report

Individuals are prohibited from export of capital for buying bonds, insurance products and real estate

You may not lend your quota to other people to send money abroad

Individuals will be strictly investigated for money laundering if the rules are broken

What about Bitcoin?

The three largest Bitcoin exchanges in China (Huobi/Okcoin/BTCC) have only recently re-enabled Bitcoin withdrawals after several months of investigation by the PBOC pushed the exchanges to tighten up on Know Your Customer / Anti-Money Laundering policies.

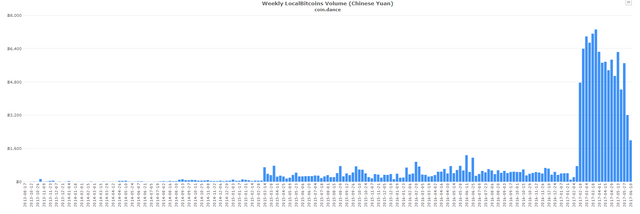

LocalBitcoins Volume in China

With the main exchanges enabling Bitcoin withdrawals, volume on localbitcoins in China has seen a significant drop. But remains above the multi-year average.

Bitcoin prices in China still command a 3% premium over average Bitcoin prices on western exchanges at time of writing.

Impacts on Bitcoin and other industries post July 1st?

Capital controls seem to be working as USD reserves have actually started going up since controls began tightening late 2016.

Now that investing in real estate is prohibited, the global property market will no longer be propped up by the worlds largest buyer of overseas real-estate.

Some reports have suggested capital flight is a large contributor to the Bitcoin bullish market.

With the PBOC closely watching the exchanges, Bitcoin may become less attractive as a method of sending larger amounts of money abroad. This is evidenced by the muted volumes on the top three exchanges.

However, our "favourite" person in Bitcoin - Jihan Wu thinks otherwise :

But I don’t think the Chinese Government will do very aggressive regulation over bitcoin. I just think they want to control the risk for those investors who don’t have enough knowledge about bitcoin.

Is the July 1st going cause some more volatility on the markets?

Most likely.

Whilst most people have been focused on the Bitcoin UASF for August 1st, it is difficult to ignore the potential significance of the Chinese capital outflow measures officially being enforced starting July 1st.

People completely unaware of Bitcoin are now asking me about it, many of them also showing great interest in ETH.

It's been a wonderful opportunity for me to introduce Steemit to them whilst general chatter about crypto is at an all time high.

What I see, is a fine example of human psychology. People see assets like Bitcoin and ETH soaring only to invest for a quick buck. Meanwhile, smart money secures their exit.

Have they not learned from the Shanghai Stock Market? Apparently not.

Set your calendars for July 1st. Something big might happen!

I want to take this opportunity to say a big thank you to Steemit and all my followers and friends who have supported me throughout my journey, giving me the opportunity to be free of the chains from China. It has been truly liberating and for that I extend my gratitude to all of you. Under normal circumstances, avid travellers such as myself would no longer have the means to go freely abroad. Steemit has changed my life forever. Travel with Me and Miss Delicious will live on!

As always, I appreciate your up-vote, follow and comment!

Great report. Bureaucracy is slow. We are faster :-)

Advice worth heeding ! Thank you

interesting

really? shoot

that sucks out there then if this is the case

this is the short cut to becoming financially independent

July 1 - noted!

hello can you support #faithinhumanity

https://steemit.com/landmine/@tinashe/when-life-becomes-living-hell-for-landmine-victim

"economic growth has slowed to the lowest level in over 25 years"

to only a 10% growth? i guess china is doing pretty well compared to numbers in the western word. i may wrong

Remember, it's the rate of change of growth that people respond to.

6.7% for 2016.

you "wowed" me again, by coming up with the right stats

like i mentioned in some replies to you earlier, you dong a fine job over here :-)

thx for it, i was too lazy to find it myself. but i knew u will come up with something

This post received a 19% upvote from @randowhale thanks to @sweetsssj! For more information, click here!

Didn't know you are also expert in economics. So used to seeing your travel blogs

Great post my cryptobrother, awesome! Thanks for sharing, I agreed, the asian market are going to play a big role on the whole cryptocurrency market, if you check the trading volume of Ethereum you will see that 3 of the top traded exchanges for Ethereum come from Korea (KRW). This can be seen in this link https://coinmarketcap.com/currencies/ethereum/#markets

cryptosister! Thankfully the Koreans have been helping keep things alive. Not a massive economy though.

the entire Korean population is only 3% of China's.

I recognize that this was posted 4 months ago but I was wondering about your opinion of where you will be in ten years.

I must apologize to you because I felt that your postings suggested that you very superficial. There isn't anything wrong with posting about travel and food ... I am jealous of your success. However I am afraid that I dismissed you as a little cute girl but very shallow in your view of the world. This single post and your responses to the comments showed to me that I am very wrong. You are both intelligent and thoughtful and I hope that you will occasionally post similar articles so I can learn from your perspective.

Hoping for your continued success...

What do you think is causing the Chinese economy growth to slow down? Is it because the US is slowing down? USD is actually down and possibly trending even lower.

Growth of an economy has to be measured not just in change in GBP. Other internal metrics to support the rise in GDP have lagged behind.

For example, mature laws, regulations, education and even cultural. There was a lot of FDI which helped the two decade long miracle growth, but it was not matched by strong domestic consumer demand.

The government took steps to tackle the rampant embezzlement of money because it made the wealth gap between rich and poor grow.

Resteemed! Good info. Globally the Central Banks are losing control, and Capital Controls are a last ditch effort in most cases. With the USD/Petrodollar on its way out, do you think the Yuan/RMB will be a gold backed currency?

Honestly, I don't sere any currency being backed by Gold.

No one really has a grasp on thee actual supply of gold, the governments (US) have been manipulating it and suppressing it for a long time, even straight up naked shorting it.

It's clear they don't want people moving their wealth into asset classes that have a finite supply.

"... even straight up naked shorting it."

Your perspective, that as I know you - is determined by your research, is highly interesting.

Jim Rickards, Jim Rogers, Mike Maloney are all propagating different views on this. I am therefore interested in more information about this. I would very much appreciate if you could point me in the right direction where to collect more info. Thanks, you are so SWEET sssj.

Both China and Russia are holding large amounts of gold. I have my doubts that the US has any left. A gold standard isn't likely as you say, I agree.

The COMEX and LBMA are heavily manipulating the monetary metals with naked short contracts, that's why it is best to hold at least some of your wealth in physical form. Become your own central bank.

The tyrants at the Federal Reserve in the U.S., and on the other side of the pond in the City of London, are, and will do their best to keep people in their fiat debt-based monetary system, with capital controls.

Very interesting read, thank you. It's pretty obvious goverment has complete control over the cryptos cause if the exhanges are made illegal then bitcoin has no direct link to fiat and it's gone. That`s why I don't get why people think we are "free from the banks", even in the USA, if the banks found crypto their enemy they could shut it down in days...

I'm sure people will continue to trade over the counter with cash. In China, it's really difficult because even sending large amounts to people domestically now requires application and investigation.

被我抢了个第了个座,真难 :)

欢迎欢迎!