Keynote typo on “How to make higher returns in the crypto recovery” by CNBC Crypto Trader

Do read my blog along with watching the youtube video by clicking on this link below

Subscribe to the Youtuber’s channel, click on the notification button to be alerted on new posted videos.

Please do read my typo as well; copy and paste for personal future reference (remember to use navigation (Ctrl + F, for Microsoft documents etc); and upvote my steem blog.

Five of the best ICOs

Spice Venture Capital (vc)

Ami Ben David, co- founder/managing partner.

Expertise in tokenization of securities.

Spice VC has tokenized their securities. Now, they will be tokenizing securities of funds, real estate, companies etc. They tokenize any asset.

I think securities will be big because it carries a larger part of the economy compared to utility tokens.

We have launched our first portfolio company called Securitize.

We are tokenizing VC funds as well.

ICO

Mission to tokenize the world. Also investing in infrastructure for security tokens. We raise $100M as cap.

Every token holder will receive their share when the

website is spicevc.com

videocoin

halsey minor, ceo of videocoin.

The CTO of videocoin invested in the video application of facebook years back.

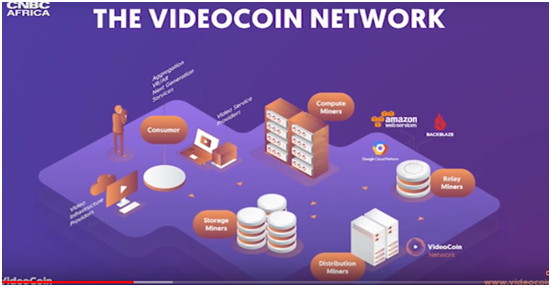

Videocoin uses servers across the internet that is ideal to encode video, store video, and stream video.

So we are essentially of a cheaper amazon webservices when it comes to video.

About 82% of the internet today is internet video, 11% web/data, 3% gaming, and 4% file sharing. This content increases at a compound interest of 5% every year.

The biggest producers of videos are media companies.

The amount of people that watch internet videos are 2.15 billion. That’s more than the population of the united states, china, brazil and germany combined.

Challenges of current internet video infrastructure

Listed below:

- Regulations

- Privacy

- Raising costs

- Censorship

- Centralization

Benefits and Examples

A company like Netflix has to take every one of their videos, and have to convert to 1000s of different formats, on different devices and bandwidth, and then stream it.

Benefits

- 50% to 80% decrease in cost. As they no longer need to pay their main competitor such as amazon, and google.

- Disintermediate market oligarchs.

- Increase in privacy

- Enable a new generation of applications

Utility Token

The token will be able to harness computational resources, storage, and bandwidth.

ICO

Capping at $50M.

Public sale at March 22nd.

Website: videocoin.io

Forking the Ethereum blockchain, because the eth blockchain doesn’t scale. So videocoin is not an ERC-20 token.

Xtrade.io

Ceo is alex kravets

A way to bring wallstreet technology into the crypto market. Thereby, making trading easy for institutional investors, hedge funds, stocks, banks etc.

Market Problems

Writing APIs

The crypto markets are currently fragmented; they are over a 100 of them. They have different access interfaces (APIs) for automated trading. So if will have to write each API a 100 times if you want to trade across multiple markets which is not convenient.

Multiple Webpage Interfaces

You also have multiple interfaces that are webpages. So if you have 5 exchanges, you will have to open five web pages.

Liquidity

If you are making a million dollar order, you have to make it across different multiple exchanges.

Products

We are actually creating four different products.

- FIXED API: fixed communication language between multiple systems for trading orders, market data system, execution system etc. In the finance FIXED stands for Financial Information Exchange. So we taking a popular protocol to create a layer with blockchain APIs, to execute a once written API at one go. This product is already built, so we just add more and more exchanges to it, to launch an advanced product at Q1 2018

ICO

Raising $45M. Most (75%) will be used for liquidity aggregation; the rest will be to develop the platform.

Use case is to pay for services such as execution charges and systems etc.

Presale feb 10th.

Colu

Amos Meiri – founder

Colu started as the main developer of colored coins which was the first protocol that enabled instant transactions of digital assets. And we developed developers’ platform to build different applications. Then we noticed that the main use case of the platform was to develop community currencies.

So we started focusing on this and issued four community coins in four cities, two in Israel and two in the U.K. we currently have 120k transactions per month (TPM)

Benefits and Examples to communities

- Solve specific community problems

- Economy for small businesses

- Solve credit problems

- Clm token provides liquidity an tradability without being listed on exchanges

Example

Chains, like texco, taking over the small businesses. The community money circulated across the small medium businesses thereby providing loans and credit

User Benefits

The new model, for every transaction you will earn a stake within the network.

Incentive Funding

Instead of fees to go to visa or mastercard, the fees goes to the stake holder that returns back to the community

Ico

1.5M clm

Website: clm.network

Nex

ethan fast is the creator of the neon wallet. Has a Ph.D in A.I - human computer interaction with A.I - in relation to the blockchain. Studying how people interact with computers.

how can we create better human interfaces, in design, for mass adoption.

for more control of funds, in decentralized provision by matching via smart contracts. The difference is NEX is that today's smart contract rely a lot on smart contracts which is not sufficient for high performance APIs

NEX will take this design goals to create a decentralized exchange to support high performance via an Offchain Matching Engine. This does the logic, and the settlement still opens onchain, that is maintain the onchain settlement.

It works like the lightening network. You don’t have to pay blockchain fees so it is cheaper.

Extra Features

Limit Orders - due to offchain engine, we can break limit orders into smaller matches to match divisible oriented orders

competition

other competitors are more protocol orientated, for example - loop ring; also 0x project.

Prototype

Wallet features; Matching Engines; Demo coming soon at the NewYork Devcon, and more details to be realized at nex's social media;

Staking rewards

holders get a share of the trading fees. If staked for a longer time 15% to 75%, to lock them in a smart contract (just like masternodes). You will be paid out in the particular token not nex. Thereby giving an index-

- into the broad market.

decentralized banking in the roadmap

A longterm vision for the future. Taking banking features such as savings account etc into the blockchain.

ICO participation

50 million tokens at $1. Twenty five million to the ICO. No private sale or presale. Limited Number of strategic investors got at no discount.

Nex will be on neo, then expand to Ethereum later in the road map

Utility

Give holders a share of the fees held by the exchange depending on how long they stake with a smart contract. 50 to 75% will be given away of general fees, because we want to build a big profitable ecosystem.