The Reserve

15 October 2017 | SUBSCRIBE

// ADOPTION DRIVES PRIVACY PROBLEMS

Coinbase is in ongoing litigation with the IRS to hand over client identities and transactions - and the general consensus from the experts at the Accounting Blockchain Coalition on their monthly call this week is that Coinbase has no chance of winning.

What transactions will be of interest? The IRS currently considers the exchange of cryptocurrency into fiat, or another cryptocurrency, a chargeable, taxable event. This includes purchasing products or services with cryptocurrency. And it also looks as if airdrops and hard forks are taxable… we just aren’t sure how, yet.

Cryptocurrency does not operate outside the governance structures that we currently live within. As the adoption of blockchains spreads, governments will fight to remove the privacy inherent in some of these systems - as the IRS put: a cryptocurrency holder has no additional right to privacy over any other taxpayer.

This is just the beginning of the IRS’ journey into blockchain and you should act as if, and expect, all transactions to be monitored by tax authorities, and for the transactions to be traceable back to you as an individual.

At least perhaps until there are more certain methods for maintaining privacy whilst being able to transact ‘normally’ - but the pursuit of such a system for the benefit of tax evasion is no vision The Reserve supports.

// MUST READS

- An overview of the impending Bitcoin hard fork

- Christine Lagarde affirms “It’s time to get serious with digital currency”

- Will regulation impact cryptocurrencies in a positive or negative way?

- Bitcoin’s price bubble will burst

- An overview of the blockchain scaling challenge

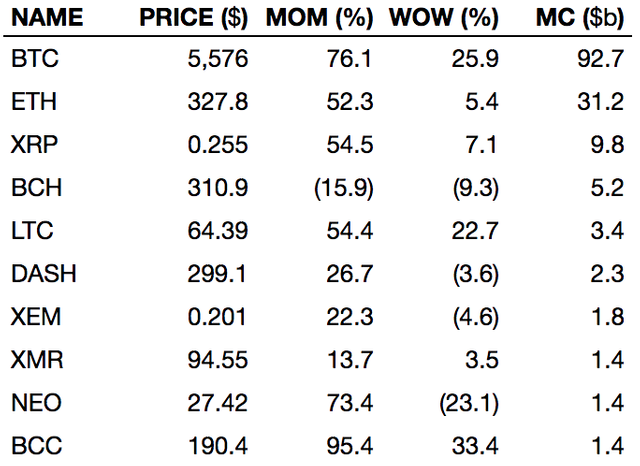

// PRICING SUMMARY

// DISASTER OF THE WEEK

Red Pulse ran the first ICO on the NEO blockchain this week. The ICO was delayed 2 minutes at very short notice - meaning thousands of contributors sent funds too early. The NEO contributed didn’t bounce - they were still sent - but were left in limbo without Red Pulse tokens being issued in exchange. Meanwhile, as you can see above, NEO has tanked 23% this week due to these problems, leaving thousands of contributors not just frustrated at missing out - but financially poorer due to a botched process.

// TRACTION

- How Zug in Switzerland became Crypto Valley

- The first house was bought on blockchain

- Nordic firms are accepting bitcoin as a means of payment for legal services

- First Debt Payment has been settle with Bitcoin in Sweden

- Lufthansa invests in bringing blockchain to the travel industry

// ROAD TO REGULATION

- Abu Dhabi has already finished regulatory guidelines for Cryptocurrencies and ICO’s

- Lawmakers are struggling with cryptocurrency regulations

- Vladimir Putin has confirmed that Russia will regulate cryptocurrencies

- Ukraine Central Bank issued a proposal for a cryptocurrency regulation framework

// ICOS

Last week highlights:

- Anryze raised $1.8m for a distributed speech recognition platform

- Blackmoon Crypto raised $30m for a tokenized investment fund platform

- Cindicator raised $18m for an intelligent asset management platform

Upcoming:

- Horizon State - October 16, 2017 - Redesigning democracy

- Synapse - October 21, 2017 - Decentralised data and Al marketplace

- Earth Token - October 23, 2017 - A natural capital asset market

// OTHER

The importance of blockchain in energy grids. Four things to consider when running an ICO. A view on the race against centralisation.

// EVENTS

Blockchain Summit Amsterdam - Amsterdam, NL - October 17, 2017M-0 1st Swiss Blockchain Conference - Crypto Valley, CH - October 17, 2017Gibraltar’s International Finch Tech conference 2017 - Gibraltar, UK - October 18-19, 2017Toronto Blockchain Conference 2017 - Toronto, CA - October 19, 2017

Melbourne Blockchain technology Conference 2017- Melbourne, AU - October 20, 2017